Broad tone mixed to neg... I left at 10:30 for a massage and then dealt with M for the Mars poster framing, didn't get back till around 14:30 ... took a bunch of stuff off in afternoon, will be nice to get it off the watchlists, clean things up. PO actives went dead quick, see TC below. Stocks du jour were all latecomers.

BOXL -- n/a, 10.7K, 74.3K, FIDO 16, stock du jour, no borrow, strong OR, shifted shortly thereafter, no borrow so no joy but coulda filled BA

PCG -- 224, 7.18K, 58.4K, pulled plug, though liquid, out of patience, took it off, decent gain

VIPS -- n/a, 14.7K, 54.2K, yes borrow, active on upgrade / new PT, something of a Usual Suspect, tricky in past, I'll keep a lazy eye on it

MBOT -- 42, 329, 42.7K, FIDO 15, no borrow full red, came back to life, rallied right into a 15:30 offering, the dirty devils, they would have driven me out had I had a borrow

CRON -- 279, 7.54K, 36.5K, FIDO 17, filled during OR, nice gain, will be good to take it off list since it’s a Usual Suspect

SPI -- n/a, n/a, 15.4K, no borrow, latecomer, don't know if on early scanner, will check, burst was 11:50ish (I was away)

ATHX -- 1.25K, 2.83K, 9.41K, yes borrow, poz drug news, active PO, no fill, just too weak and went super thin

SNGX -- 1.25K, 5.6K, 8.32K, yes borrow, patent news, active PO, C fill only, out minC and Typ3 in absentia, nice gain

FNMA -- 8, 2.03K, 5.84K, got a fill finally during OR and they dropped it much lower of course (the only way you can get a fill on OTC/BB nightmare), nice gain

RCON -- 120, 3.31K, 5.41K, yes borrow, filled CB, out minC, touched Typ3 but no fill, felt me out and took it back up, ridiculously thin

BBBY -- came close to Typ3 but no fill, big bounce, patience running out

AVCO -- no borrow, active at open, super weak, maybe C fill possible with borrow but no joy

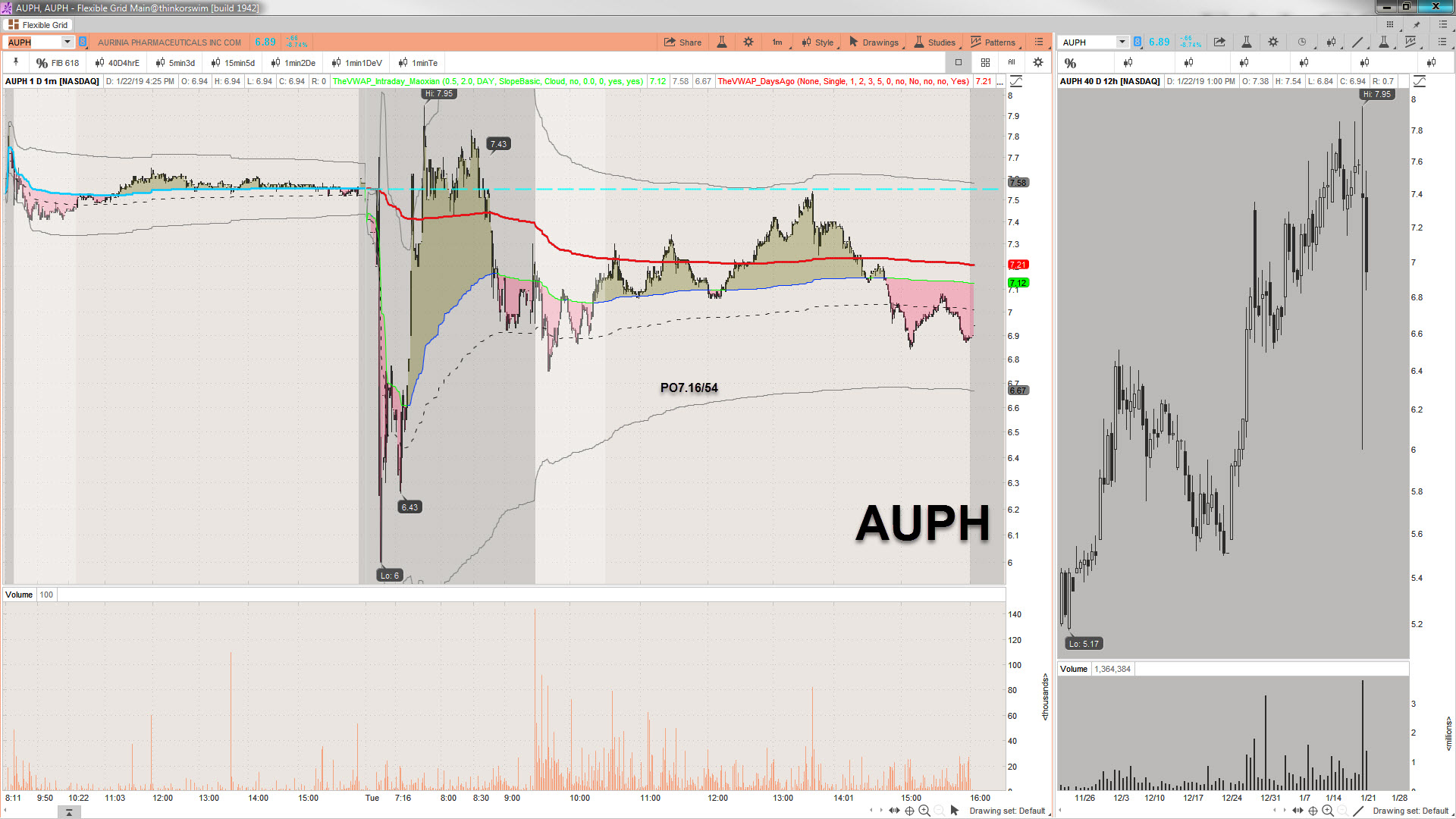

AUPH -- pulled plug, no liquidity, no patience, out with decent gain

FTK -- pulled plug, super illiquid, just so dead, sick of it on monitor, decent gain