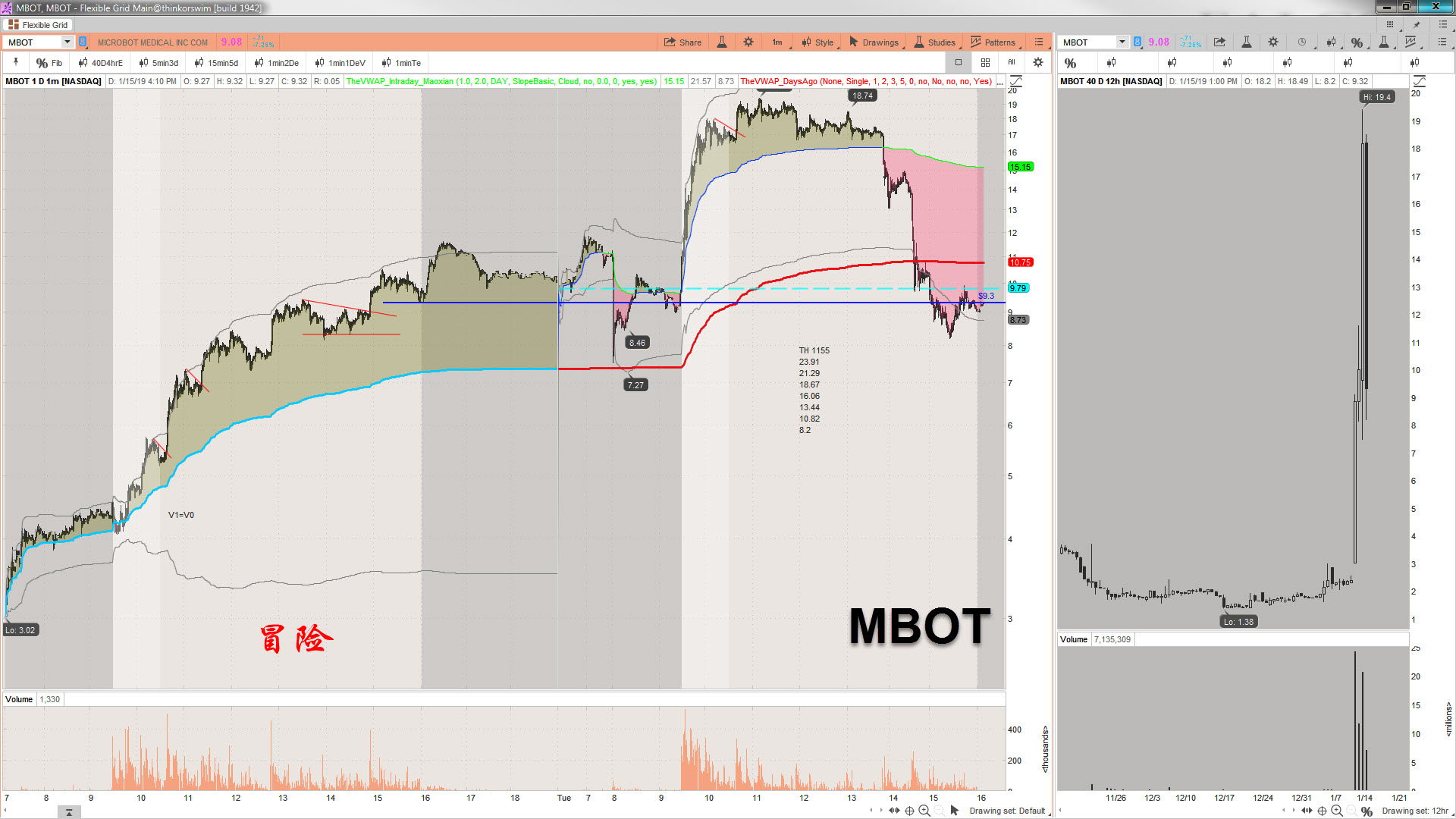

Broad tape strong … lots of action in small cap land … they took MBOT to new highs after the offering news (hit 7.50 PO), nearly hit $20 during RH then closed it below $10 :-), some beautiful spots for the Chairman but no borrow means no joy … KTOV I did have pre-open borrow but didn’t take them since I thought they’d be around when I needed ‘em, wrong! … flip side of that was looking for ABIL borrow pre-open, nothing, then after it tanks, they have 250K avail. SMH. NEO, those phuckers, filled me tiny pre-open, again sniffing out, filled quite a bit more 2 cents above me during OR but then took it up, I lowered stop, they felt me out and filled me .999 (no joke) then took it down (well played) … FTK being patient but it may come back on me. Did short NBEV pre-open which was ok, but then LLP had dentist, had to run, no way to manage re-entries, etc., but it was a good, disciplined trade, nice gain. Shorted some BBBY, didn’t get best fill at open which woulda been sweet, nice cuz unlimited borrow, didn’t get target, may fail, I’ll be patient .. stalking VHC tomorrow since I have lots of borrow (for now!)

KTOV: Some borrow pre-open, none when I needed them, FIDO #9

09:25 3.27K, 10:00 22.8K, 16:00 118K

MBOT: No borrow, FIDO #2

09:25 2.23K, 10:00 33.0K, 16:00 107K

NBEV: Yes borrow, FIDO #11

09:25 2.78K, 10:00 17.9K, 16:00 67.5K

VHC: Yes borrow, relentless trend up, note 10/16 dichotomy in TC

09:25 360, 10:00 3.24K, 16:00 62.8K

BBBY: Yes borrow, shorted B and C, coulda shorted A but missed, note 16 TC

09:25 37, 10:00 4.52K, 16:00 47.5K

ABIL: No borrow pre-open, after it collapsed lots of borrow, TC died after it sank, note 10/16 TC

09:25 3.16K, 10:00 7.87K, 16:00 12.9K