Notes to myself....

Notes for Chat with Traders, Episode 62

Episode 62 ... @chigrl (41:02) [recorded May 2016]

- International relations major, Middle East focus

- Sold medical supplies, "medical grade plastics," hated it, was living in Newport Beach

- Quit job, moved to Chicago [what year was this?]

- Knocked on every possible door

- Begged for first job at a boiler room, later shut down by NFA

- Nobody wanted to hire a woman

- Making 200 calls a day trying to get Mom and Pop to part with 10 grand to trade options [laughing]

- Her Dad was a commodities trader

- Wanted to learn the industry from the inside out

- Went from working as broker to working on trading floor

- Clerked for Fed Funds trader

- Moved to grains floor, was head of trading desk, when Fed Funds went to zero

- Then moved to bonds floor

- First ticket she ever wrote she wrote backwards, ended up being a 30K winner

- Left the floor in 2012, started trading for prop firm, got funded

- Being a prop trader forces you not to do "stupid shit" ... someone is watching you

- She is an intraday, technical trader, but also has fundamental knowledge of oil market

- She has a system, makes the same trade over and over again

- Your worst enemy is your own head

- If you have a system where you always take the trade, can take your head out of the equation

- Rotation levels, Fibonacci, volume profile, footprint -- these are what she uses

- Fell in love with oil market, has traded for ten years straight

- Doesn't trade crude during Asia hours ... too illiquid, a 50 lot can move the market

- Crude is a "manic" market ... trades fast

- She's a market junkie ... 120 hour work week in front of the screens

- After ten years of trading, you can "go with your gut" ... but not at the beginning

- Government websites, esp. EIA, full of good information

- Follow her Twitter stream since she tweets all the best information

- [She has a smoker's laugh ... wonder if she smokes?]

- Supply-demand drives the oil market, it's simple

- Day traders trade what's in front of them, not the macro view

- Twitter is invaluable, there are experienced traders on there, only dicks don't reply to your questions

- Start with a mini contract

- Have to find a system that works for you

- Don't be afraid to lose money in the beginning

- Successful traders don't care if you have two followers, they'll answer your questions

- Key skill good traders have: patience, they wait for the market to come to them, they don't overtrade

- She has a swing trading account and a day trading account, separately

- Twitter: @chigrl

Trying To Turn My Black Nights Blue

Andy Fairweather Low still crowing 50 years on ... great song, esp. for those who rely on the bottle to get through the night.

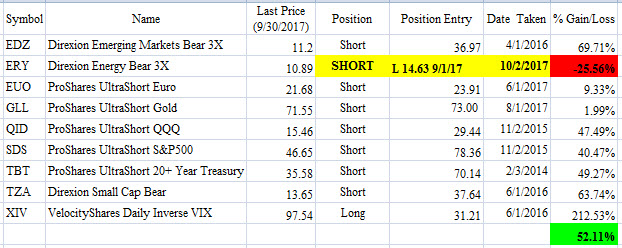

ETF Trading Portfolio Update -- End of September 2017

Getting short the Energies (long the bear fund) at the beginning of September was perfectly bad timing, and I will take a big loss first thing tomorrow morning (Oct. 2). Will my reversal long (short the bear fund) also be perfectly wrong? Time will tell....

Dirty Dozen, Long Only Portfolio, End of September 2017

One change this month, getting long Amgen (AMGN) tomorrow (Oct. 2). Why sell it at $139 last November only to buy back at $186 this October? Good question ... and the reason why buy and hold (and forget about it) is so compelling. But look at the exits on Chipotle and Gilead and Starbucks and Twitter ... I don't always get it so wrong.

Movies Watched -- Hell or High Water

102 minute running time. [SPOILERS]

Inexplicably has a 96% Fresh rating from "Top Critics" at Rotten Tomatoes, which caused me to borrow it from the local Redbox, to my chagrin. Mumble, mumble, couldn't understand half the dialogue and for some reason the subtitles were disabled on my disc.

Has a weird No Country For Old Men copycat vibe (that was a *great* movie), but it just doesn't work. Jeff Bridges plays Tommy Lee Jones, but he's mumbling worse than ever, even worse than his Texas Marshal role in True Grit. He has a half-Mexican, half-Injun partner whom he insults endlessly ... don't worry, the "half-breed" has his head blown off in the end.

Two scrawny brothers ... old Ma dies with family ranch in hock to EVIL banksters and back taxes ... one brother recently released after a ten year stretch in jail (though not for killin' his Pa) ... non-felon brother gets the bright idea to start robbin' banks across west Texas to pay off them EVIL banksters and the gubmint, and dumb criminal brother is game.

Scenes of these desolate, shitty towns and FAST CASH billboards (hint hint) ... oh, and the movie starts off with graffiti on the side of a house that says, "Three tours in I-raq but no bailout for folks like me," or something along those lines. Ya know, subtle.

Badly done poker scene where criminal brother splashes the pot with a bet -- I winced. And you can't exchange more than X dollars at the casino without having your tax ID attached to it.

They keep burying cars that are worth more than the bank drawer cash they're stealin', but I guess they're stolen cars. Old Jeff Bridges mumbling and stumbling after them across the vast expanse of west Texas. Jeff will forever be The Dude, he isn't going to shake that no matter how much he mumbles and stumbles.

Surly ex-wife of the non-felon brother, ya know, once a purty girl but run-down by her shitty life ... it isn't clear what he's done to earn such derision from his ex- and boys (one, a fatty with glasses, only get a glimpse of him at the end) ... maybe it was explained and I didn't hear it (possible), but I doubt it. Did I mention that this brother is a dead ringer for Josh Brolin's kid brother?

Dumbest part of all is there's Crude Earl or Natty under the ranch, and old Ma could've leased it to Chevron decades ago and been pumpin' out $50,000 worth every month since then ... but nah, scrawny cows were the way to go. And the boys couldn't have done the lease at any time before her death, just cuz.

Ends with Bridges and Brolin's little brother exchanging mumbled threats across a bare lawn, pfffffft. Only saving grace here is the movie stopped short of the sacred 100 minute mark.

Ah, I see now that the kid who wrote it also did Sicario, which I didn't like either.

There were some funny bits, and some clever bits of dialogue in the little I could understand, but damn, this movie is NOT recommended. Let me go find some critics who agree and paste their stuff below ... only able to find ONE! Crazy, what a bunch of hacks.

Peter Sobczynski: "it's somewhat less than the sum of its parts ... [the writer] appears to have elected to raid the Cormac McCarthy playbook in order to employ the celebrated author’s sparse and laconic tone wherever possible ... it tries so hard to emulate the likes of 'No Country for Old Men' at times that you can feel it practically straining from the effort without quite pulling it off" ... and the key paragraph in its entirety, with which I agree:

"It’s frustrating that 'Hell or High Water' contains so many good things that just don’t coalesce into a fully satisfying moviegoing experience [He means movie but needed more syllables]. The story as a whole is a little too derivative for its own good and not even the strong elements are quite able to compensate for that. Of course, seeing as how even vaguely competent films have been so few and far between as of late, some viewers may be a little more willing to overlook its flaws—to wildly paraphrase one of the key lines from 'No Country for Old Men,' 'If it ain’t a good movie, it’ll do till the good movie gets here.' [SAD] If only it had spent a little more time trying to find its own voice and a little less overtly trying to ape the styles of its influences, 'Hell or High Water' might have been as good of a movie as it wishes it was."

Notes for Chat with Traders, Episode 63

Episode 63 ... Nicola Duke (44:00)

- Has a posh? British accent [I'm no judge of accents]

- Mom gave her money when in her teens and she bought stocks

- Joined the Royal Air Force

- Later worked as air traffic controller at Heathrow

- Chemical Bank did experiment training air traffic controllers as traders, before her time

- Working in Toronto, running a company

- Boyfriend gave her a copy of Victor Sperandeo's book, she thought, "I can do this"

- Trading FX from Toronto, not getting much sleep

- Sold company and went full time trading FX

- Air traffic controllers feel they're always minutes away from disaster

- Trading is similar, you're often uncomfortable

- Must learn to be comfortable with being uncomfortable

- Joined a live trading room, learned a lot

- Doesn't believe people should trade alone, should at least have a mentor

- Blew out first account ($10,000) within a month after being "the queen of paper trading"

- Got a mentor who helped her with discipline

- Got through her first year flat, mentor said "this proves that you can make it"

- Bad days where you stick to your rules are good days -- treat yourself!

- Mentor was friend of Tom Dante's ... met in a forum

- Mentor taught her how to take emotion out when you win or lose

- She's an introvert, doesn't like shouting

- Mentor never gave her a single trade idea or set-up ... just worked on her mental game

- In Toronto she would trade London open (2 AM her time), no social life for two years

- Trading knocks keep you from getting full of yourself

- 2008 lots of money to be made, went full time

- Got lucky to sell her travel? business before the crash

- Swing trader using Fibonacci levels for entries / exits

- Uses Heiken-Ashi charts and moving averages as triggers

- Looks at 36 markets every day

- Scans weekly and daily charts

- Average trade lasts a couple of days in 2016

- In 2015 she would hold trades for two or three weeks

- Volatile markets hard to trade as a discretionary trader -- too much emotion

- Rules-based triggers, targets, stop adjustment ... all systematic now, no discretion

- Won't move a stop until price has made a new high or low

- Looks at closing prices only, close below a 50-period MA would instantly get her out

- Has lots of "time of day" rules

- Don't spend mental capital in an "offside position" for too long, use a time stop

- Don't be patient with losers -- they don't just cost money, but "mental capital"

- Only risks 3% of her capital at any one time

- Avoids news events

- Looks at monthly, weekly, daily charts

- Finds entries on intraday chart

- Planning is everything

- Looks at Fibonacci patterns, measured moves ... marks all the levels on the chart

- Levels of confluence, high probability of reversal (or support)

- People who can make a plan and stick to it can be good traders

- Trading is really hard work, not a hobby, don't treat it that way

- She is not competitive, you're only accountable to yourself, be better than you were yesterday

- Compete with yourself, cooperate with others

- When she sees squeezes, she feels that "us versus them" thing, but fleetingly

- People fail because they can't lose money well -- it's all about mindset

- Trading is the hardest simple thing to do

- Everyone she follows or re-tweets on Twitter is awesome

- She uses:

- CQG for charts (expensive, over GBP1000 a month),

- TTX Trader to execute,

- started off on MetaTrader 4

- Twitter: @NicTrades

Have Pity On Those Whose Chances Grow Thinner

A live version of the Chambers Brothers covering Curtis Mayfield's great song, "People Get Ready."

No More Yellow Clover

Completely unintelligible lyrics but I dig the sound ... I heard Kacy & Clayton interviewed, they come across like nitwit inbreds from backwoods Canada, but I love that retro-folk sound.

Notes for Chat with Traders, Episode 29

Episode 29 ... Brian Shannon (63:13)

- As a kid, watched Wall Street Week with his doctor Dad on Friday nights

- Made money as a kid from caddying and delivering newspapers

- First stock he ever bought was LoJack, made $6,000, hooked him for life, "why work?"

- Grew up in Massachusetts?

- First job after college as a stockbroker

- Passed Series 7, realized job was glorified telemarketer

- Went to Lehman Brothers next and learned how to sell

- Learned how markets worked using other people's money

- Read the Cabot Market Letter, idea was buying above levels of resistance

- Read Investors Business Daily, saw prop firm ad that offered 20:1 leverage

- Made $25,000 deposit with this prop firm

- Excited with his 48K baud modem trading from his home's basement for the firm

- Opened office for this NYC-based prop firm in Denver

- Prop firm made money from commissions

- People are their own worst enemies in the market

- Still astounded by dumb decisions he makes even today

- Chantal Pharmaceuticals, miracle skin cream, stock got halted after hit piece in Barron's

- Lost $8-$12K overnight in Chantal Pharma ... one lesson he learned along the way, position with too much size

- In 2000, 2001 market was getting crushed and he was losing pretty consistently, thought about quitting

- Slowed things down, reduced size dramatically, ground his way back

- His first six or seven months, he was profitable every month, then he got cocky

- Trading is an evolution, you always come back to the basic principles

- "Only price pays. Follow the trend" -- these are his catchphrases

- Hold yourself accountable, don't blame other things, only yourself

- Uses multiple time frames

- Swing trading his preferred time frame

- Looks at direction of 50-day moving average: uptrend or downtrend

- Looks for volatility contraction, diminished volume, pullbacks to "support" on daily chart

- Drops to 30-minute chart next, looks at 5-day moving average on 30-min chart

- Distance from entry to his initial protective stop, distance to perceived targets measured -- figures his risk : reward

- Drops to 10-minute chart, looks for an entry that makes sense given all of the above analysis

- Don't gamble on earnings plays

- Accountants lie, CEOs lie, only price pays

- Ego and the need to be right clouds your judgment

- Fan of using Volume Weighted Average Price -- VWAP -- esp. since some specific event (e.g., the IPO date)

- Been looking at VWAP for 12 or 13 years

- Stumbled across VWAP, it spoke to him ... now becoming more widely used by retail traders

- Stan Weinstein's book, Secrets For Profiting in Bull and Bear Markets, had a huge influence on him

- "If they don't scare you out, they'll wear you out"

- Traders tend to be ADD looking for action

- Time frame must suit your personality ... how much time, capital, and experience do you have?

- Never start off by day trading, that's something you evolve to, or devolve to [chuckling]

- Start off with a longer term horizon, like swing trading

- Swing traders should make more money than day traders

- Trading is extremely difficult ... anyone who says it's easy is lying ... misleading you for nefarious reasons

- You need a lot of capital to start

- People get impatient, make big mistakes before they learn who they are

- First master yourself (understand yourself and which time frame suits you)

- Brian says some nice things to Aaron in parting ... Aaron not as polished in these early episodes

- www.alphatrends.net

- His book: Technical Analysis Using Multiple Timeframes

- Twitter: @alphatrends