The great Barbara Lewis surrounded by a weirdly unmoved (until cued), mostly white, studio audience:

Trading Notes -- 20190128 Monday

Broad tone neg ... short tailwind... jammed out pre-open on remainder BIOC (bastards), woulda been shaken out same spot in reg hours but still, dirty, small loss in the end, will have to look for precise number but very small; CLRO covered some at minC looking for Typ3, maybe too greedy, reevaluated, prolly 185 more realistic than 175, it's so completely dead impossible to exit any size, StuckAtaProfit Day Two dog; BBBY finally went to B/E level to take me out, instantly dropped back 50 cents, comical, should have been out of that days ago; OSTK came in with a plan, they tested the prev day high during OR clever devils, reversed, filled B & A hoping for A+ no joy; SLM got lucky opened weak, got out of all at modest targets, dodged a bullet cuz that was definitely a revenge trade with revenge size and I got away with it, needed the money :)

AVCO (2.74K, 14.1K, 63.9K) and BIOC (1.46K, 11.1K, 21.7K) the stocks du jour, AVCO FIDO 15, no borrow in either at IB/ToS, shorted (0.065) AVCO at B coulda gotten A but it was tricky during OR, covered some at minC, it came back in afternoon stopped me out on balance at A, re-shorted it at B which had become perfect support lol, instantly jammed out at 1R loss but I didn't add A A+ which was good, once difangs shot on the afternoon short squeeze, I'm sort of at a loss (ha!) but think it best to leave alone, avoid revenge trading, it was a good solid player, tons of activity and volatility, really enjoyed it. Pretty quick to figure out new order entry system, slippage not proving to be horrible, but it shows you how good IB's TWS really is. Liked the 3PM failed breakout in AVCO so took another stab at it, broke hard to VWAP and held, very hard to piece out a position using limit orders since there are no OCOs, it's all hot key stuff, too quick for an old man. Took it all off at A level in pieces, clock was ticking but B level woulda also worked. Got back a little. OK to lose a couple hundred bucks monkeying around with new order entry platform.

BIOC there was an opp during OR but required anticipation and I was afraid of revenging it so focused on much more active AVCO instead, which was good.

Need to get the ~$4K out of ToS since it's useless for trading more or less and everyone tells me they keep their account open with $100, so I'll do that this week.

AVCO was a perfect long of course (look at the chart below) but I'm always looking short... I know how to get long, I have good, nay near-perfect, entries, etc., but I'm just opposed to it for some bizarre psychological reason.

TRVN sub $1 stock that came over a dollar and showed up on scanner, no borrow IB, oops they found 150K shares just for me, above magic level no play.

Movies Watched -- Black Coal, Thin Ice (2014)

In Chinese. 106 minutes, but felt at least 15 minutes too long. Weird one from China. The Chinese title is 白日焰火, which means daytime fireworks, which makes sense at the end of the movie (it’s also the name of a night club within). Sort of a crime / mystery / thriller, but it was none of those things really — more a low-budget art house movie than anything. The only thing that interested me about it was that it was set in Harbin, a city I have some familiarity with, having spent my fall semester of my junior year abroad (in 1990!) at the Harbin Institute of Technology … and of course I know China well.

Structure of the movie wasn’t very good, fairly disjointed, lot of leaps of logic, femme fatale angle didn’t really work, just strange — how did the detective (who was later killed) track down the killer? Did the other detective love the girl? Why? And why screw her and not save her? Yellow rating for those who think about China, and especially Harbin, with some nostalgia, red rating for everyone else.

Luke Buckmaster correctly writes, “It's hard to imagine it traveling much wider than the festival circuit.“

是我干的

Movies Watched -- Darkest Hour (2017)

125 minute running time so at least 25 minutes too long, but I liked this one. Gary Oldman plays Churchill … it’s a sort of a companion movie to 2004’s Der Untergang. I don’t know how historically accurate it is, but the movie was very entertaining. I also like Lily James’s look (see below) … I first saw her in Baby Driver (she played the waitress).

A rare green rating from the Chairman.

Just looking at you

This is another movie from 2017 that I can recommend along with:

Trading Notes -- 20190125 Friday

Broad tone poz, shorts no tailwind. Ear infection, saw doc at 11AM, spent afternoon in bed… CLRO the stock du jour (1.13K, 14.5K, 34.2K), the only game in town, I shorted C&B and came close to getting an A entry but no cigar, holding for targets well below; took a loss in SLM, once again forgot I had open orders in there and filled a bunch pre-open which was a mistake and increased the loss about 25%, but nothing crazy, just annoying, also noticed I missized one of the original legs, bah, this is what happens you change your bet sizing during experiments; able to cover a leg of BIOC; VIPS rallied and stopped me out on last so a scratch, I hate that stock, it acts like a Usual Suspect, very difficult; re-shorted SLM in afternoon off of ORR, maybe a revenge trade, lotta size, but it felt ok, we’ll see.

Trading Notes -- 20190124 Thursday

Broad tone poz … yesterday’s heroes become today’s zeros, look at BOXL and SPI (though BOXL did a cynical run in the afternoon, straight into yday’s closing level), monkeyed with ToS order entry, no way to put on multiple legs out with a single order, pretty lame, but customer service wasn’t terrible, I had to call them after multiple chats with semi-competent reps (unlike IB where everyone seems sharp), I don’t think I’ll leave much money with ToS with the crummy order entry and $7 a ticket :-), power outage before the open and another right before 10 AM, not cool but all my stops were in.

PCG -- 230, 4.56K, 188K, halted near 15:30 then gapped up to $15ish on limited liability news, glad I wasn't involved in that one, knew halt risk was high

SLM — 30, 15.2K, 75.6K, yes borrow, poz earnings, strong morning, shorted in both ToS account (experiment) and IB, C & B entries

VIPS — 198, 8.84K, 40.2K, yes borrow, short C covered minC, waiting for Typ3

BLNK -- 565, 16.1K, 25.4K, stock du jour looked like, no borrow, went dead though, note 10/16 TC dichotomy

VTVT -- n/a, 4.48K, 22.3K, back from the dead, no borrow, gave beautiful spots, coulda had full amazing position but no borrow means no joy

MBOT — 540, 7.1K, 18.3K, full red restricted from short sale, came alive in afternoon, super cynical drive, slimy stock

BIOC -- 25, 2.57K, 12.6K, yes borrow (surprise!), so even though very thin, shorted B & A (new sizing experiment, not a great idea, go back to original amounts — no risk, no reward), they filled me on 100x cover, but didn’t fill me a single share short there, bastards, another reason not to cover any there, ever

CLDC — 1.43K, 8.55K, 12.0K, active PO then went dead, no borrow

BOXL -- 140, 1.47K, 4.66K, completely dead, H2Z, 10TC1.53K, no borrow

SPI -- 110, 1.22K, 3.27K, completely dead, H2Z, 10TC1.23K, no borrow

TLGT — 131, 653, 1.53K, yes borrow, semi-active PO and a good example of something that is thin and dead, note 10/16 TC (see chart below)

Trading Notes -- 20190123 Wednesday

Broad tone mixed to neg... I left at 10:30 for a massage and then dealt with M for the Mars poster framing, didn't get back till around 14:30 ... took a bunch of stuff off in afternoon, will be nice to get it off the watchlists, clean things up. PO actives went dead quick, see TC below. Stocks du jour were all latecomers.

BOXL -- n/a, 10.7K, 74.3K, FIDO 16, stock du jour, no borrow, strong OR, shifted shortly thereafter, no borrow so no joy but coulda filled BA

PCG -- 224, 7.18K, 58.4K, pulled plug, though liquid, out of patience, took it off, decent gain

VIPS -- n/a, 14.7K, 54.2K, yes borrow, active on upgrade / new PT, something of a Usual Suspect, tricky in past, I'll keep a lazy eye on it

MBOT -- 42, 329, 42.7K, FIDO 15, no borrow full red, came back to life, rallied right into a 15:30 offering, the dirty devils, they would have driven me out had I had a borrow

CRON -- 279, 7.54K, 36.5K, FIDO 17, filled during OR, nice gain, will be good to take it off list since it’s a Usual Suspect

SPI -- n/a, n/a, 15.4K, no borrow, latecomer, don't know if on early scanner, will check, burst was 11:50ish (I was away)

ATHX -- 1.25K, 2.83K, 9.41K, yes borrow, poz drug news, active PO, no fill, just too weak and went super thin

SNGX -- 1.25K, 5.6K, 8.32K, yes borrow, patent news, active PO, C fill only, out minC and Typ3 in absentia, nice gain

FNMA -- 8, 2.03K, 5.84K, got a fill finally during OR and they dropped it much lower of course (the only way you can get a fill on OTC/BB nightmare), nice gain

RCON -- 120, 3.31K, 5.41K, yes borrow, filled CB, out minC, touched Typ3 but no fill, felt me out and took it back up, ridiculously thin

BBBY -- came close to Typ3 but no fill, big bounce, patience running out

AVCO -- no borrow, active at open, super weak, maybe C fill possible with borrow but no joy

AUPH -- pulled plug, no liquidity, no patience, out with decent gain

FTK -- pulled plug, super illiquid, just so dead, sick of it on monitor, decent gain

CCXI 5/10/16

For my own reference:

Enable lightbox

Trading Notes -- 20190122 Tuesday

Broad tone poor, indexes down 2%, short tailwind ... figured out (thanks rep ScottA) that you can add an HTB/ETB column in a ToS watchlist, sweet! Figured out how to turn crosshairs off of tone.

PCG 642, 24.3K, 197K FIDO 25 didn't realize I had a C order resting in market, filled pre-open of course, so I increased risk when I wanted to take some off, weak open tried to reduce risk by half, missed me by three ticks then went straight up for a 1R loss (actually little less than 1R since no A+ entry), anyway, darn it, I really blew that one, again had multiple chances to take very small loss/gain or even scratch it but ended up taking the planned loss instead, on the bright side at least I didn't add and go crazy since it ran $8.38 during OR, could have been mega-loss instead of disciplined loss, so that's good, stalked it, shorted A again (lucky), added B, patience is a virtue (sing along)

CRON 384, 15.5K, 59.7K, FIDO 8 got C and B missed A by a tick (annoying rounding), covered minC rest below at Typ3

MDWD 1.83K, 3.78K, 37.9K FIDO 28!! note 10 TC, odd, no borrow, hit 6.50 PO, opened around 5, big beautiful bounce to round number 6, working off PO coulda had C entry or off OR levels B&C IF anticipated slope shift but with no borrow no joy

BBBY 2, 117, 31.7K note EOD TC given AM, slightly less dead but again at BE with remainder since time is of the essence

STAF 1.48K, 14.9K, 21.8K, note 10/16 TC dichotomy, no borrow, stuffed at the open, woulda had to be PO entries (possible), all targets hit.

FNMA 72, 3.51K, 15.1K, FIDO 26 came in with a plan, shorted A and A+ then they ran me out, kept stalking it, didn't realize it's PINK, makes it harder since those guys are ruthless, flatline it at will, just terrible, OTC/BB should be avoided like the plague, re-shorted B, looked to add C, no hope for A, forgot to update C entry price, they skipped through me, no add, shit, covered minC, waiting rest at Typ3, phuckers wouldn't fill me at the bid, god knows they felt me out, be patient grasshopper

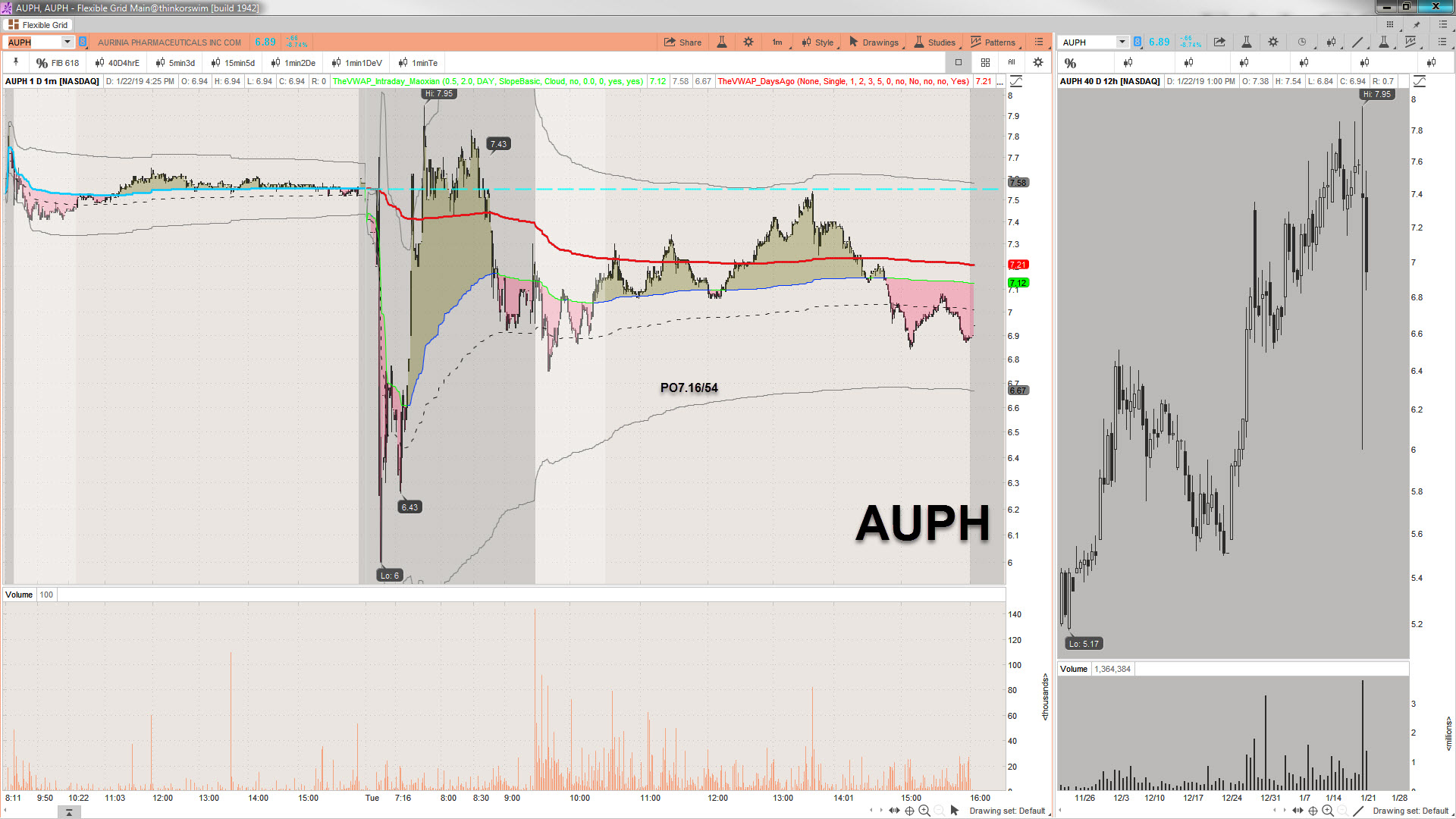

AUPH 1.64K, 4.26K, 14.8K, note PO to 10/16 TC, weird one, poz drug data but some whacky up and down PO action (low 6 high 8), had borrow, shorted B, no break, looked to add A, will reconsider how to handle manana, prolly no add in the money

APHA 620 3.64K, 14.6K anticipated slope shift (dangerous?), nah it did shift, it was fine, sorta came near A entry but failed, C entry, covered at minC waiting on rest at Typ3, decent win, much needed given PCG screw-up, they partialed me at Typ3, too much size of course, they feel me out and penny above, the bastards, crazy after hours bullshit straight up, hard to fill exit out, really scummy to pull that after the close, got lucky to scratch remainder!

KTOV 259, 943, 2.72K slightly active PO, did have small borrow, possible play, woulda worked, just too thin, I don't regret avoiding it despite missing big winner, possible StuckAtaProfit scenario with a $1 stock and a zillion shares

FTK 0, 324, 2.00K so dead glad I'm at BE with remainder

CCCL 9, 178, 806 exited remainder at Typ3, still no liquidity but possible to cover near bottom tick at open, around 800! trades total EOD, insane! Try covering 40K short in that one on Day Two, smart guy!

Movies Watched -- The Lost City of Z (2017)

140 minute running time so at least 40 minutes too long … I had to watch it at 4x ffwd ... no subtitles ... period piece ... about a British explorer, Percy Fawcett, his travels to the Amazon at the turn of the century, mapmaking, but ended up searching for a lost civilization ... life interrupted by WWI ... injured in combat ... got Royal Geographical Survey gold medal ... went back to Amazon multiple times, final trip taken with his son ... both disappeared, presumed killed by “savages.” I wasn't into it, and it was way too long, but probably not a bad movie for people interested in early 20th C. explorers.

Mick LaSalle wasn’t thrilled: “…if Fawcett were pursuing some noble end, then it might be worth our while to sit and watch his struggle.“

… a man’s reach should exceed his grasp.