One of the greatest smoker's voices of all time, Lee Hazlewood .. the second song is no good, but She Comes Running is a classic.

Notes for Chat with Traders, Episode 58

Episode 58 ... Paul Singh (54:01)

- Started trading in college

- 40 years old now

- Went to law school in 1990s

- Took $5,000 to $200,000 during dot com boom

- Worst time to learn how to trade since you could just blindly buy and make money

- $200,000 went to zero in the dot com bust

- Blew up another $5,000 account a little later

- Third attempt in 2004, 2005 with $5,000 ... things started to click, he got more serious

- Have to persevere ... helps if you love it ... never give up

- Working as a lawyer then

- Commodities boom next to play ... recognized it from dot com boom experience

- 2011 started trading full time, stopped lawyering

- Waited until he had enough money, patiently built a large stake, before he went full time

- His wife works, she has a good job, they had a lot of savings, good safety net

- Needed mid six figures as trading stake to be comfortable going full time

- Biggest mistake people make is trying to trade without a proper trading stake

- Don't give up your paycheck until you have built a significant trading stake

- Can never be worried about daily expenses when you're trading

- Take the amount you think you need to be comfortable trading full time and double it

- Trading full time is boring, esp. swing trading (holding several days to several months)

- Have to prevent yourself from "filling your day" by watching every tick

- Swing trading all about after-hours homework, market hours just about executing the trade

- Trading is more than stock picking

- Three parts to trading:

- Stock picking the least important part,

- Risk management, which is fairly easy,

- Trade management, which is the hard part

- Risk management is understanding probability and risk versus reward

- Trade management separates winning and losing traders -- the psychological game

- Trade management is where you need to work really hard, controlling emotions

- Lightbulb moment: doesn't matter what stock you pick, with proper risk and trade management, can be profitable

- Has basket of 10 to 15 set-ups he trades regularly

- Pays close attention to money flow across broad market and sectors

- Doesn't have a favorite set-up

- Whatever is working today is his favorite set-up, have to be adaptable

- Set-ups stop working

- Breakouts, breakout-pullbacks, moving averages, re-mounts -- fall in and out of usefulness

- He exclusively trades stocks -- have to master one domain

- Used to do options, futures, etc. but has dropped all that ... just stocks now

- Hated to have to trade around the clock ... likes defined hours of stocks

- Got interested in pre-market trading

- The more experience you have, the fewer indicators you use

- Experts learn to simplify, tune things out

- New painters paint lots of lines ... not true of experienced painters

- "Set it and forget it" -- don't micromanage positions

- Don't watch every tick, don't switch up timeframes and see "new" things

- Day trading gets his mind off his swing trading

- Easier to part-time swing trade than full-time swing trade since mind occupied elsewhere

- Taking a quick profit is human nature, hardwired, but the antithesis of good trading

- You can't be a successful trader with 1:1 risk reward

- First thing he does is a market analysis, looking for market leaders

- Focuses on money flows across sectors

- Builds watchlist of 50-150 stocks to stalk

- Tries to narrow it down to 5-15 stocks in the evening or morning

- Then writes a plan for each stock: entry range, stop range, target range -- in Evernote

- Sizes positons based on those levels in advance

- Doing position sizing in advance makes it so he has no anxiety, just pulls trigger given plan

- Common mistake traders make is not taking into account the natural volatility of a stock

- [They set their stops too tight]

- Bad idea to place stops at obvious support and resistance, everyone is there ... it will be run

- Take smaller position to be able to hold through stop gunning, then add once the stop gunning has passed

- Used to look at ATR and volatility measures for stop placement, but now just eyeballs it

- Pattern recognition comes after time, have to put in the hours

- "John Tudor Jones" ;-)

- His wife can't tell if he's had a winning or losing day [she must be an angel]

- People have goals without a plan

- Focus on one thing and master it

- Gets up at 4AM (lives on west coast)

- Does a detailed monthly review of his trades

- www.bullsonwallstreet.com

- themarketspeculator.blogspot.com

- www.pauljsingh.com

- Twitter: @PaulJSingh

Notes for Chat with Traders, Episode 126

Episode 126 ... "Jonathan" (69:55)

- Division 1 baseball scholarship to college in Louisiana

- Got injured (hurt back), professional baseball career not possible

- Lost scholarship, didn't know if he could stay in school

- Back still nags him today

- Uncle was a Wall Street guy, worked for Shearson Lehman

- Uncle had a nice house, nice car, nice boat ... that attracted him

- Had friends who had moved to NYC ... visited ... loved it, moved there, age 20

- Spent a lot of time in the New York Public Library trying to educate himself

- Did odd jobs, but had some savings

- Read the Jack Schwager Market Wizards books at library

- Met a guy (won't name names) in 2004 through family friends who had worked for Steve Cohen, retired at age 35, working from home

- Guy took him under his wing, acted as mentor

- Jonathan sat with him at his trading desk, for over a year he did this

- Mentor from India, born poor, but he made it big in America ... saw Jonathan's passion, competitive drive

- At first Jonathan was incredibly intimidated

- Mentor traded futures, 250 contracts at a clip

- Mentor did stat arb ... a quant

- Mentor taught Jonathan to be open minded, you can learn something new every day

- Jonathan's first account was $10,000, piggybacked off of the mentor's trades, did well

- Mentor wanted Jonathan to finish his college degree, so he moved home to Dallas and got degree in economics / quantitative finance

- Mentor discouraged him from going to a prop firm, get a degree instead, work for a hedge fund

- Many prop firms in New York City were Churn and Burn outfits

- Took out student loans and used money to trade futures and lost all of it ($35,000)

- Traded too big with his student loan money and blew up

- Most people who blow up, quit, but not him

- Sent resume out blind to many hedge funds ... 92 hedge funds ... got three interviews

- Paradigm Capital in Ft. Worth hired him as intern

- Thought he blew the interview, lots of tough math questions

- What is 24 times 86? He froze up, started sweating, took him five to seven minutes to answer

- Paradigm traded credit default swaps, he knew nothing about them

- Promoted from intern to assistant trader to trader to head trader, within six months (in 2008)

- Paradigm did well between 2008 and 2013 ... all discretionary, no modeling

- Learned MatLab, started building models, also used Bloomberg Terminal to build stuff

- European sovereign credit crisis was a great opportunity, worked 3AM to 6PM, seven days a week

- Paradigm was $5BB at its biggest, trading book had $3BB ... [not a garage band hedge fund]

- When he joined it was $2BB

- Left Paradigm in 2013 ... he had made partner, had equity in the fund, started butting heads with the boss

- "The bacon is all in the year-end bonus."

- He took equity in the fund instead of a year-end bonus

- European regulators "banned" speculation in European CDS ... liquidity vanished

- Wife encouraged him to quit, trade from home [she must be an angel]

- Started trading 2014 on his own with $250,000 ... all discretionary trading

- Made $60K in first month, thought this is easy!

- Lost $80K in second month, oops, needed to create a systematic approach

- Didn't have Bloomberg Terminal at home

- Taught himself "R" language and built a system, sort of a hybrid, still uses some discretion

- Still executes all trades manually

- Mentor recommended Market Delta platform

- Found patterns in the data ... uses Volume Profile, spots order flow stuck at extremes

- Not a fan of derivatives of price (moving averages, lagging indicators)

- Fan of re-tests ... people stuck getting out at "breakeven," easy to see on Footprint charts

- Numbers don't lie, your eyeballing stuff lies

- Brains are pattern recognition machines, sees patterns everywhere

- Have to teach your system "market context"

- Found his entries and exits better when he does it manually

- Patient, he always waits for a signal

- But there are times he gets a signal and ignores it

- He only trades E-mini (ES) futures and crude oil (CL) futures ... most liquid markets

- Doesn't like headline risk of trading FX

- Specializing in one market is a great thing, just need to master one

- Has six monitors in home office

- Don't complicate things, keep your approach simple

- He knows nothing about candlesticks and MACD and stochastics, etc.

- Trading isn't rocket science

- Given his results, has been approached by people about starting a hedge fund, but he has no interest

- Too many regulations to start a hedge fund ... just a headache

- Wife encouraged him to get Twitter account [she must be an angel]

- Twitter: @HF_Trader

Notes for Chat with Traders, Episode 129

Episode 129 ... Victor Haghani (42:49)

- Father was a goods trader (Sephardic Jew born in Iran?)

- Went to University in London (LSE)

- His dad said go for the less bureaucratic firm (why he chose Salomon over JP Morgan)

- John Merriwether asked him to become a trader, government bonds arb desk

- Youngest trader on the desk

- He had been in fixed income research at Salomon Brothers

- Merriwether left Salomon in 1992, Haghani left in late 1992 ... founded LTCM

- Started LTCM's London office

- Worked for 13 bank consortium after LTCM failed in 1998 ... helped liquidate portfolio

- JWM Partners hedge fund ... also helped start that

- Founded Elm Partners five years ago ... "active index investing"

- Lowenstein's "When Genius Failed" -- a good read, but not 100% accurate

- Dunbar's book is also OK

- Buy the Harvard Business School case studies on LTCM, by Andre Perold

- We're a product of our experiences

- Haghani wrote paper on biased coin flip

- Gave 61 subjects (financial professionals) $25, coin biased 60% heads, could keep whatever they made after 30 minutes of flipping, capped at $250

- [Sounds similar to Van Tharp's old experiment that he has given hundreds of times]

- [Van Tharp gave subjects bag of ten marbles: Seven 1R losers, one 5R loser, two 10R winners. Subjects got 40 marble pulls and a $100,000 bankroll. Expectancy is 0.8R (positive) but most people end up broke because their bet size is too large and they revenge trade]

- People bet a lot on tails :-) ... usually after a streak of heads [laughing]

- People believe random things have some sort of predictability (human experience versus math)

- People got bored of betting on heads [laughing again]

- 1/3 of people went bust betting on a 60:40 biased coin

- 1/5 reached max payout ... kids who could flip really fast with smaller bet size mainly

- 1/2 won $80

- Using simple rule of only betting 15% of bankroll would give 95% chance of hitting max payout within 30 minutes

- "Suboptimal behavior"

- Nearly everyone voluntarily bet their whole stake at some point

- Those all-in bets *always* happened after someone took a loss on an outsized bet, classic need to "get it back"

- People who busted didn't want to talk about it

- A whole range of bet sizes works (8 or 9% to 20%) to hit max payout within 30 minutes

- Kelly Criterion number (optimal bet) was 20%

- Optimal solution is very complicated, but just use heuristics (common sense)

- Without the cap, expected value would be $3,000,000, 4% return on every flip (betting 20% of bankroll)

- St. Petersburg Paradox ... expected value versus expected utility

- People won't bother to play even if they have positive expected payout

- Have to understand your own risk aversion

- Betting 50% gives negative expected utility (with 60:40 coin)

- Bet sizing is not simple, not secondary ... it's incredibly important [I say it's *everything*]

- LTCM trade sizing was all screwed up (position sizes were way too big)

- Global equities should have a positive expected return above the risk-free rate or inflation, trouble is the Sharpe Ratio

- Thorp inspired the coin-flipping experiment

- Haghani believes there are some rare people who can beat the market, trouble is finding them, identifying them in time

- Past returns are not indicative of future returns (because we don't have enough data)

- How do you identify the biased coin after only 30 flips? You can't, it takes 143 flips

- Need to find an investor or trader with 143 year track record

- "I don't have very much on the wisdom front"

- www.elmfunds.com

- Not on Twitter, "haven't figured it out"

You Hang Your Head and Pray

From 2006 ... dummy falling from the balcony a gag ... Folds is solidly Gen X and lives in California.

Notes for Chat with Traders, Episode 132

Episode 132 ... Mark Gardner (55:43)

- Australian, heavy accent, difficult to understand

- Has four kids

- Has a three strikes rule (mistakes, rule breaking, bad judgment, misses something) and he takes a break

- In front of screen for 20 years, 80,000+ hours

- [Can't understand him, he talks fast ... and there's the accent ... missing half of what he says]

- Parents were blue collar, worked seven days a week, hard workers

- Goes on "auto-pilot" when he's trading

- Sets up his screens consistently, like a gamer, chart pattern recognition

- Same things in his field of vision for 15 years

- When he's stimulated, he's relaxed ... not worried about burnout

- Working for himself, no one else ... that makes a big difference that he doesn't get sick of it

- Power napper

- Your rules shouldn't say "don't don't not not" ... make constructive rules when in neutral state of mind

- Last year of high school in Australia, you need to get work experience

- 14-year old first time on Australian trading floor ... he was enthralled, exciting, knew he wanted to do this

- 17-year old he went right to work for brokerage

- Grew up in small country town, not studious, University not something he wanted to do

- Had a mentor who worked him hard, very strict, but he needed that, no regrets

- Ten year apprenticeship, only two or three months of losses over ten years

- Top 10% will always eat the bottom 90%

- Eventually had enough capital to handle the swings psychologically

- Got arrogant in 2014, thought he couldn't lose, then predictably took a big hit in March 2015

- "God Complex," took position way too large, lost six or seven months of gains in four hours

- Lightning strike hit house, everything knocked out, lost 20% right when that happened, once back up realized he was badly stuck, got angry, snowballed

- Usually level-headed and calm, this stressed him out, he sort of freaked out, had a lot of bad thoughts, couldn't walk away, calm down

- Tightened up all his redundancy measures after this event (diesel generator, backup computers, etc.)

- Took six months to make it all back, which he did

- Re-gained his respect for the market after this, respect for risk management

- Feels his edge has diminished over the last 15 years

- He's not up against another human anymore, he's up against quants

- The competition had changed, he had to adapt

- Quants are taking advantage of the inefficiencies of human traders

- Math guys don't respect old traders, no love for the discretionary traders' pattern recognition and intuition

- Human mind can adapt and make complex associations that are not quantifiable but need to be respected

- Don't cuddle up to other losing traders when you're losing ... don't seek comfort

- Twitter: @42trading

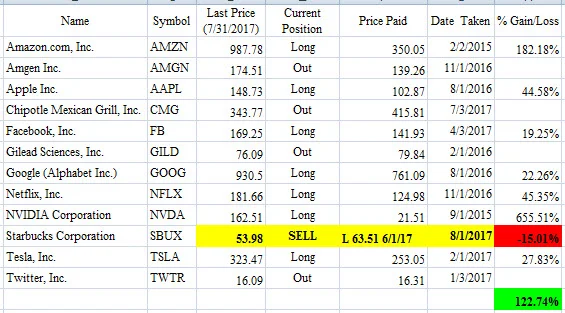

Dirty Dozen, Long Only Portfolio, End of July 2017

Sorry for the delay in posting this ... I've been re-learning how to day trade these last several months and it's hard work, but I think I'm making progress, however slow-going.

One change to the Dirty Dozen portfolio: sold Starbucks (SBUX) on August 1 for a loss (I was worried about it at the end of June). Amgen, Chipotle, Gilead, and Twitter remain on the sidelines for now.

Changes in 2017 include selling Twitter in January, while getting long Chipotle and Tesla in February, Facebook in April, and Starbucks in June. The Chipotle sale last month appears to be well-timed, and we'll see how the Starbucks sale in August looks in time.

Notes for Chat with Traders, Episode 46

Episode 46 ... Hans Dederle (46:39)

[Can't tell if this guy really makes any money?]

- Worked for accounting firm doing tax prep, quit

- Joined brokerage firm, got series 7

- Got interested in trading off of earnings reports

- "So to speak...."

- Started trading a couple months before the 2008 peak

- Blew up his account a couple of times [doesn't give details]

- Boredom traded, revenge traded, averaged down, blew up

- Had eleven months of trading profits, friends and family wanted to give him money [11 month track record?]

- Managing other people's money, he's less emotional, more professional

- For his style, high volatility stocks the only way to go

- Looks for reversals in the first thirty minutes of the day

- Don't try to beat the market makers, join them

- Uses five minute candlesticks, finds support on gaps down, resistance on gaps up

- Trades one to three things a day

- Looks for extreme volume in individual stocks

- Buys calls and puts, not the actual stock [how does he price them?]

- Also looks at Level 2

- Commissions will eat up your profits if you overtrade

- Trails a stop on his option positions [market liquid enough to do this??]

- Holds positions usually one to five minutes [what?!?]

- Tries to set entry and target with every position

- Done by 10:30 AM every day, never swings anything

- Trades NFLX and AMZN all the time

- "For me, ...."

- Don't confuse yourself with too many indicators, keep it simple

- Uses RSI (lagging) to judge extreme moves

- You need a system to stay disciplined

- "Fail your way to success" [Zen koan?]

- Don't think about the money, think about staying true to your strategy

- Has tweaked his strategy all along, adapted to changing markets

- Paper traded his strategy for six months to fine-tune and gain confidence

- "Hold and hope" instead of stopping out -- deadly

- Everyone in the beginning cuts her profits short and lets her losses run, it's only natural

- Figure out what works for you

- Twitter: @Hdederle

Notes for Chat with Traders, Episode 48

[I've always liked Linda Raschke ... she's the real deal and every word is gold. You should seek out everything she has ever written and recorded]

Episode 48 ... Linda Raschke (49:29)

- 1981, started as equity options trader on the floor

- Barriers to entry minuscule today compared with the past when she started

- Once you find the key, they change the lock

- Must learn to adapt

- What works for someone else might not work for you

- Still learns something new every day

- After ten years of trading, she felt confident with her plan

- You can't go and copy another trader

- Have to move to markets where there's volume and volatility

- Many markets she used to trade no longer exist (pork bellies, OEX options, etc.)

- Markets either go up or down

- Don't force anything

- Like tennis, keep the ball in play until you see an opening

- The big money is made holding overnight, which is riskier

- Don't use linear framework to approach the market

- Wyckoff ideas of range contraction and tests and re-tests still good

- Look for strong volume, strong directional bias

- Lethal to trade in the middle of a range

- Trade location irrelevant if you're getting on a trend

- Market moves now efficient, instantly goes to new equilibrium level

- Look at price, not derivatives of price, like oscillators

- Always check liquidity first ... can you get out quickly?

- Intuition just the sum of experience, she's not a fan of intuition

- Every time she's had a hunch, she's been wrong as often as right

- Need a very consistent approach or framework to the market

- Prepares the night before, has a game plan, comes in next morning ready to go

- 80% of your profits come from 10% of your trades

- Don't scramble in the morning to get prepared, do it the night before

- You need to concentrate and focus, don't get distracted by Twitter and TV, shut out the noise

- Take anybody else's opinion with a grain of salt

- Most "educators" couldn't trade their way out of a paper bag

- Anyone who trades well doesn't teach anybody else how to trade, it's a bottom-line business

- Find your own style, do your own work

- Print out charts and make a notebook, study action that preceded big moves

- Gann was demented at the end, suffering from syphilis

- Concentrate on one initial pattern and study it: a breakout thing, or a retracement in direction of trend

- Keep track of your performance statistics, turn it into a game

- Free yourself from ego, rid yourself of the need to call turns

- Imagine yourself standing on your surfboard alone in the ocean waiting for the great wave

- People think trading is easy, want to follow a guru -- they're doing it wrong

- Every successful trader has found one little thing that works for her, and does it consistently

- Has a website but neglects it

- Look for YouTube videos of her ... all free! (5,210 results)

Your Warmth Sets Like the Sun

The great Joan Armatrading... pity about the keyboardist's solo.