Broad tone poz, shorts no tailwind. Ear infection, saw doc at 11AM, spent afternoon in bed… CLRO the stock du jour (1.13K, 14.5K, 34.2K), the only game in town, I shorted C&B and came close to getting an A entry but no cigar, holding for targets well below; took a loss in SLM, once again forgot I had open orders in there and filled a bunch pre-open which was a mistake and increased the loss about 25%, but nothing crazy, just annoying, also noticed I missized one of the original legs, bah, this is what happens you change your bet sizing during experiments; able to cover a leg of BIOC; VIPS rallied and stopped me out on last so a scratch, I hate that stock, it acts like a Usual Suspect, very difficult; re-shorted SLM in afternoon off of ORR, maybe a revenge trade, lotta size, but it felt ok, we’ll see.

Trading Notes -- 20190124 Thursday

Broad tone poz … yesterday’s heroes become today’s zeros, look at BOXL and SPI (though BOXL did a cynical run in the afternoon, straight into yday’s closing level), monkeyed with ToS order entry, no way to put on multiple legs out with a single order, pretty lame, but customer service wasn’t terrible, I had to call them after multiple chats with semi-competent reps (unlike IB where everyone seems sharp), I don’t think I’ll leave much money with ToS with the crummy order entry and $7 a ticket :-), power outage before the open and another right before 10 AM, not cool but all my stops were in.

PCG -- 230, 4.56K, 188K, halted near 15:30 then gapped up to $15ish on limited liability news, glad I wasn't involved in that one, knew halt risk was high

SLM — 30, 15.2K, 75.6K, yes borrow, poz earnings, strong morning, shorted in both ToS account (experiment) and IB, C & B entries

VIPS — 198, 8.84K, 40.2K, yes borrow, short C covered minC, waiting for Typ3

BLNK -- 565, 16.1K, 25.4K, stock du jour looked like, no borrow, went dead though, note 10/16 TC dichotomy

VTVT -- n/a, 4.48K, 22.3K, back from the dead, no borrow, gave beautiful spots, coulda had full amazing position but no borrow means no joy

MBOT — 540, 7.1K, 18.3K, full red restricted from short sale, came alive in afternoon, super cynical drive, slimy stock

BIOC -- 25, 2.57K, 12.6K, yes borrow (surprise!), so even though very thin, shorted B & A (new sizing experiment, not a great idea, go back to original amounts — no risk, no reward), they filled me on 100x cover, but didn’t fill me a single share short there, bastards, another reason not to cover any there, ever

CLDC — 1.43K, 8.55K, 12.0K, active PO then went dead, no borrow

BOXL -- 140, 1.47K, 4.66K, completely dead, H2Z, 10TC1.53K, no borrow

SPI -- 110, 1.22K, 3.27K, completely dead, H2Z, 10TC1.23K, no borrow

TLGT — 131, 653, 1.53K, yes borrow, semi-active PO and a good example of something that is thin and dead, note 10/16 TC (see chart below)

Trading Notes -- 20190123 Wednesday

Broad tone mixed to neg... I left at 10:30 for a massage and then dealt with M for the Mars poster framing, didn't get back till around 14:30 ... took a bunch of stuff off in afternoon, will be nice to get it off the watchlists, clean things up. PO actives went dead quick, see TC below. Stocks du jour were all latecomers.

BOXL -- n/a, 10.7K, 74.3K, FIDO 16, stock du jour, no borrow, strong OR, shifted shortly thereafter, no borrow so no joy but coulda filled BA

PCG -- 224, 7.18K, 58.4K, pulled plug, though liquid, out of patience, took it off, decent gain

VIPS -- n/a, 14.7K, 54.2K, yes borrow, active on upgrade / new PT, something of a Usual Suspect, tricky in past, I'll keep a lazy eye on it

MBOT -- 42, 329, 42.7K, FIDO 15, no borrow full red, came back to life, rallied right into a 15:30 offering, the dirty devils, they would have driven me out had I had a borrow

CRON -- 279, 7.54K, 36.5K, FIDO 17, filled during OR, nice gain, will be good to take it off list since it’s a Usual Suspect

SPI -- n/a, n/a, 15.4K, no borrow, latecomer, don't know if on early scanner, will check, burst was 11:50ish (I was away)

ATHX -- 1.25K, 2.83K, 9.41K, yes borrow, poz drug news, active PO, no fill, just too weak and went super thin

SNGX -- 1.25K, 5.6K, 8.32K, yes borrow, patent news, active PO, C fill only, out minC and Typ3 in absentia, nice gain

FNMA -- 8, 2.03K, 5.84K, got a fill finally during OR and they dropped it much lower of course (the only way you can get a fill on OTC/BB nightmare), nice gain

RCON -- 120, 3.31K, 5.41K, yes borrow, filled CB, out minC, touched Typ3 but no fill, felt me out and took it back up, ridiculously thin

BBBY -- came close to Typ3 but no fill, big bounce, patience running out

AVCO -- no borrow, active at open, super weak, maybe C fill possible with borrow but no joy

AUPH -- pulled plug, no liquidity, no patience, out with decent gain

FTK -- pulled plug, super illiquid, just so dead, sick of it on monitor, decent gain

CCXI 5/10/16

For my own reference:

Enable lightbox

Trading Notes -- 20190122 Tuesday

Broad tone poor, indexes down 2%, short tailwind ... figured out (thanks rep ScottA) that you can add an HTB/ETB column in a ToS watchlist, sweet! Figured out how to turn crosshairs off of tone.

PCG 642, 24.3K, 197K FIDO 25 didn't realize I had a C order resting in market, filled pre-open of course, so I increased risk when I wanted to take some off, weak open tried to reduce risk by half, missed me by three ticks then went straight up for a 1R loss (actually little less than 1R since no A+ entry), anyway, darn it, I really blew that one, again had multiple chances to take very small loss/gain or even scratch it but ended up taking the planned loss instead, on the bright side at least I didn't add and go crazy since it ran $8.38 during OR, could have been mega-loss instead of disciplined loss, so that's good, stalked it, shorted A again (lucky), added B, patience is a virtue (sing along)

CRON 384, 15.5K, 59.7K, FIDO 8 got C and B missed A by a tick (annoying rounding), covered minC rest below at Typ3

MDWD 1.83K, 3.78K, 37.9K FIDO 28!! note 10 TC, odd, no borrow, hit 6.50 PO, opened around 5, big beautiful bounce to round number 6, working off PO coulda had C entry or off OR levels B&C IF anticipated slope shift but with no borrow no joy

BBBY 2, 117, 31.7K note EOD TC given AM, slightly less dead but again at BE with remainder since time is of the essence

STAF 1.48K, 14.9K, 21.8K, note 10/16 TC dichotomy, no borrow, stuffed at the open, woulda had to be PO entries (possible), all targets hit.

FNMA 72, 3.51K, 15.1K, FIDO 26 came in with a plan, shorted A and A+ then they ran me out, kept stalking it, didn't realize it's PINK, makes it harder since those guys are ruthless, flatline it at will, just terrible, OTC/BB should be avoided like the plague, re-shorted B, looked to add C, no hope for A, forgot to update C entry price, they skipped through me, no add, shit, covered minC, waiting rest at Typ3, phuckers wouldn't fill me at the bid, god knows they felt me out, be patient grasshopper

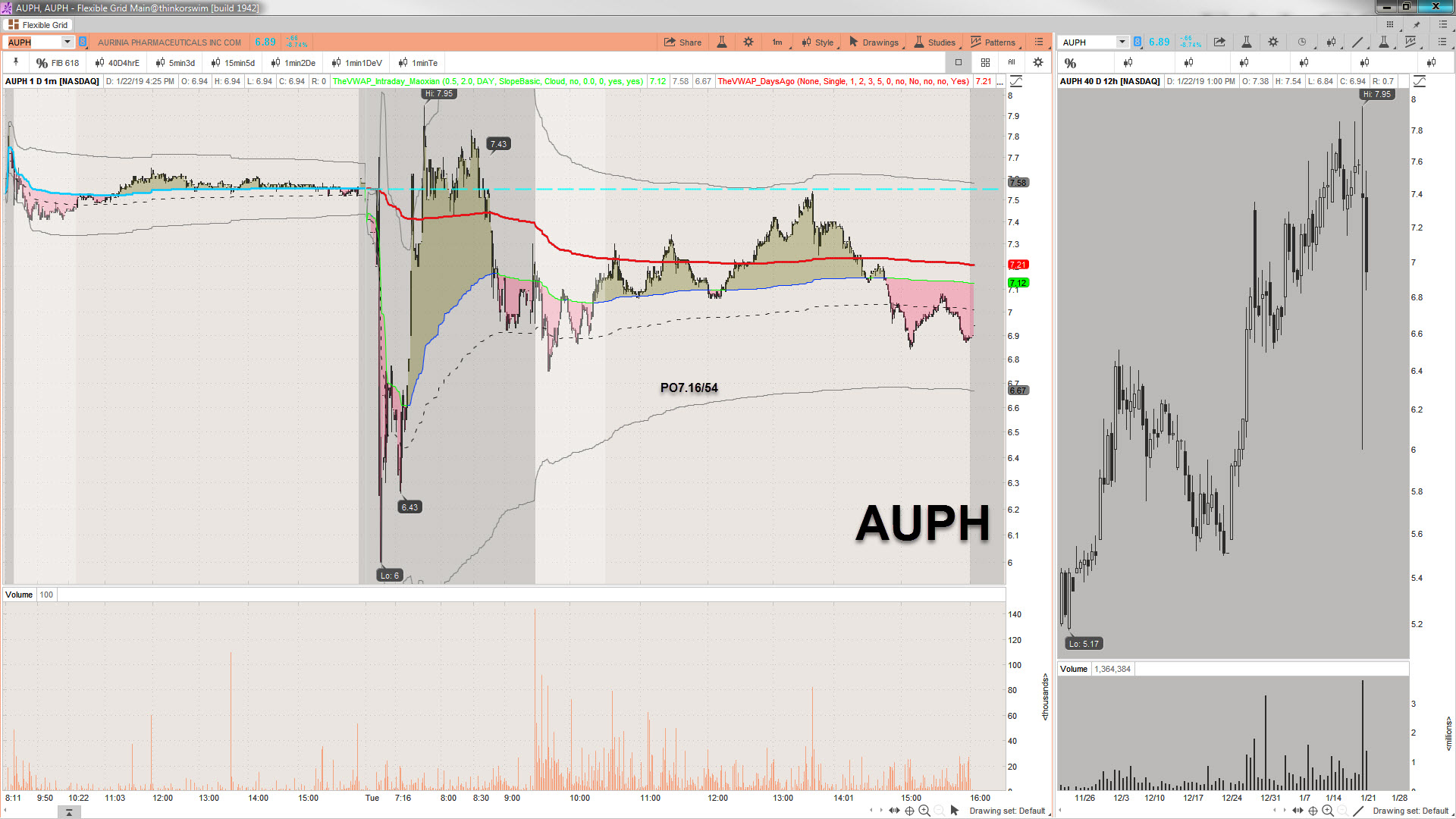

AUPH 1.64K, 4.26K, 14.8K, note PO to 10/16 TC, weird one, poz drug data but some whacky up and down PO action (low 6 high 8), had borrow, shorted B, no break, looked to add A, will reconsider how to handle manana, prolly no add in the money

APHA 620 3.64K, 14.6K anticipated slope shift (dangerous?), nah it did shift, it was fine, sorta came near A entry but failed, C entry, covered at minC waiting on rest at Typ3, decent win, much needed given PCG screw-up, they partialed me at Typ3, too much size of course, they feel me out and penny above, the bastards, crazy after hours bullshit straight up, hard to fill exit out, really scummy to pull that after the close, got lucky to scratch remainder!

KTOV 259, 943, 2.72K slightly active PO, did have small borrow, possible play, woulda worked, just too thin, I don't regret avoiding it despite missing big winner, possible StuckAtaProfit scenario with a $1 stock and a zillion shares

FTK 0, 324, 2.00K so dead glad I'm at BE with remainder

CCCL 9, 178, 806 exited remainder at Typ3, still no liquidity but possible to cover near bottom tick at open, around 800! trades total EOD, insane! Try covering 40K short in that one on Day Two, smart guy!

Movies Watched -- The Lost City of Z (2017)

140 minute running time so at least 40 minutes too long … I had to watch it at 4x ffwd ... no subtitles ... period piece ... about a British explorer, Percy Fawcett, his travels to the Amazon at the turn of the century, mapmaking, but ended up searching for a lost civilization ... life interrupted by WWI ... injured in combat ... got Royal Geographical Survey gold medal ... went back to Amazon multiple times, final trip taken with his son ... both disappeared, presumed killed by “savages.” I wasn't into it, and it was way too long, but probably not a bad movie for people interested in early 20th C. explorers.

Mick LaSalle wasn’t thrilled: “…if Fawcett were pursuing some noble end, then it might be worth our while to sit and watch his struggle.“

… a man’s reach should exceed his grasp.

Resorts Master List

Florida

Amelia Island — Elizabeth Pointe Lodge ($199) (Independent)

Amelia Island — Omni Amelia Island Plantation Resort ($152) (Omni Hotels)

Amelia Island — The Ritz-Carlton, Amelia Island ($319) (Marriott)

Atlantic Beach — One Ocean Resort & Spa ($199) (Remington)

Aventura — Turnberry Isle Miami, Autograph Collection ($529) (Marriott)

Boca Grande — Gasparilla Inn & Club (???)

Boca Raton — Boca Beach Club, A Waldorf Astoria Resort ($724) (Hilton)

Boca Raton — Boca Raton Resort and Club, A Waldorf Astoria Resort ($479) (Hilton)

Bonita Springs — Hyatt Regency Coconut Point Resort And Spa ($349) (Hyatt)

Clearwater Beach — Sandpearl Resort ($271) (Independent, marketed through Opal Collection)

Clearwater Beach — Opal Sands Resort ($244) (Independent, marketed through Opal Collection)

Doral — Trump National Doral Miami ($249)

Duck Key — Hawks Cay Resort ($419) (Independent)

Fort Lauderdale — Lago Mar Beach Resort & Club ($345) (Independent, Walter Banks)

Fort Lauderdale — Pelican Grand Beach Resort ($369) (Noble House)

Fort Myers Beach — Pink Shell Beach Resort & Marina ($329) (Independent)

Hollywood — The Diplomat Beach Resort Hollywood, Curio Collection by Hilton ($287) (Hilton)

Islamorada — Amara Cay Resort ($199) (Independent, also own Post Card Inn)

Islamorada — Cheeca Lodge & Spa ($319) (Independent)

Islamorada — The Moorings Village ($799) (Charlestowne Hotels)

Islamorada — Post Card Inn Beach Resort And Marina At Holiday Isle ($249) (Independent, also own Amara Cay)

Jupiter — Jupiter Beach Resort & Spa ($610) (Independent, marketed through Opal Collection)

Key Largo — Key Largo Bay Marriott Beach Resort ($242) (Marriott)

Key Largo — Playa Largo Resort & Spa, Autograph Collection ($319) (Marriott)

Key West — Casa Marina Key West, A Waldorf Astoria Resort ($402) (Hilton)

Key West — Hyatt Centric Key West Resort & Spa ($399) (Hyatt)

Key West — Margaritaville Key West Resort & Marina ($215) (Independent)

Key West — The Marker Key West ($309) (Highgate)

Key West — Ocean Key Resort & Spa ($409) (Noble House)

Key West — Parrot Key Hotel & Villas ($176) (Independent)

Key West — Pier House Resort & Spa ($386) (Remington)

Key West — Southernmost Beach Resort ($255)

Key West — Sunset Key Cottages ($759) (Independent, marketed through Opal Collection)

Little Torch Key — Little Palm Island Resort & Spa (on Munson Island) (???) (Noble House)

Longboat Key — The Resort at Longboat Key Club ($483)

Longboat Key — Zota Beach Resort ($207)

Manalapan — Eau Palm Beach ($659)

Marco Island — JW Marriott Marco Island Beach Resort ($519) (Marriott)

Miami — The Ritz-Carlton Key Biscayne, Miami ($709) (Marriott)

Miami Beach — Carillon Miami Wellness Resort ($479)

Miami Beach — Eden Roc Miami Beach ($355)

Miami Beach — The St. Regis Bal Harbour Resort ($639) (St. Regis)

Naples — LaPlaya Beach & Golf Resort ($495)

Naples — Naples Grande Beach Resort ($329)

Naples — The Ritz-Carlton, Naples ($989) (Marriott)

Palm Beach — The Breakers Palm Beach ($1,120)

Palm Beach — Four Seasons Resort Palm Beach ($770) (Four Seasons)

Palm Coast — The Hammock Beach Resort ($199)

Ponte Vedra Beach — Ponte Vedra Inn & Club ($219)

Riviera Beach — Palm Beach Marriott Singer Island Beach Resort & Spa ($652) (Marriott)

Santa Rosa Beach — WaterColor Inn ($295)

Sarasota — The Ritz-Carlton, Sarasota ($469) (Marriott)

St. Petersburg — The Vinoy Renaissance St. Petersburg Resort & Golf Club ($249) (SGC, Bryan Glazer)

Sunny Isles Beach — Acqualina Resort ($700) (Independent, Eddie & Jules Trump)

Trading Notes -- 20190118 Friday

Positive broad tone… no borrow on GEVO or BPTH, both possible home runs … included LMFA in charts below to show hero to zero … TSX with beautiful CRON long but I ignored and actually faded it toward end of day, which wasn’t terrible, sort of smartassy, I ended up scratching it. PCG could turn into a 1R loss (from newly sized up B entry), but maybe I’ll get lucky, think I had fomo, upset with self for missing yday so short today, bad dumb, etc. but very disciplined entries and exits lol. CCCL I got tiny surprise borrow, enough to fill worst possible C entry, no chance to add at B but I had a shit ton of shares there. So despite PCG mistake, had I had full fill on CCCL not to mention GEVO or BPTH, it could have been a very good day. FNMA on Fido, never on scanner despite 2.8BB mkt cap, will put on watch for next week.

PCG: Yes borrow, filled B&A … shorting into a bottom? FOMO after missing yday? Bad, two ticks from exit, reversed, but the psych damage is done, darn it… Friday afternoon before a long weekend! FIDO #27

832, 24.8K, 146K

CRON: Yes borrow, filled C half size fading Jeff :-) kinda dumb though, boredom trade? Scratched it. FIDO #15

328, 11.6K, 65.5K

GEVO: No borrow, woulda had to be pre-open entry cuz it collapsed on open

4.17K, 20.1K, 37.5K

BPTH: No borrow, reverse split garbage, woulda been a beauty (see below)

543, 10.3K, 31.7K

UPL: Yes borrow, filled C at open covered yiban at zero line, impatient got out rest a penny above zero line

2.70K, 8.18K, 17.6K

BIOC: No borrow, offering pre-open, super dirty how they ran it yday, but no borrow means no joy

32, 5.28K, 14.0K

CCCL: Tiny borrow at worst C price then none on attempted adds at B, phuckers, thin puppy, someone dumped 40K into the close and filled half of me but rest remains below

55, 2.24K, 5.03K

Who'd Have Believed You'd Come Along

Young Neil … born in 1941 … attended Surprise Lake Camp … no bigger sex symbol of his day.

Discontinued Legos Premium

This past Xmas I got my daughter Lego set 21110, “Research Institute.” She was still playing with Duplos when this set came out in 2014, so I didn’t buy it then, and it got retired somewhere between then and now. I ended up paying $46 for it (new) on eBay — it originally retailed for $20 in 2014. So this article on Bloomberg, The Hot New Asset Class Is Lego Sets, caught my eye.

In the past I’ve joked with the kids that we should stockpile sets that we think are going to appreciate, but who has time for that? Kids do! It could be a good experiment for them — a lesson in market values and scarcity premium and asset appreciation (or obsolescence) and storage costs and time value of money. I’ll let you know if we do it.