No changes this week.

Please Me, Torture And Tease Me

The great Kenny Rankin singing In The Name of Love:

Short Set-up in Nvidia

NVDA has been unusually active since reporting earnings late last week, so it should be on your radar for idiot wave setups ... and fortunately around 11:30 AM today it gave a decent risk/reward spot to get short with a $107.75 first target. It's hard to keep an eye on things if you're working off of one cracked laptop monitor, so you might want to crack open your wallet and get several big screens (they're so cheap now, it's crazy).

Once again it didn't get down to the target by the end of the day, but still, covering at the close was nothing to cry about.

Click to enlarge

Zippo Lighter -- "Tiger Eye"

The latest addition to my collection of Zippo Armor lighters, "77685," a special order release.

Long Set-up in Activision Blizzard

ATVI was one of the most active things I was watching on Friday morning ... it gapped up big after-hours on Thursday following an earnings report ... unusually active means it gets on my radar looking for idiot wave set-ups, as I've explained in a previous post.

I was visiting a new local casino when it set-up during the lunch hour, so I didn't see it in real time, but it's pretty enough to post here after-the-fact. It didn't hit the target during the day on Friday, but it would have been a fine play to close at end of day and something to keep in mind as we go into next Monday.

Click to enlarge

Long Set-up in Hassenfeld Brothers

HAS first lit up the scanner as it 1) gapped up pre-open (on earnings), 2) made a new yearly high at the open, and 3) became unusually active at the open, then at 9:34 AM, and finally at 10:55 AM. This means I put it on my "idiot wave" watch list, and open the 1-minute, 3-minute, 5-minute, and 15-minute charts on one screen to look for low risk set-ups.

The unusual activity into 10:55 AM was actually a dip which formed a zig zag on the 3-minute which was playable. A masterful (i.e., lucky) entry could have been $93.75 off of the 1-minute chart, but more realistically entry off of the 3-minute would have been $94.14 with the same stop (below $93.30). Target was $96 and high change so the initial risk/reward was acceptable (not great, just ok, gets the green light).

Now this trade didn't work in the end, it was a scratch, no harm, no foul ... but the important thing is the thinking was good, and from the masterful entry you could take something off and carry the rest into the close with a breakeven stop, something like that. I've been out of the game for long enough to be rusty, but I'm just sharing my thoughts, and am happy to hear yours.

Click to enlarge

Chairman Recommended: Slippers

I am almost completely housebound during the winter here in Appalachia and only leave to:

- Take the kids somewhere (school, swimming, art lessons, etc.),

- Buy groceries,

- Play poker.

So my indoor footwear is very important and I use LL Bean's aptly named Wicked Good Scuffs III. I love them because they:

- Have rubber soles,

- Are made from soft sheepskin and are shearling-lined (Australian sheep),

- Are scuffs ("a flat-soled slipper without quarter or heel strap").

I'm at the advanced stage of laziness where all my footwear must be easily slipped on and off, so I slip out of these moccasins and into my slip-on boots when I go outside (to get the paper or put out the trash) and then back in again when I come inside. I wear them all day every day -- highly recommended by the Chairman!

(See this post for my recommended summertime footwear.)

Pretty Set-up in the Biotechs

I'm going to be trading a bit more in 2017 now that baby has started Kindergarten and the house is quieter in the mornings.

Yesterday (1/31/2017) the scanner alerted me to the fact that XBI (the S&P Biotech SPDR) was unusually active around 9:48 AM. I always keep an eye on the recently issued LABU (the Biotech 3x Bull fund based on XBI) these days since it's already fairly liquid and the leverage makes it a decent trading vehicle.

I like to see low risk, high reward set-ups based on the zig-zag "idiot wave pattern," and one thankfully appeared at lunchtime in XBI/LABU off the five minute chart. I might not have been looking as hard at LABU if it hadn't been for that early in the day alert on XBI.

Click to enlarge

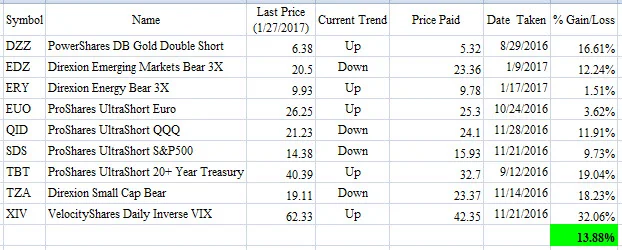

ETF Trading Portfolio Update -- January 30, 2017

No changes this week.

I'll Leave Him Just For You

Love Lucy Rose's Shiver ... great stuff. She was born in 1989.

ETF Trading Portfolio Update -- January 23, 2017

No changes this week.

ETF Trading Portfolio Update -- January 16, 2017

Reversing my longest-held long (Energy) after the holiday.

ETF Trading Portfolio Update -- January 9, 2017

Reversing the Emerging Markets... getting long just in time to get whipsawed?

Trading Instruments and Inception Dates

3x

(SPXL) | SPXS, Direxion Daily S&P 500 Bull and Bear 3x Shares, 2008.11.05

TNA | TZA, Direxion Daily Small Cap Bull and Bear 3x Shares, 2008.11.05

ERX | (ERY), Direxion Daily Energy Bull and Bear 3x Shares, 2008.11.06

FAS | (FAZ), Direxion Daily Financial Bull and Bear 3x Shares, 2008.11.06

UPRO | SPXU, ProShares UltraPro and UltraPro Short S&P500, 2009.06.23

(UDOW) | SDOW, ProShares UltraPro and UltraPro Short Dow30, 2010.02.09

(TQQQ) | SQQQ, ProShares UltraPro and UltraPro Short QQQ, 2010.02.09

NUGT | DUST, Direxion Daily Gold Miners Index Bull and Bear 3x Shares, 2010.12.08

(UGAZ) | DGAZ, VelocityShares 3x Long and Inverse Natural Gas ETN, 2012.02.07

UWTI | (DWTI), VelocityShares 3x Long and Inverse Crude Oil ETN, 2012.02.07 (Discontinued 2016.12.08 (pdf))

JNUG | JDST, Direxion Daily Junior Gold Miners Index Bull and Bear 3x Shares, 2013.10.03

LABU | LABD, Direxion Daily S&P Biotech Bull and Bear 3x Shares, 2015.05.28

2x

QID | (QLD), ProShares UltraShort QQQ, 2006.07.11

SDS | SSO, ProShares UltraShort and Ultra S&P500, 2006.07.11

TBT | (TBZ), ProShares UltraShort 20+ Year Treasury, 2008.04.29

UCO | (SCO), ProShares Ultra Bloomberg Crude Oil, 2008.11.24

UVXY | (SVXY), ProShares Ultra VIX Short-Term Futures ETF, 2011.10.03

TVIX, VelocityShares Daily 2x VIX Short-Term ETN, 2010.11.29

() Parentheses denote relatively illiquid sibling, no link to product page.

ETF Trading Portfolio Update -- January 2, 2017

No changes this week.

Weight Watchers Progress -- Month One

Background

After moving back to America from China in July 2015, I quickly gained around 30 pounds, going from ~190 pounds to ~220 pounds. I'm a little over six feet tall and broad shouldered, so I can carry a lot of weight without looking especially fat, but I began to feel uncomfortable (even my "fat" pants didn't fit) and decided to lose all the extra weight.

I didn't join Weight Watchers, I simply got their Getting Started guide, Complete Food Companion, and Points Finder card. You can find these cheaply on eBay, mine is the 2001 edition. I don't need the support group or peer pressure aspect of the program since I'm self motivated.

Method

Because I started at ~220 pounds, the program gives me a daily "point range" of 24 to 29, and they suggest targeting the middle of the range, i.e., consuming 26.5 points of food a day. Obviously the reason anyone gets fat is because he is overeating. The great insight of Weight Watchers is that you should not undereat, that is, you must consume at least 24 points of food every day. Vegetables are zero points so you can consume an unlimited amount of them.

I had tried eating only 500 calories two days a week (Monday and Thursday) earlier in the year, but it was a disaster. I would eat twice as much on the days preceding or following the fast day. It was an idiotic idea. It figures that I learned about it, while browsing People magazine in the supermarket checkout line, from a late-night talk show host. Fasting occasionally might make sense if you are very fit, but it's a terrible idea if you are fat.

You must keep a detailed food diary recording your points consumed. You need to be honest with yourself and strictly record everything. If you cheat, you will fail.

Exercise

You can gain points by doing exercise, but not a lot. I row every day (Concept2), always have, through fit and fat. A gentle 30 minute row will give you two extra points, but I still shoot for my 26.5 point goal despite gaining these points. I suppose some people might want to consume those extra two points since they "earned" them, but I simply "bank" them.

Meals

Here are examples of what I eat every day:

Breakfast (6.5 points total)

- Egg fried in 1/2 teaspoon of butter: 2.5 points

- Slice of rosemary olive oil bread, toasted (no butter): 3 points

- One boiled egg white: 0 points

- One orange: 1 point

Lunch (8 points)

- Beef tenderloin (or chicken breast) fried in 1/2 teaspoon of butter: 3.5 points (three ounces cooked weight)

- Salad (only the avocado, olives, pesto, and dressing have points): 4.5 points

Supper (10 points)

- My wife cooks supper so there's a lot of variety here, but I'm always careful about counting the points accurately and sizing portions appropriately.

Snacks (2 points, some examples below):

- Apple: 1 point

- Orange: 1 point

- Cup of grapes: 1 point

- 1/2 banana: 1 point

- 3 cups popcorn (oil popped): 2 points

- 1/8 cup Craisins: 1 point

- 1 tablespoon hummus: 1 point

Tips for Success

Bubble tea straws, carrot sticks, and Ricola Honey-Herb cough drops. When I started out, I was eating a TON of carrot sticks every day (zero points) just to have something in my mouth -- some kind of oral fixation thing, I guess. The other tip is sucking on Ricola cough drops (I only like the Honey-Herb flavor). Again, they are sweet and satisfy some oral craving, and you can suck on them a long time (I think five of them equal one point, but you only have one from time to time).

Drink water with every meal. A bubble tea straw will help you consume a lot of water very quickly.

Results

I started on the Weight Watchers program on December 1st, 2016 at 217 pounds and weighed in on the 31st at 206.5 pounds, so I lost around ten pounds in one month, which is a lot! The interesting thing will be seeing how things go in the second month now that the "easy" weight has been lost. I will continue to report my progress (he says hopefully) at the end of January 2017.

That Old Crazy Asian War

The great Kenny Rogers singing Mel Tillis's song in 1972 ... that old crazy Asian war was still ongoing.

ETF Trading Portfolio Update -- December 26, 2016

No changes this week.

BHP Billiton Should Fall Below the 2016 Low

Every fellow Idiot Waver has been watching BHP Billiton $BHP for many weeks now, waiting for a good spot to get short. Those who got short on the reversal in early October were shaken out by the post-election surge, but that set up an even better entry: short below $37.40 (protective stop at $40.xx). This is a weekly chart, a very long-term set-up, if it works out it will take *months* to do so, not a "day trade."

What's important about the whole play is how it shapes your thinking towards industrial metals, Australia, China, Brazil, currencies, The Donald playing a completely unsuitable (and potentially catastrophic) role, etc. You don't need to take the trade, just keep it in the back of your mind.

click to enlarge, (get a bigger monitor, dummy)

ETF Trading Portfolio Update -- December 19, 2016

No changes this week....