One of the greatest smoker's voices of all time, Lee Hazlewood .. the second song is no good, but She Comes Running is a classic.

Notes for Chat with Traders, Episode 58

Episode 58 ... Paul Singh (54:01)

- Started trading in college

- 40 years old now

- Went to law school in 1990s

- Took $5,000 to $200,000 during dot com boom

- Worst time to learn how to trade since you could just blindly buy and make money

- $200,000 went to zero in the dot com bust

- Blew up another $5,000 account a little later

- Third attempt in 2004, 2005 with $5,000 ... things started to click, he got more serious

- Have to persevere ... helps if you love it ... never give up

- Working as a lawyer then

- Commodities boom next to play ... recognized it from dot com boom experience

- 2011 started trading full time, stopped lawyering

- Waited until he had enough money, patiently built a large stake, before he went full time

- His wife works, she has a good job, they had a lot of savings, good safety net

- Needed mid six figures as trading stake to be comfortable going full time

- Biggest mistake people make is trying to trade without a proper trading stake

- Don't give up your paycheck until you have built a significant trading stake

- Can never be worried about daily expenses when you're trading

- Take the amount you think you need to be comfortable trading full time and double it

- Trading full time is boring, esp. swing trading (holding several days to several months)

- Have to prevent yourself from "filling your day" by watching every tick

- Swing trading all about after-hours homework, market hours just about executing the trade

- Trading is more than stock picking

- Three parts to trading:

- Stock picking the least important part,

- Risk management, which is fairly easy,

- Trade management, which is the hard part

- Risk management is understanding probability and risk versus reward

- Trade management separates winning and losing traders -- the psychological game

- Trade management is where you need to work really hard, controlling emotions

- Lightbulb moment: doesn't matter what stock you pick, with proper risk and trade management, can be profitable

- Has basket of 10 to 15 set-ups he trades regularly

- Pays close attention to money flow across broad market and sectors

- Doesn't have a favorite set-up

- Whatever is working today is his favorite set-up, have to be adaptable

- Set-ups stop working

- Breakouts, breakout-pullbacks, moving averages, re-mounts -- fall in and out of usefulness

- He exclusively trades stocks -- have to master one domain

- Used to do options, futures, etc. but has dropped all that ... just stocks now

- Hated to have to trade around the clock ... likes defined hours of stocks

- Got interested in pre-market trading

- The more experience you have, the fewer indicators you use

- Experts learn to simplify, tune things out

- New painters paint lots of lines ... not true of experienced painters

- "Set it and forget it" -- don't micromanage positions

- Don't watch every tick, don't switch up timeframes and see "new" things

- Day trading gets his mind off his swing trading

- Easier to part-time swing trade than full-time swing trade since mind occupied elsewhere

- Taking a quick profit is human nature, hardwired, but the antithesis of good trading

- You can't be a successful trader with 1:1 risk reward

- First thing he does is a market analysis, looking for market leaders

- Focuses on money flows across sectors

- Builds watchlist of 50-150 stocks to stalk

- Tries to narrow it down to 5-15 stocks in the evening or morning

- Then writes a plan for each stock: entry range, stop range, target range -- in Evernote

- Sizes positons based on those levels in advance

- Doing position sizing in advance makes it so he has no anxiety, just pulls trigger given plan

- Common mistake traders make is not taking into account the natural volatility of a stock

- [They set their stops too tight]

- Bad idea to place stops at obvious support and resistance, everyone is there ... it will be run

- Take smaller position to be able to hold through stop gunning, then add once the stop gunning has passed

- Used to look at ATR and volatility measures for stop placement, but now just eyeballs it

- Pattern recognition comes after time, have to put in the hours

- "John Tudor Jones" ;-)

- His wife can't tell if he's had a winning or losing day [she must be an angel]

- People have goals without a plan

- Focus on one thing and master it

- Gets up at 4AM (lives on west coast)

- Does a detailed monthly review of his trades

- www.bullsonwallstreet.com

- themarketspeculator.blogspot.com

- www.pauljsingh.com

- Twitter: @PaulJSingh

Notes for Chat with Traders, Episode 126

Episode 126 ... "Jonathan" (69:55)

- Division 1 baseball scholarship to college in Louisiana

- Got injured (hurt back), professional baseball career not possible

- Lost scholarship, didn't know if he could stay in school

- Back still nags him today

- Uncle was a Wall Street guy, worked for Shearson Lehman

- Uncle had a nice house, nice car, nice boat ... that attracted him

- Had friends who had moved to NYC ... visited ... loved it, moved there, age 20

- Spent a lot of time in the New York Public Library trying to educate himself

- Did odd jobs, but had some savings

- Read the Jack Schwager Market Wizards books at library

- Met a guy (won't name names) in 2004 through family friends who had worked for Steve Cohen, retired at age 35, working from home

- Guy took him under his wing, acted as mentor

- Jonathan sat with him at his trading desk, for over a year he did this

- Mentor from India, born poor, but he made it big in America ... saw Jonathan's passion, competitive drive

- At first Jonathan was incredibly intimidated

- Mentor traded futures, 250 contracts at a clip

- Mentor did stat arb ... a quant

- Mentor taught Jonathan to be open minded, you can learn something new every day

- Jonathan's first account was $10,000, piggybacked off of the mentor's trades, did well

- Mentor wanted Jonathan to finish his college degree, so he moved home to Dallas and got degree in economics / quantitative finance

- Mentor discouraged him from going to a prop firm, get a degree instead, work for a hedge fund

- Many prop firms in New York City were Churn and Burn outfits

- Took out student loans and used money to trade futures and lost all of it ($35,000)

- Traded too big with his student loan money and blew up

- Most people who blow up, quit, but not him

- Sent resume out blind to many hedge funds ... 92 hedge funds ... got three interviews

- Paradigm Capital in Ft. Worth hired him as intern

- Thought he blew the interview, lots of tough math questions

- What is 24 times 86? He froze up, started sweating, took him five to seven minutes to answer

- Paradigm traded credit default swaps, he knew nothing about them

- Promoted from intern to assistant trader to trader to head trader, within six months (in 2008)

- Paradigm did well between 2008 and 2013 ... all discretionary, no modeling

- Learned MatLab, started building models, also used Bloomberg Terminal to build stuff

- European sovereign credit crisis was a great opportunity, worked 3AM to 6PM, seven days a week

- Paradigm was $5BB at its biggest, trading book had $3BB ... [not a garage band hedge fund]

- When he joined it was $2BB

- Left Paradigm in 2013 ... he had made partner, had equity in the fund, started butting heads with the boss

- "The bacon is all in the year-end bonus."

- He took equity in the fund instead of a year-end bonus

- European regulators "banned" speculation in European CDS ... liquidity vanished

- Wife encouraged him to quit, trade from home [she must be an angel]

- Started trading 2014 on his own with $250,000 ... all discretionary trading

- Made $60K in first month, thought this is easy!

- Lost $80K in second month, oops, needed to create a systematic approach

- Didn't have Bloomberg Terminal at home

- Taught himself "R" language and built a system, sort of a hybrid, still uses some discretion

- Still executes all trades manually

- Mentor recommended Market Delta platform

- Found patterns in the data ... uses Volume Profile, spots order flow stuck at extremes

- Not a fan of derivatives of price (moving averages, lagging indicators)

- Fan of re-tests ... people stuck getting out at "breakeven," easy to see on Footprint charts

- Numbers don't lie, your eyeballing stuff lies

- Brains are pattern recognition machines, sees patterns everywhere

- Have to teach your system "market context"

- Found his entries and exits better when he does it manually

- Patient, he always waits for a signal

- But there are times he gets a signal and ignores it

- He only trades E-mini (ES) futures and crude oil (CL) futures ... most liquid markets

- Doesn't like headline risk of trading FX

- Specializing in one market is a great thing, just need to master one

- Has six monitors in home office

- Don't complicate things, keep your approach simple

- He knows nothing about candlesticks and MACD and stochastics, etc.

- Trading isn't rocket science

- Given his results, has been approached by people about starting a hedge fund, but he has no interest

- Too many regulations to start a hedge fund ... just a headache

- Wife encouraged him to get Twitter account [she must be an angel]

- Twitter: @HF_Trader

Notes for Chat with Traders, Episode 129

Episode 129 ... Victor Haghani (42:49)

- Father was a goods trader (Sephardic Jew born in Iran?)

- Went to University in London (LSE)

- His dad said go for the less bureaucratic firm (why he chose Salomon over JP Morgan)

- John Merriwether asked him to become a trader, government bonds arb desk

- Youngest trader on the desk

- He had been in fixed income research at Salomon Brothers

- Merriwether left Salomon in 1992, Haghani left in late 1992 ... founded LTCM

- Started LTCM's London office

- Worked for 13 bank consortium after LTCM failed in 1998 ... helped liquidate portfolio

- JWM Partners hedge fund ... also helped start that

- Founded Elm Partners five years ago ... "active index investing"

- Lowenstein's "When Genius Failed" -- a good read, but not 100% accurate

- Dunbar's book is also OK

- Buy the Harvard Business School case studies on LTCM, by Andre Perold

- We're a product of our experiences

- Haghani wrote paper on biased coin flip

- Gave 61 subjects (financial professionals) $25, coin biased 60% heads, could keep whatever they made after 30 minutes of flipping, capped at $250

- [Sounds similar to Van Tharp's old experiment that he has given hundreds of times]

- [Van Tharp gave subjects bag of ten marbles: Seven 1R losers, one 5R loser, two 10R winners. Subjects got 40 marble pulls and a $100,000 bankroll. Expectancy is 0.8R (positive) but most people end up broke because their bet size is too large and they revenge trade]

- People bet a lot on tails :-) ... usually after a streak of heads [laughing]

- People believe random things have some sort of predictability (human experience versus math)

- People got bored of betting on heads [laughing again]

- 1/3 of people went bust betting on a 60:40 biased coin

- 1/5 reached max payout ... kids who could flip really fast with smaller bet size mainly

- 1/2 won $80

- Using simple rule of only betting 15% of bankroll would give 95% chance of hitting max payout within 30 minutes

- "Suboptimal behavior"

- Nearly everyone voluntarily bet their whole stake at some point

- Those all-in bets *always* happened after someone took a loss on an outsized bet, classic need to "get it back"

- People who busted didn't want to talk about it

- A whole range of bet sizes works (8 or 9% to 20%) to hit max payout within 30 minutes

- Kelly Criterion number (optimal bet) was 20%

- Optimal solution is very complicated, but just use heuristics (common sense)

- Without the cap, expected value would be $3,000,000, 4% return on every flip (betting 20% of bankroll)

- St. Petersburg Paradox ... expected value versus expected utility

- People won't bother to play even if they have positive expected payout

- Have to understand your own risk aversion

- Betting 50% gives negative expected utility (with 60:40 coin)

- Bet sizing is not simple, not secondary ... it's incredibly important [I say it's *everything*]

- LTCM trade sizing was all screwed up (position sizes were way too big)

- Global equities should have a positive expected return above the risk-free rate or inflation, trouble is the Sharpe Ratio

- Thorp inspired the coin-flipping experiment

- Haghani believes there are some rare people who can beat the market, trouble is finding them, identifying them in time

- Past returns are not indicative of future returns (because we don't have enough data)

- How do you identify the biased coin after only 30 flips? You can't, it takes 143 flips

- Need to find an investor or trader with 143 year track record

- "I don't have very much on the wisdom front"

- www.elmfunds.com

- Not on Twitter, "haven't figured it out"

You Hang Your Head and Pray

From 2006 ... dummy falling from the balcony a gag ... Folds is solidly Gen X and lives in California.

Notes for Chat with Traders, Episode 132

Episode 132 ... Mark Gardner (55:43)

- Australian, heavy accent, difficult to understand

- Has four kids

- Has a three strikes rule (mistakes, rule breaking, bad judgment, misses something) and he takes a break

- In front of screen for 20 years, 80,000+ hours

- [Can't understand him, he talks fast ... and there's the accent ... missing half of what he says]

- Parents were blue collar, worked seven days a week, hard workers

- Goes on "auto-pilot" when he's trading

- Sets up his screens consistently, like a gamer, chart pattern recognition

- Same things in his field of vision for 15 years

- When he's stimulated, he's relaxed ... not worried about burnout

- Working for himself, no one else ... that makes a big difference that he doesn't get sick of it

- Power napper

- Your rules shouldn't say "don't don't not not" ... make constructive rules when in neutral state of mind

- Last year of high school in Australia, you need to get work experience

- 14-year old first time on Australian trading floor ... he was enthralled, exciting, knew he wanted to do this

- 17-year old he went right to work for brokerage

- Grew up in small country town, not studious, University not something he wanted to do

- Had a mentor who worked him hard, very strict, but he needed that, no regrets

- Ten year apprenticeship, only two or three months of losses over ten years

- Top 10% will always eat the bottom 90%

- Eventually had enough capital to handle the swings psychologically

- Got arrogant in 2014, thought he couldn't lose, then predictably took a big hit in March 2015

- "God Complex," took position way too large, lost six or seven months of gains in four hours

- Lightning strike hit house, everything knocked out, lost 20% right when that happened, once back up realized he was badly stuck, got angry, snowballed

- Usually level-headed and calm, this stressed him out, he sort of freaked out, had a lot of bad thoughts, couldn't walk away, calm down

- Tightened up all his redundancy measures after this event (diesel generator, backup computers, etc.)

- Took six months to make it all back, which he did

- Re-gained his respect for the market after this, respect for risk management

- Feels his edge has diminished over the last 15 years

- He's not up against another human anymore, he's up against quants

- The competition had changed, he had to adapt

- Quants are taking advantage of the inefficiencies of human traders

- Math guys don't respect old traders, no love for the discretionary traders' pattern recognition and intuition

- Human mind can adapt and make complex associations that are not quantifiable but need to be respected

- Don't cuddle up to other losing traders when you're losing ... don't seek comfort

- Twitter: @42trading

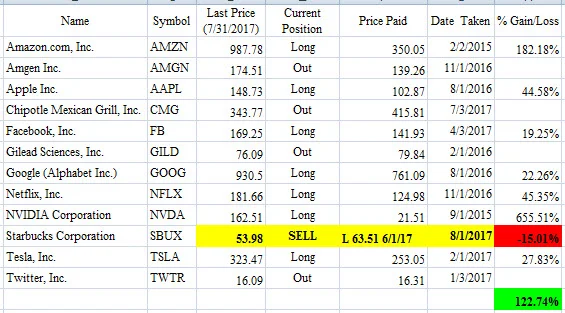

Dirty Dozen, Long Only Portfolio, End of July 2017

Sorry for the delay in posting this ... I've been re-learning how to day trade these last several months and it's hard work, but I think I'm making progress, however slow-going.

One change to the Dirty Dozen portfolio: sold Starbucks (SBUX) on August 1 for a loss (I was worried about it at the end of June). Amgen, Chipotle, Gilead, and Twitter remain on the sidelines for now.

Changes in 2017 include selling Twitter in January, while getting long Chipotle and Tesla in February, Facebook in April, and Starbucks in June. The Chipotle sale last month appears to be well-timed, and we'll see how the Starbucks sale in August looks in time.

Notes for Chat with Traders, Episode 46

Episode 46 ... Hans Dederle (46:39)

[Can't tell if this guy really makes any money?]

- Worked for accounting firm doing tax prep, quit

- Joined brokerage firm, got series 7

- Got interested in trading off of earnings reports

- "So to speak...."

- Started trading a couple months before the 2008 peak

- Blew up his account a couple of times [doesn't give details]

- Boredom traded, revenge traded, averaged down, blew up

- Had eleven months of trading profits, friends and family wanted to give him money [11 month track record?]

- Managing other people's money, he's less emotional, more professional

- For his style, high volatility stocks the only way to go

- Looks for reversals in the first thirty minutes of the day

- Don't try to beat the market makers, join them

- Uses five minute candlesticks, finds support on gaps down, resistance on gaps up

- Trades one to three things a day

- Looks for extreme volume in individual stocks

- Buys calls and puts, not the actual stock [how does he price them?]

- Also looks at Level 2

- Commissions will eat up your profits if you overtrade

- Trails a stop on his option positions [market liquid enough to do this??]

- Holds positions usually one to five minutes [what?!?]

- Tries to set entry and target with every position

- Done by 10:30 AM every day, never swings anything

- Trades NFLX and AMZN all the time

- "For me, ...."

- Don't confuse yourself with too many indicators, keep it simple

- Uses RSI (lagging) to judge extreme moves

- You need a system to stay disciplined

- "Fail your way to success" [Zen koan?]

- Don't think about the money, think about staying true to your strategy

- Has tweaked his strategy all along, adapted to changing markets

- Paper traded his strategy for six months to fine-tune and gain confidence

- "Hold and hope" instead of stopping out -- deadly

- Everyone in the beginning cuts her profits short and lets her losses run, it's only natural

- Figure out what works for you

- Twitter: @Hdederle

Notes for Chat with Traders, Episode 48

[I've always liked Linda Raschke ... she's the real deal and every word is gold. You should seek out everything she has ever written and recorded]

Episode 48 ... Linda Raschke (49:29)

- 1981, started as equity options trader on the floor

- Barriers to entry minuscule today compared with the past when she started

- Once you find the key, they change the lock

- Must learn to adapt

- What works for someone else might not work for you

- Still learns something new every day

- After ten years of trading, she felt confident with her plan

- You can't go and copy another trader

- Have to move to markets where there's volume and volatility

- Many markets she used to trade no longer exist (pork bellies, OEX options, etc.)

- Markets either go up or down

- Don't force anything

- Like tennis, keep the ball in play until you see an opening

- The big money is made holding overnight, which is riskier

- Don't use linear framework to approach the market

- Wyckoff ideas of range contraction and tests and re-tests still good

- Look for strong volume, strong directional bias

- Lethal to trade in the middle of a range

- Trade location irrelevant if you're getting on a trend

- Market moves now efficient, instantly goes to new equilibrium level

- Look at price, not derivatives of price, like oscillators

- Always check liquidity first ... can you get out quickly?

- Intuition just the sum of experience, she's not a fan of intuition

- Every time she's had a hunch, she's been wrong as often as right

- Need a very consistent approach or framework to the market

- Prepares the night before, has a game plan, comes in next morning ready to go

- 80% of your profits come from 10% of your trades

- Don't scramble in the morning to get prepared, do it the night before

- You need to concentrate and focus, don't get distracted by Twitter and TV, shut out the noise

- Take anybody else's opinion with a grain of salt

- Most "educators" couldn't trade their way out of a paper bag

- Anyone who trades well doesn't teach anybody else how to trade, it's a bottom-line business

- Find your own style, do your own work

- Print out charts and make a notebook, study action that preceded big moves

- Gann was demented at the end, suffering from syphilis

- Concentrate on one initial pattern and study it: a breakout thing, or a retracement in direction of trend

- Keep track of your performance statistics, turn it into a game

- Free yourself from ego, rid yourself of the need to call turns

- Imagine yourself standing on your surfboard alone in the ocean waiting for the great wave

- People think trading is easy, want to follow a guru -- they're doing it wrong

- Every successful trader has found one little thing that works for her, and does it consistently

- Has a website but neglects it

- Look for YouTube videos of her ... all free! (5,210 results)

Your Warmth Sets Like the Sun

The great Joan Armatrading... pity about the keyboardist's solo.

Notes for Chat with Traders, Episode 128

Episode 128 ... Andy Kershner (49:55)

- Geologist by training

- Ski bumming, early 1990s

- [Has a laconic speaking style, a native Texan]

- Started trading options out of the library with his buddy with $5,000

- Dyslexic friend, Scott Dyer?, in Texas, great at pattern recognition, "savant-ish"

- Top 100 IBD names, trade options on them ... all pre-internet

- Turned $5,000 into $1,500, couldn't get the prices they saw on the screen

- SOES came into being, little guy finally had a chance to get quoted prices

- Went to Cornerstone Securities, which became ProTrader, in 1996

- David Jamail, David Birch -- founders of Cornerstone?

- ProTrader started with 12 seats in Austin, 500 day traders across branch offices at their peak

- Sold ProTrader to Instinet in 2001, kept proprietary trading group

- He lives and breathes trading

- Cornerstone willing to hire savant buddy, but not him, he was a "trainwreck waiting to happen"

- Worked part-time jobs, was friends with all the ProTrader traders in Austin

- Made one trade a day on the side at first

- Markets change, strategies changes, but habits don't change

- Once he was on his own and loaned enough capital, he made 100K a month "forever"

- 80% of his trades were scratches or small losses, 20% were big winners

- He's from the era when there was a human on the other side of the trade (mid-1990s)

- Computer models today are always searching for stops, no more human involvement

- His biggest strength/weakness: he can take a lot of pain

- Big numbers don't bother him

- Trade according to your psychology, do what works well for you, and is repeatable

- Find an edge and see how large you can do it without changing what you do

- Best traders trade 100,000 shares exactly the same way they trade 1,000 shares

- [He means the decision-making process, not the actual execution which is different]

- If you're sitting in a seat all day, you might as well being doing some size

- He ladders in and out of positions now

- Risks 1.5 to make 3.5 to 4 ... 50:50 odds he's right

- Will triple his size when he thinks he can win big

- Lots of styles work: scalpers, swing traders, high win rates, low win rates ... it can all work

- Have to discover what you're good at, amount of risk you're willing to take

- Develop good habits: journaling, reviewing, preparing

- Strategies don't matter, good habits matter

- Exercise and rest important

- Review at end of day, what you got right and wrong, journaling

- May 23, 2017 ... his MOMO position, wanted out 46-48, didn't happen .. tanked to 38, sold 41

- Lost 90K more on that trade than he expected, gave it too much room [charts below]

- He didn't have his game plan structured well enough, too much thinking on his feet

- Have to do what you think you have to do ... making and losing money doesn't matter

- Fades overextended moves, laddering in, both on the upside and downside

- Where people are getting stopped out, that's where you should step in

- Trades 100% US equities and loses money consistently trading options [he has a sense of humor]

- When you know that you're wrong, get out

- He ladders in equal-sized usually ... position sized by liquidity and confidence

- Find 3-4 : 1 RR winners, win ratio a little better than 50%

- Add to your winners, not your losers

- Teaches people good habits for six weeks at his firm, then they go live

- Looks for people who have overcome adversity, people who can act with limited information

- Engineers tend to be bad discretionary traders

- Common mistake new traders make is thinking it's easy

- Only 2 out of 10 of the carefully chosen, great people he takes in make it, takes years to make it

- Need your finances in order before you start, need your working spouse to float you for those *years*

- Recommends reading Reminiscences of a Stock Operator, Market Wizard books

- Find the best short-term trader you can find, and go work for him (her)

- Shortcut your process

- He talked to all the best traders at first in Austin and cut learning process from five years to one month

- Good trading goes against basic human instincts -- fight or flight, have to do the opposite

- Good trading requires extreme discipline

- Don't keep doing the same thing if it's not working

- If you're overly emotional, look into automated trading

- Do you care about being right or making money?

- Software eating the world, everything is getting automated, incl. trading and investing

- AI is only a tool, still need smart humans to employ it

- Generally uses Python to build models

- www.kershnertrading.com

- www.cloudquant.com

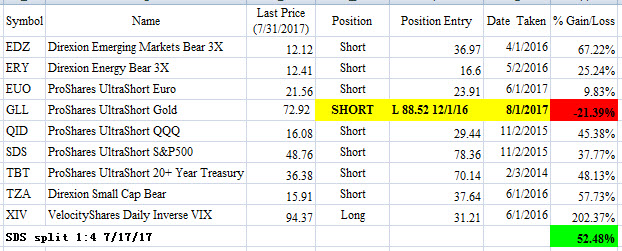

ETF Trading Portfolio Update -- End of July 2017

Cutting losses in the long gold position and reversing short. Everything else is doing fine.

Loving the Real Cheryl Lynn

Thrilled they have a live version of this great song on YouTube ... an amazing voice ... and I think that's one of the songwriters on the piano:

Comments on Grittani Trade Recap: Short CAPR

Tim Grittani has started doing recaps of selected trades on YouTube, which are interesting to review. Here's an annotated chart with my comments for his short trade in $CAPR, initiated on July 19, 2017.

Position size: ~$39,000

Comments on Grittani Trade Recap: Short MOSY

Tim Grittani has started doing recaps of selected trades on YouTube, which are interesting to review. Here's an annotated chart with my comments for his short trade in $MOSY, initiated on July 14, 2017.

Position size: ~$85,000

My Life, My Love, and My Lady

A Billboard #1 when I was two ... I remember it well.

Notes for Chat with Traders, Episode 96

Episode 96 ... "Nico" (71:07)

- Has two 43" screens, Dell multi-clients, 12 usable virtual screens, 4K resolution

- Previously four 24" screens and one vertical 28"

- Ikea desk

- Aug 2016 best month to date [podcast recorded in Sep 2016]

- Worked for software development firm out of high school

- Wanted to make more money

- He didn't want to take core college courses, just computer science, dropped out

- Built his own software development business from nothing

- First client he had was a successful stock trader

- Discovered that microcap stocks moved 20, 30, 40% in a day

- Lived paycheck to paycheck in the beginning, had no savings

- Had to save up money for a year to build trading stake

- [Blipped out some bad habit?]

- Do not quit your day job! Try something on the side first

- First trade in early 2007, bought AAPL, no time horizon, sold dame day for $100 gain

- "Easiest $100 he ever made"

- Didn't want to work in a cube and make $100

- Used Telechart by Worden Brothers in 2007, had built-in chat window, that was cool!

- Charting appealed to him, fundamentals "too much work"

- Timing the market using charts -- instant gratification

- Did not know about shorting at first, just went long

- Microcap market of 2007, he made $20K just getting long microcap runners

- He thought, "this is easy" -- worst thing that could happen

- First account was $5,000 with Fidelity

- Either the market changed or his luck ran out, but he kept "pulling the handle" (slot machine reference)

- Second year lost all his profits, cold reality slammed him in the face

- Now he understood why trading is "damn near impossible," 90%+ fail

- Lost consistently for the next seven! years

- Easy to lose trading profits, hard to lose "legitimately" earned income

- Started to put his size in check, started trading small, $5,000 positions, maybe $10K

- He would hit periods of profitability during those seven years, but then give it all back

- He was making a good living as a software developer, trading losses didn't really matter, "slow bleed"

- Three steps forward and five steps back

- At one point he had over $25K, not shackled by Pattern Day Trader rule

- Wished he didn't exceed PDT rule, wasted a lot of time and money

- PDT rule exists because of degenerate gamblers (like he was)

- Loves solving problems and puzzles, thought he could figure out the market

- This shit is tough, I'm getting my ass handed to me, small size kept him from blowing up

- As the years passed, self-doubt crept in, but people supported him despite his failures

- Periods of profitability gave him hope

- Can't be luck alone, because he's losing more than he's making [made me laugh]

- Reached end of his rope, had a serious sit-down talk with himself, sick of adding money to trading accounts and losing it

- Went full-time, stopped growing his software biz, focused solely on the market

- Never had Facebook, MySpace, Instagram, Snapchat

- Traded in isolation for those eight years, floated around, went nowhere

- Discovering Twitter changed everything for him, every trader is on there [even good ones ;-)]

- Discovered shorting, those first eight years were long only

- Investors Underground gave him a connection to good traders

- His software biz big enough, successful enough, he can make his own hours, and has savings

- He loves shorting, 90% short, 10% long

- "Flying Pigs" ... short the microcap junk companies doing dirty stuff to boost stock price

- Fluffy PRs, huge gaps up, presents good opportunity to short

- Look at pre-market movers and gappers

- Look at pre-market unusual volume

- Has a watch list called "Pigs" ... every pig encountered is added to the list

- Has 200 pigs on his list

- Pig list sorted by net % change, former runners appear once again, no homework needed

- Top of the net % change list become his candidates for shorts

- Wait for the backside, "crack VWAP," or "high of day rejection"

- Shorting the frontside is stepping in front of a train, have to make an educated guess where the top is

- Controlling your size is everything, don't be a gunslinger

- He isn't comfortable sizing up because he still has lots to learn

- One bullet shooting only necessary if you can't scale in

- You can't improve what you don't measure [smart]

- Account balance alone isn't a truly useful measure

- Start plotting your equity curve

- Puts everything on Twitter to curb his degenerate gambler impulses

- Stopped overtrading, being impatient

- He's the rare guy who thinks you should post your P&L publicly [I say: bad idea]

- All about accountability, kept him from being reckless

- Aaron mentions that you must have measures other than P&L to measure success [from "HF71"]

- Track your daily P&L in great detail

- Take a scientific approach and measure what you're doing

- Develop good habits ... he had bad habits for eight years

- Identify what you struggle with: Are you impatient? Are you a degenerate gambler?

- Don't trade in solitude, surround yourself with better traders who are like-minded

- One wolf hunting for food isn't going to eat as well as a member of a pack

- Boy Scout system, try to keep each other out of trouble

- Has developed spreadsheet for trade tracking, willing to give it away from free

- Lots of people pay for TraderVue, but can just use his spreadsheet

- Twitter: @inefficientmrkt

Looking at the Short Squeeze in DryShips

The notorious $DRYS did yet another reverse split on Friday, July 21 (this one 1:7). I've been avoiding shorting this stock because I've been fearing a squeeze, which would happen the moment I got short, thinks Mr. Paranoid. I hadn't thrown in the towel and finally shorted it, but there was a wicked short squeeze last Friday. I didn't make a dime off of this expected squeeze, mainly because I was too busy tweeting about it instead of playing it.

My Twitter addiction costs me so many opportunities, and I have to work on curbing my need to be publicly "right." I really need to force myself to shut off Twitter during market hours ... I just have to go cold turkey. Catching this one trade could have made my week / month / year!

Click for lightbox

Notes for Chat with Traders, Episode 98

Episode 98 ... Peter To (80:04)

- 2004 started playing online poker, 15 years old

- Inspired by Chris Moneymaker winning WSOP in 2003

- Wasn't athletic, all intellectual power, poker a good fit

- Deceived Mom to fund his PayPal account to fund poker account

- Started with $20 and lost it all, devastated

- Second $20 he tried to make it work playing 10 cent blinds

- Did hand analysis on 2+2 forums

- He was playing tight, but too passively, not getting enough money into the pot

- First became profitable limit player, then profitable no-limit player

- Turned $20 into $20,000 over two and a half years

- No innate talent for poker

- Never plays poker anymore, edge is too small now

- Lives in New York City, comes from Southern California

- Poker has advanced so much, so sophisticated today, very hard to win now

- "Game Theory Optimal" -- everyone knows the correct line now, everyone knows the math

- Poker has become an efficient market now [smart comment, he's right]

- Lost the passion for poker ... no fun chasing bad players online [even worse to do it offline when face to face]

- Variance in poker also very high

- Knew nothing about the stock market until college

- Best friend talked about trading and investing, interest piqued

- Natural transition from poker to trading

- Got interested in 2008 2009, Great Financial Crisis

- Started out as a gold bug, feared hyperinflation

- Bought physical gold coins with his $20K, paid 8% spread [I'm chuckling, but it's good to be suckered at first, I believe]

- Still a big libertarian

- He's able to debunk himself quickly, fortunately

- Sold his gold coins for breakeven

- Second stage he was a value investor -- read Ben Graham, Peter Lynch

- Bought Apple, Wells Fargo, Baidu, Dow Chemical all at the lows during the crash

- Realized he didn't have the patience to hold all this stuff

- Turned $20K into $30K, got account over the pattern day trader rule

- Third stage: day trader using technical analysis

- Mom's friend taught him how to read charts and structure trades

- Read a lot of blogs, sourced his learning from all over

- Discovered the ARCA pre-market cross in OTC junk stocks

- Stock closed at $1, offered in pre-market on ARCA at $0.85

- Would pick off all those $0.85 offers pre-open then sell for $1 at the open

- This happened from time to time over two years, a few times a month

- OTC market making is manual ... quotes not honored ... shady stuff

- Moved to NYC and started prop trading

- Doesn't want to name prop firm

- Had been trading every day for two years while in college

- Started trading club in college

- Good things and bad things about being in prop firm, but experience invaluable

- Many prop firms are about "burn and churn" ... get a guy in, get commissions, until he blows up

- Prop firms would "fine" people ... e.g., couldn't trade odd lots

- Prop firms can offer capital to scale stategy, proprietary technology to enhance strategy

- Started meeting seven-figure traders, their strategies not do-able on a retail platform, needed capital and technology of prop firm

- Compares a good prop firm to a good farm team in baseball [nice analogy]

- Read Glassdoor about every prop firm you're considering, lots of shady practices

- Big red flag is if prop firm requires a deposit

- Careful of groupthink in a prop firm, herd mentality, tunnel vision

- There's lots of ways to make money trading, not just momentum

- Wants to catch all-day runners

- Unusual volume, unusual volatility, unusual attention being paid to it

- Not intellectually deep, just using intraday chart, price and volume

- Shorting parabolic microcap stocks, thesis is overextended junk will eventually collapse

- Trick is timing the turn precisely, how to minimize damage when your timing is off

- Takes years to hone this skill

- Follow the order flow, can't just rely on your shorting-microcap-parabolics-play, they dry up

- Chapter on Jimmy Balodimas in Schwager book made big impression on him

- "Stepping in Front of Freight Trains" -- fight trend, add to losers, fades huge moves, gave self huge leeway, took quick profits, in short Jimmy did everything "wrong" based on conventional wisdom

- Peter has developed "trading nihilism" -- process doesn't matter [another smart comment]

- His firm bought the Flash Crash, risked the firm, risked everything, best day ever. Skill or luck? Was it wrong?

- No mathematical framework in trading that you have in poker

- The market never repeats itself like a poker or blackjack hand does [yes, exactly]

- Throwing the book out from time to time, not following your rules, it's all guts and intuition

- Some people just have conviction, don't care about price action

- He was consistently profitable at first, but made no money [just like "winning" with tight, passive poker play]

- He's a very emotional person, but makes emotion work for him

- Feels the fire and allows his greed to take over -- results in best or worst days

- Fannie Mae his biggest loss ever, most popular blog post

- Shorted AVXL, one of his best trades ever

- When he loses money, he wants to sleep in the next day

- When the wheels fall off, self-doubt creeps in, needs to take a break

- Has had worries that he'll never trade again

- October 2016 the worst month in an otherwise good year

- Can't get out in these microcap stocks, you get stuck, 1x loss become 3x loss

- Built muscle memory for trading certain stocks, which betrayed him when trading OTC stocks

- Lived in NYC for four years, 26 yo now

- Used to keep detailed journal, made detailed plans, did detailed trading reviews -- now he's relaxed, doesn't do any of this, just wings it [sounds familiar]

- Try less hard, take the pressure off yourself

- Trading is not easy, markets constantly changing

- Thoughts on trading BitCoin: insane volume and volatility, psychology same as crazy stocks

- Exchange security is everything, you get hacked and lose everything, you're just not safe

- Multiple exchanges with multiple rules, none of them have good infrastructure and security and no oversight, don't get involved with this, way too risky

- peterkto.blogspot.com

- Twitter: @peterkto

Notes for Chat with Traders, Episode 101

Episode 101 ... Siam Kidd (113:27)

- "Sitting in my Tesla"

- "I love Elon Musk"

- 0-60 in 2.8 seconds, he says

- British

- 30 years old now, stone broke at age 25

- Was pilot in Air Force, station commander can earn 80-90K GBP after 20 years in, realized he had to get out

- Joined Air Force at age 18

- Had been trading for seven years (since 18), first four years of trading a horror story

- "Billy Big Balls Syndrome" -- he'd go on a streak, get overconfident

- Online gambling and trading the only ways he could figure how to make "easy" money

- Martingale strategy using online roulette, thought he had cracked the system [funny]

- Revenge gambled his maxed-out Virgin credit card on online roulette, lost it all

- Moved on to trading where he "did considerably worse" [he has a sense of humor]

- Opened 2,000 GBP account, lost it within one day

- Blew his 2,000 GBP Air Force income every month for four years, all off one minute chart

- Girlfriend was supportive of his leaving the Air Force, trusted him to dig himself out [she must be an angel]

- Left Air Force with no safety net, ten grand in savings, started trading full time

- Made 30% per month for the first few months, then lost half his capital in one month

- Shopping in Lidl, could choose cheese or mayo, couldn't have both, rock bottom

- Got 16K admin role at some staffing company, had to pay the bills, completely demoralizing

- Still trading his 2,000 account, went back to the drawing board

- Risk management finally clicked after year seven, went back to the daily charts

- "Triple R" ... risk reward ratio must be 1 to 3 and preferably 1 to 8

- Van Tharp book a huge help

- Wish he had had a mentor who knew what he/she was doing, something more than just googling for answers

- Made every mistake he could: strategy hopping, buying black boxes, scalping, day trading

- No good or bad forms of trading, all about risk management

- New traders should never day trade

- "Boring trading is good trading"

- Second guessing yourself with every new five minute candlestick

- Making more decisions than you need to when intraday trading

- Be super selective, don't take many trades

- Only 100K traders in the UK, 95% of them losing money hand over fist

- Smart traders know how retail traders think and take advantage of them

- Stop running is rampant among pro traders and institutions, they seek out the retail orders

- Scouring the internet for "systems" ... that's a real rat race

- Markets only trend 15% of the time, chop the rest

- Trades currencies now, looks at 20 different pairs

- He's flat almost all the time, small wins, small losses, and a very occasional huge win

- Tries to catch reversals, so he gets stopped out a lot

- He will put orders out into space at "support or resistance" and hopes to get hit

- Get the best Triple R from this kind of entry

- His win rate is 32%

- Didn't want to stare at charts all day long

- Max risk for him is 0.25% per trade

- When trade goes in his favor, he scales in, adds .75% and then between .25% and .50%

- Thought Trump would win and markets would tumble, he didn't anticipate rebound and rally

- He looks for "coiling" ... volatility drops dramatically, range contracts ... "market compression"

- Places "fishing nets" above and below

- Gets shorts in during stop runs above [and I presume longs in during stop runs below]

- "It's just a numbers game." All about managing risk-reward

- Catch a thousand+ pip trade once or twice is year, you're set

- Has a lot of physical gold and silver as a hedge

- Make things mechanical, don't scare yourself out

- Uses two moving averages to manage his stop losses (8 EMA 21 EMA), keeps it simple

- Uses round numbers and .50 levels, trails below 8 EMA and these levels

- 21 EMA gives you enough space to catch the trends

- Spends less than five minutes a day trading, adjusting stop losses using 21 EMA

- You can do 10,000 hours of chart time and "still be shit at it" ... will take a lot longer time than that if you're not focused

- Read everything that Van Tharp has ever written

- People quit trading because it just takes too much time to do (screen time)

- Uses three screens

- If he has to think about it longer than three seconds, he won't take the trade

- Once you're back from holiday, trade very small until you get your market sense back

- Business is the best "asset class" there is ... best risk/reward there is

- Has a stake in 15 different businesses now (says he's down to seven now)

- You need a lot of capital to make money trading ... making 30% on a 10 grand account, even every month, doesn't mean anything

- You don't want to be rich through compounding because you'll be too old to enjoy it

- If you run a business, get out of the weeds (don't get bogged down in the details)

- His first two or three businesses failed miserably

- Bought silver in bulk, made under 20 grand profit on 1.4MM in turnover ... horrible time-adjusted return

- Took M&A course for 7,000 GBP in Mallorca ... shockingly it wasn't a scam

- "All business owners are mugs."

- BIMBO ... buy in management buy out

- Has a very negative outlook on the world

- HFT now seeping into the currency markets, already licked the equity markets

- Don't try to make money trading unless you already have a large amount of money to trade

- Never think trading will get you out of the financial hole you're in

- Get your trading record audited so it's "proper legit" ... then easier to raise capital

- Find 3,000 people who pay you seven quid a month regularly (with a product or service), then sell it for 2MM

- "Never deliver shit"

- Dollar shave club dot com a great example

- Passionate views on schooling system, did a TedX Talk on topic

- Kids being killed mentally by schools

- Work 40 hours a week for 40 years and get a pension at 40% of what you made

- Kids now have "bugger-all skills"

- Has five-month-old child, doesn't want creativity beaten out of him

- Wants to create just one school that adopts his philosophy

- Wants kids playing with robotics, 3D printing, augmented reality from Day One

- He's not a fan of trigonometry [I'm chuckling]

- Long summer holidays from school all about the Harvest (not relevant anymore)

- Will need 10MM quid to build his school, doesn't want any external funding

- "I'm a simple bloke with average qualities from Norwich"

- Sir Ken Robinson, big fan of him

- He's not naturally a Big Thinker

- Do Review Apply ... Air Force saying [reminds me of Netto]

- Goal setting is silly, focus on your habits instead

- Think and Grow Rich, by Napoleon Hill ... big fan of the book

- Everyone thinks small, you should think big

- You're swimming in an ocean of opportunity

- Always think bigger, not "I have to buy a house," but "I have to buy a village"

- Humans always adapt, always "up-skill"

- But rate of technological change has increased so much, will create future shock for humans

- Recommends the book, Abundance by Peter Diamandis

- "Sorry for rambling on"

- Says some nice things to Aaron in parting

- Has YouTube videos

- Twitter: @SiamKidd