Andy Fairweather Low still crowing 50 years on ... great song, esp. for those who rely on the bottle to get through the night.

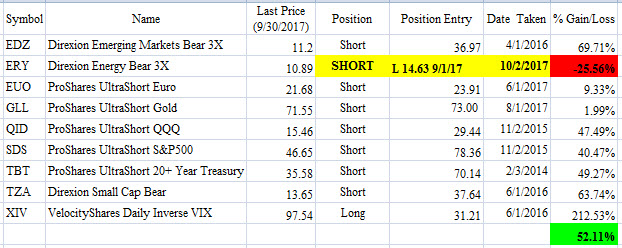

ETF Trading Portfolio Update -- End of September 2017

Getting short the Energies (long the bear fund) at the beginning of September was perfectly bad timing, and I will take a big loss first thing tomorrow morning (Oct. 2). Will my reversal long (short the bear fund) also be perfectly wrong? Time will tell....

Dirty Dozen, Long Only Portfolio, End of September 2017

One change this month, getting long Amgen (AMGN) tomorrow (Oct. 2). Why sell it at $139 last November only to buy back at $186 this October? Good question ... and the reason why buy and hold (and forget about it) is so compelling. But look at the exits on Chipotle and Gilead and Starbucks and Twitter ... I don't always get it so wrong.

Movies Watched -- Hell or High Water

102 minute running time. [SPOILERS]

Inexplicably has a 96% Fresh rating from "Top Critics" at Rotten Tomatoes, which caused me to borrow it from the local Redbox, to my chagrin. Mumble, mumble, couldn't understand half the dialogue and for some reason the subtitles were disabled on my disc.

Has a weird No Country For Old Men copycat vibe (that was a *great* movie), but it just doesn't work. Jeff Bridges plays Tommy Lee Jones, but he's mumbling worse than ever, even worse than his Texas Marshal role in True Grit. He has a half-Mexican, half-Injun partner whom he insults endlessly ... don't worry, the "half-breed" has his head blown off in the end.

Two scrawny brothers ... old Ma dies with family ranch in hock to EVIL banksters and back taxes ... one brother recently released after a ten year stretch in jail (though not for killin' his Pa) ... non-felon brother gets the bright idea to start robbin' banks across west Texas to pay off them EVIL banksters and the gubmint, and dumb criminal brother is game.

Scenes of these desolate, shitty towns and FAST CASH billboards (hint hint) ... oh, and the movie starts off with graffiti on the side of a house that says, "Three tours in I-raq but no bailout for folks like me," or something along those lines. Ya know, subtle.

Badly done poker scene where criminal brother splashes the pot with a bet -- I winced. And you can't exchange more than X dollars at the casino without having your tax ID attached to it.

They keep burying cars that are worth more than the bank drawer cash they're stealin', but I guess they're stolen cars. Old Jeff Bridges mumbling and stumbling after them across the vast expanse of west Texas. Jeff will forever be The Dude, he isn't going to shake that no matter how much he mumbles and stumbles.

Surly ex-wife of the non-felon brother, ya know, once a purty girl but run-down by her shitty life ... it isn't clear what he's done to earn such derision from his ex- and boys (one, a fatty with glasses, only get a glimpse of him at the end) ... maybe it was explained and I didn't hear it (possible), but I doubt it. Did I mention that this brother is a dead ringer for Josh Brolin's kid brother?

Dumbest part of all is there's Crude Earl or Natty under the ranch, and old Ma could've leased it to Chevron decades ago and been pumpin' out $50,000 worth every month since then ... but nah, scrawny cows were the way to go. And the boys couldn't have done the lease at any time before her death, just cuz.

Ends with Bridges and Brolin's little brother exchanging mumbled threats across a bare lawn, pfffffft. Only saving grace here is the movie stopped short of the sacred 100 minute mark.

Ah, I see now that the kid who wrote it also did Sicario, which I didn't like either.

There were some funny bits, and some clever bits of dialogue in the little I could understand, but damn, this movie is NOT recommended. Let me go find some critics who agree and paste their stuff below ... only able to find ONE! Crazy, what a bunch of hacks.

Peter Sobczynski: "it's somewhat less than the sum of its parts ... [the writer] appears to have elected to raid the Cormac McCarthy playbook in order to employ the celebrated author’s sparse and laconic tone wherever possible ... it tries so hard to emulate the likes of 'No Country for Old Men' at times that you can feel it practically straining from the effort without quite pulling it off" ... and the key paragraph in its entirety, with which I agree:

"It’s frustrating that 'Hell or High Water' contains so many good things that just don’t coalesce into a fully satisfying moviegoing experience [He means movie but needed more syllables]. The story as a whole is a little too derivative for its own good and not even the strong elements are quite able to compensate for that. Of course, seeing as how even vaguely competent films have been so few and far between as of late, some viewers may be a little more willing to overlook its flaws—to wildly paraphrase one of the key lines from 'No Country for Old Men,' 'If it ain’t a good movie, it’ll do till the good movie gets here.' [SAD] If only it had spent a little more time trying to find its own voice and a little less overtly trying to ape the styles of its influences, 'Hell or High Water' might have been as good of a movie as it wishes it was."

Notes for Chat with Traders, Episode 63

Episode 63 ... Nicola Duke (44:00)

- Has a posh? British accent [I'm no judge of accents]

- Mom gave her money when in her teens and she bought stocks

- Joined the Royal Air Force

- Later worked as air traffic controller at Heathrow

- Chemical Bank did experiment training air traffic controllers as traders, before her time

- Working in Toronto, running a company

- Boyfriend gave her a copy of Victor Sperandeo's book, she thought, "I can do this"

- Trading FX from Toronto, not getting much sleep

- Sold company and went full time trading FX

- Air traffic controllers feel they're always minutes away from disaster

- Trading is similar, you're often uncomfortable

- Must learn to be comfortable with being uncomfortable

- Joined a live trading room, learned a lot

- Doesn't believe people should trade alone, should at least have a mentor

- Blew out first account ($10,000) within a month after being "the queen of paper trading"

- Got a mentor who helped her with discipline

- Got through her first year flat, mentor said "this proves that you can make it"

- Bad days where you stick to your rules are good days -- treat yourself!

- Mentor was friend of Tom Dante's ... met in a forum

- Mentor taught her how to take emotion out when you win or lose

- She's an introvert, doesn't like shouting

- Mentor never gave her a single trade idea or set-up ... just worked on her mental game

- In Toronto she would trade London open (2 AM her time), no social life for two years

- Trading knocks keep you from getting full of yourself

- 2008 lots of money to be made, went full time

- Got lucky to sell her travel? business before the crash

- Swing trader using Fibonacci levels for entries / exits

- Uses Heiken-Ashi charts and moving averages as triggers

- Looks at 36 markets every day

- Scans weekly and daily charts

- Average trade lasts a couple of days in 2016

- In 2015 she would hold trades for two or three weeks

- Volatile markets hard to trade as a discretionary trader -- too much emotion

- Rules-based triggers, targets, stop adjustment ... all systematic now, no discretion

- Won't move a stop until price has made a new high or low

- Looks at closing prices only, close below a 50-period MA would instantly get her out

- Has lots of "time of day" rules

- Don't spend mental capital in an "offside position" for too long, use a time stop

- Don't be patient with losers -- they don't just cost money, but "mental capital"

- Only risks 3% of her capital at any one time

- Avoids news events

- Looks at monthly, weekly, daily charts

- Finds entries on intraday chart

- Planning is everything

- Looks at Fibonacci patterns, measured moves ... marks all the levels on the chart

- Levels of confluence, high probability of reversal (or support)

- People who can make a plan and stick to it can be good traders

- Trading is really hard work, not a hobby, don't treat it that way

- She is not competitive, you're only accountable to yourself, be better than you were yesterday

- Compete with yourself, cooperate with others

- When she sees squeezes, she feels that "us versus them" thing, but fleetingly

- People fail because they can't lose money well -- it's all about mindset

- Trading is the hardest simple thing to do

- Everyone she follows or re-tweets on Twitter is awesome

- She uses:

- CQG for charts (expensive, over GBP1000 a month),

- TTX Trader to execute,

- started off on MetaTrader 4

- Twitter: @NicTrades

Have Pity On Those Whose Chances Grow Thinner

A live version of the Chambers Brothers covering Curtis Mayfield's great song, "People Get Ready."

No More Yellow Clover

Completely unintelligible lyrics but I dig the sound ... I heard Kacy & Clayton interviewed, they come across like nitwit inbreds from backwoods Canada, but I love that retro-folk sound.

Notes for Chat with Traders, Episode 29

Episode 29 ... Brian Shannon (63:13)

- As a kid, watched Wall Street Week with his doctor Dad on Friday nights

- Made money as a kid from caddying and delivering newspapers

- First stock he ever bought was LoJack, made $6,000, hooked him for life, "why work?"

- Grew up in Massachusetts?

- First job after college as a stockbroker

- Passed Series 7, realized job was glorified telemarketer

- Went to Lehman Brothers next and learned how to sell

- Learned how markets worked using other people's money

- Read the Cabot Market Letter, idea was buying above levels of resistance

- Read Investors Business Daily, saw prop firm ad that offered 20:1 leverage

- Made $25,000 deposit with this prop firm

- Excited with his 48K baud modem trading from his home's basement for the firm

- Opened office for this NYC-based prop firm in Denver

- Prop firm made money from commissions

- People are their own worst enemies in the market

- Still astounded by dumb decisions he makes even today

- Chantal Pharmaceuticals, miracle skin cream, stock got halted after hit piece in Barron's

- Lost $8-$12K overnight in Chantal Pharma ... one lesson he learned along the way, position with too much size

- In 2000, 2001 market was getting crushed and he was losing pretty consistently, thought about quitting

- Slowed things down, reduced size dramatically, ground his way back

- His first six or seven months, he was profitable every month, then he got cocky

- Trading is an evolution, you always come back to the basic principles

- "Only price pays. Follow the trend" -- these are his catchphrases

- Hold yourself accountable, don't blame other things, only yourself

- Uses multiple time frames

- Swing trading his preferred time frame

- Looks at direction of 50-day moving average: uptrend or downtrend

- Looks for volatility contraction, diminished volume, pullbacks to "support" on daily chart

- Drops to 30-minute chart next, looks at 5-day moving average on 30-min chart

- Distance from entry to his initial protective stop, distance to perceived targets measured -- figures his risk : reward

- Drops to 10-minute chart, looks for an entry that makes sense given all of the above analysis

- Don't gamble on earnings plays

- Accountants lie, CEOs lie, only price pays

- Ego and the need to be right clouds your judgment

- Fan of using Volume Weighted Average Price -- VWAP -- esp. since some specific event (e.g., the IPO date)

- Been looking at VWAP for 12 or 13 years

- Stumbled across VWAP, it spoke to him ... now becoming more widely used by retail traders

- Stan Weinstein's book, Secrets For Profiting in Bull and Bear Markets, had a huge influence on him

- "If they don't scare you out, they'll wear you out"

- Traders tend to be ADD looking for action

- Time frame must suit your personality ... how much time, capital, and experience do you have?

- Never start off by day trading, that's something you evolve to, or devolve to [chuckling]

- Start off with a longer term horizon, like swing trading

- Swing traders should make more money than day traders

- Trading is extremely difficult ... anyone who says it's easy is lying ... misleading you for nefarious reasons

- You need a lot of capital to start

- People get impatient, make big mistakes before they learn who they are

- First master yourself (understand yourself and which time frame suits you)

- Brian says some nice things to Aaron in parting ... Aaron not as polished in these early episodes

- www.alphatrends.net

- His book: Technical Analysis Using Multiple Timeframes

- Twitter: @alphatrends

Notes for Chat with Traders, Episode 66

Episode 66 ... Dan Shapiro (66:25)

- Return guest (Episode 32)

- First started looking at charts in 2003

- Fast talker, native New Yorker? ... sounds remarkably like Joe Fahmy

- Looks at 60 minute charts exclusively

- Social media the best and worst thing for new traders

- Most new day traders obsess over the one minute chart

- Uneducated, underfunded, no-process bungee jumpers are down on the one minute chart

- "Barry Sanders Effect" -- getting stopped for two yards twenty times a day -->

- Instead you should wait for a hole to open up, run 60 yards

- Most stocks are not tradable

- Get rid of the social media noise

- He's "not the sharpest tool in the shed" [sounds pretty sharp to me]

- He's been trading since 1999, has a lot of screen time

- Netflix and Tesla his two favorite stocks

- Hasn't updated his eSignal in at least a decade

- His charts are covered with squiggly lines: moving averages, Bollinger Bands, linear regression lines

- You need to know where the bodies are buried (areas of supply)

- Most traders don't know what they're being patient for

- [Likes to use football analogies]

- Stocks go from supply to supply (areas of support / resistance)

- FANG (Facebook, Apple, (Amazon?), Netflix, Google) names are market sensitive -- is Netflix weak when the market is strong? Why?

- Don't win the day, win the intervals of the chart

- Is the trade worth it? Distance from one zone to the next large enough?

- FANG stocks have great range and volume ... tradable [i.e., Usual Suspects]

- Six years ago started doing live webinars

- Looks through 500 daily charts every night, finds things "coming out of a range"

- Writes down six to ten ideas every day

- He'd rather drink cyanide than trade the pre-market highs and lows lists

- Everybody wants to drive that fast car, but new drivers should drive slowly

- Newborn babies don't come out of the womb running

- How many horror stories are there of people shorting a pre-market screamer ("Flying Pig") and busting out

- Trading should be boring

- Watching six candles a day (60 minute charts) forces you to be patient

- Doesn't want to be fighting a guy with a $2,000 account who is getting stopped out every two minutes

- Traders have to be humble but also killers, willing to take food out of some other guy's kids' mouths

- Don't turn a paper cut into a severed head

- [He's a fun guy, fast talker, should be in sales, maybe he was, maybe he still is]

- During monthly review, looks hardest at his losing days

- "Don't trade like a putz" -- spot those days you were trading like a putz

- "Ish happens" [instead of "shit happens" ... a Yiddish thing?]

- Advice to new traders: don't be undercapitalized (and max risk should be 1% of account)

- Trades only have three parts: process [method], tier size [risk management], result [trade management]

- Don't risk $1000 to make $300

- "Let me give you the reality"

- Prop firms used to make so much money from commissions, they didn't care about how much risk people were taking

- Only four or five major players left in the prop business ... it's dead

- Game has completely changed -- no money left in commissions

- The money isn't in commissions anymore, it's in "education"

- Prop firms won't give you any capital now, won't let you trade any more than 100 share lots

- Offshore prop firms are bookies

- Avoiding "Pattern Day Trader" rule by going offshore to a "bookie" broker a bad idea

- What's a good amount of money to start trading: A LOT

- "You, my friend, are a commodity"

- If you're doing millions of shares a month, you can negotiate a very low commission rate

- "You are the rising star ... invest in youself."

- Peter Luger doesn't serve his steaks on paper plates

- You need screen time to learn what NOT to do, not what to do [yes, indeed]

- Borrowed money from a loan shark to get his start [I'd like to hear more about this]

- In 2003 he was at Spectrum Securities, bought out by Schonfeld Securities, met Dan Mirkin then

- In 2003 he started using Trade-Ideas [should have Dan Mirkin on the show]

- Trade-Ideas still cheap at $500 a month [it isn't that much]

- He doesn't upgrade anything he uses, 2003 version of Trade-Ideas, ancient version of eSignal

- Turned profitable after 2003, a coincidence with Trade-Ideas adoption?

- Many years of desperate trial and error before he found success

- Has no need to show off, hates the social media circus

- You need to put in the time to learn how to trade ... people will doubt you and you will doubt yourself, but don't give up

- "Some random avatar isn't a superstar, you are the superstar"

- How does he have this level of energy? Lots of cocaine [he's a funny guy]

- www.accessatrader.com

- Twitter: danshep55

ETF Trading Portfolio Update -- End of August 2017

One change to the portfolio ... covered the Energy (ERY) short from May 2016 and got long on September 1. Getting short gold at the beginning of August appears to be a well-timed move (so far).