The great Joan Armatrading... pity about the keyboardist's solo.

Notes for Chat with Traders, Episode 128

Episode 128 ... Andy Kershner (49:55)

- Geologist by training

- Ski bumming, early 1990s

- [Has a laconic speaking style, a native Texan]

- Started trading options out of the library with his buddy with $5,000

- Dyslexic friend, Scott Dyer?, in Texas, great at pattern recognition, "savant-ish"

- Top 100 IBD names, trade options on them ... all pre-internet

- Turned $5,000 into $1,500, couldn't get the prices they saw on the screen

- SOES came into being, little guy finally had a chance to get quoted prices

- Went to Cornerstone Securities, which became ProTrader, in 1996

- David Jamail, David Birch -- founders of Cornerstone?

- ProTrader started with 12 seats in Austin, 500 day traders across branch offices at their peak

- Sold ProTrader to Instinet in 2001, kept proprietary trading group

- He lives and breathes trading

- Cornerstone willing to hire savant buddy, but not him, he was a "trainwreck waiting to happen"

- Worked part-time jobs, was friends with all the ProTrader traders in Austin

- Made one trade a day on the side at first

- Markets change, strategies changes, but habits don't change

- Once he was on his own and loaned enough capital, he made 100K a month "forever"

- 80% of his trades were scratches or small losses, 20% were big winners

- He's from the era when there was a human on the other side of the trade (mid-1990s)

- Computer models today are always searching for stops, no more human involvement

- His biggest strength/weakness: he can take a lot of pain

- Big numbers don't bother him

- Trade according to your psychology, do what works well for you, and is repeatable

- Find an edge and see how large you can do it without changing what you do

- Best traders trade 100,000 shares exactly the same way they trade 1,000 shares

- [He means the decision-making process, not the actual execution which is different]

- If you're sitting in a seat all day, you might as well being doing some size

- He ladders in and out of positions now

- Risks 1.5 to make 3.5 to 4 ... 50:50 odds he's right

- Will triple his size when he thinks he can win big

- Lots of styles work: scalpers, swing traders, high win rates, low win rates ... it can all work

- Have to discover what you're good at, amount of risk you're willing to take

- Develop good habits: journaling, reviewing, preparing

- Strategies don't matter, good habits matter

- Exercise and rest important

- Review at end of day, what you got right and wrong, journaling

- May 23, 2017 ... his MOMO position, wanted out 46-48, didn't happen .. tanked to 38, sold 41

- Lost 90K more on that trade than he expected, gave it too much room [charts below]

- He didn't have his game plan structured well enough, too much thinking on his feet

- Have to do what you think you have to do ... making and losing money doesn't matter

- Fades overextended moves, laddering in, both on the upside and downside

- Where people are getting stopped out, that's where you should step in

- Trades 100% US equities and loses money consistently trading options [he has a sense of humor]

- When you know that you're wrong, get out

- He ladders in equal-sized usually ... position sized by liquidity and confidence

- Find 3-4 : 1 RR winners, win ratio a little better than 50%

- Add to your winners, not your losers

- Teaches people good habits for six weeks at his firm, then they go live

- Looks for people who have overcome adversity, people who can act with limited information

- Engineers tend to be bad discretionary traders

- Common mistake new traders make is thinking it's easy

- Only 2 out of 10 of the carefully chosen, great people he takes in make it, takes years to make it

- Need your finances in order before you start, need your working spouse to float you for those *years*

- Recommends reading Reminiscences of a Stock Operator, Market Wizard books

- Find the best short-term trader you can find, and go work for him (her)

- Shortcut your process

- He talked to all the best traders at first in Austin and cut learning process from five years to one month

- Good trading goes against basic human instincts -- fight or flight, have to do the opposite

- Good trading requires extreme discipline

- Don't keep doing the same thing if it's not working

- If you're overly emotional, look into automated trading

- Do you care about being right or making money?

- Software eating the world, everything is getting automated, incl. trading and investing

- AI is only a tool, still need smart humans to employ it

- Generally uses Python to build models

- www.kershnertrading.com

- www.cloudquant.com

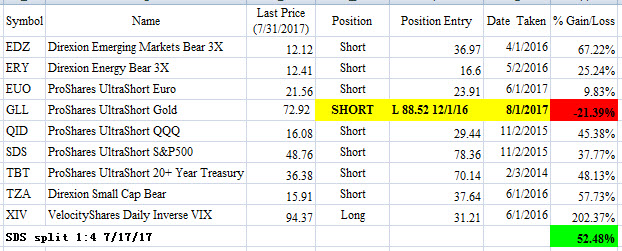

ETF Trading Portfolio Update -- End of July 2017

Cutting losses in the long gold position and reversing short. Everything else is doing fine.

Loving the Real Cheryl Lynn

Thrilled they have a live version of this great song on YouTube ... an amazing voice ... and I think that's one of the songwriters on the piano:

Comments on Grittani Trade Recap: Short CAPR

Tim Grittani has started doing recaps of selected trades on YouTube, which are interesting to review. Here's an annotated chart with my comments for his short trade in $CAPR, initiated on July 19, 2017.

Position size: ~$39,000

Comments on Grittani Trade Recap: Short MOSY

Tim Grittani has started doing recaps of selected trades on YouTube, which are interesting to review. Here's an annotated chart with my comments for his short trade in $MOSY, initiated on July 14, 2017.

Position size: ~$85,000

My Life, My Love, and My Lady

A Billboard #1 when I was two ... I remember it well.

Notes for Chat with Traders, Episode 96

Episode 96 ... "Nico" (71:07)

- Has two 43" screens, Dell multi-clients, 12 usable virtual screens, 4K resolution

- Previously four 24" screens and one vertical 28"

- Ikea desk

- Aug 2016 best month to date [podcast recorded in Sep 2016]

- Worked for software development firm out of high school

- Wanted to make more money

- He didn't want to take core college courses, just computer science, dropped out

- Built his own software development business from nothing

- First client he had was a successful stock trader

- Discovered that microcap stocks moved 20, 30, 40% in a day

- Lived paycheck to paycheck in the beginning, had no savings

- Had to save up money for a year to build trading stake

- [Blipped out some bad habit?]

- Do not quit your day job! Try something on the side first

- First trade in early 2007, bought AAPL, no time horizon, sold dame day for $100 gain

- "Easiest $100 he ever made"

- Didn't want to work in a cube and make $100

- Used Telechart by Worden Brothers in 2007, had built-in chat window, that was cool!

- Charting appealed to him, fundamentals "too much work"

- Timing the market using charts -- instant gratification

- Did not know about shorting at first, just went long

- Microcap market of 2007, he made $20K just getting long microcap runners

- He thought, "this is easy" -- worst thing that could happen

- First account was $5,000 with Fidelity

- Either the market changed or his luck ran out, but he kept "pulling the handle" (slot machine reference)

- Second year lost all his profits, cold reality slammed him in the face

- Now he understood why trading is "damn near impossible," 90%+ fail

- Lost consistently for the next seven! years

- Easy to lose trading profits, hard to lose "legitimately" earned income

- Started to put his size in check, started trading small, $5,000 positions, maybe $10K

- He would hit periods of profitability during those seven years, but then give it all back

- He was making a good living as a software developer, trading losses didn't really matter, "slow bleed"

- Three steps forward and five steps back

- At one point he had over $25K, not shackled by Pattern Day Trader rule

- Wished he didn't exceed PDT rule, wasted a lot of time and money

- PDT rule exists because of degenerate gamblers (like he was)

- Loves solving problems and puzzles, thought he could figure out the market

- This shit is tough, I'm getting my ass handed to me, small size kept him from blowing up

- As the years passed, self-doubt crept in, but people supported him despite his failures

- Periods of profitability gave him hope

- Can't be luck alone, because he's losing more than he's making [made me laugh]

- Reached end of his rope, had a serious sit-down talk with himself, sick of adding money to trading accounts and losing it

- Went full-time, stopped growing his software biz, focused solely on the market

- Never had Facebook, MySpace, Instagram, Snapchat

- Traded in isolation for those eight years, floated around, went nowhere

- Discovering Twitter changed everything for him, every trader is on there [even good ones ;-)]

- Discovered shorting, those first eight years were long only

- Investors Underground gave him a connection to good traders

- His software biz big enough, successful enough, he can make his own hours, and has savings

- He loves shorting, 90% short, 10% long

- "Flying Pigs" ... short the microcap junk companies doing dirty stuff to boost stock price

- Fluffy PRs, huge gaps up, presents good opportunity to short

- Look at pre-market movers and gappers

- Look at pre-market unusual volume

- Has a watch list called "Pigs" ... every pig encountered is added to the list

- Has 200 pigs on his list

- Pig list sorted by net % change, former runners appear once again, no homework needed

- Top of the net % change list become his candidates for shorts

- Wait for the backside, "crack VWAP," or "high of day rejection"

- Shorting the frontside is stepping in front of a train, have to make an educated guess where the top is

- Controlling your size is everything, don't be a gunslinger

- He isn't comfortable sizing up because he still has lots to learn

- One bullet shooting only necessary if you can't scale in

- You can't improve what you don't measure [smart]

- Account balance alone isn't a truly useful measure

- Start plotting your equity curve

- Puts everything on Twitter to curb his degenerate gambler impulses

- Stopped overtrading, being impatient

- He's the rare guy who thinks you should post your P&L publicly [I say: bad idea]

- All about accountability, kept him from being reckless

- Aaron mentions that you must have measures other than P&L to measure success [from "HF71"]

- Track your daily P&L in great detail

- Take a scientific approach and measure what you're doing

- Develop good habits ... he had bad habits for eight years

- Identify what you struggle with: Are you impatient? Are you a degenerate gambler?

- Don't trade in solitude, surround yourself with better traders who are like-minded

- One wolf hunting for food isn't going to eat as well as a member of a pack

- Boy Scout system, try to keep each other out of trouble

- Has developed spreadsheet for trade tracking, willing to give it away from free

- Lots of people pay for TraderVue, but can just use his spreadsheet

- Twitter: @inefficientmrkt

Looking at the Short Squeeze in DryShips

The notorious $DRYS did yet another reverse split on Friday, July 21 (this one 1:7). I've been avoiding shorting this stock because I've been fearing a squeeze, which would happen the moment I got short, thinks Mr. Paranoid. I hadn't thrown in the towel and finally shorted it, but there was a wicked short squeeze last Friday. I didn't make a dime off of this expected squeeze, mainly because I was too busy tweeting about it instead of playing it.

My Twitter addiction costs me so many opportunities, and I have to work on curbing my need to be publicly "right." I really need to force myself to shut off Twitter during market hours ... I just have to go cold turkey. Catching this one trade could have made my week / month / year!

Click for lightbox

Notes for Chat with Traders, Episode 98

Episode 98 ... Peter To (80:04)

- 2004 started playing online poker, 15 years old

- Inspired by Chris Moneymaker winning WSOP in 2003

- Wasn't athletic, all intellectual power, poker a good fit

- Deceived Mom to fund his PayPal account to fund poker account

- Started with $20 and lost it all, devastated

- Second $20 he tried to make it work playing 10 cent blinds

- Did hand analysis on 2+2 forums

- He was playing tight, but too passively, not getting enough money into the pot

- First became profitable limit player, then profitable no-limit player

- Turned $20 into $20,000 over two and a half years

- No innate talent for poker

- Never plays poker anymore, edge is too small now

- Lives in New York City, comes from Southern California

- Poker has advanced so much, so sophisticated today, very hard to win now

- "Game Theory Optimal" -- everyone knows the correct line now, everyone knows the math

- Poker has become an efficient market now [smart comment, he's right]

- Lost the passion for poker ... no fun chasing bad players online [even worse to do it offline when face to face]

- Variance in poker also very high

- Knew nothing about the stock market until college

- Best friend talked about trading and investing, interest piqued

- Natural transition from poker to trading

- Got interested in 2008 2009, Great Financial Crisis

- Started out as a gold bug, feared hyperinflation

- Bought physical gold coins with his $20K, paid 8% spread [I'm chuckling, but it's good to be suckered at first, I believe]

- Still a big libertarian

- He's able to debunk himself quickly, fortunately

- Sold his gold coins for breakeven

- Second stage he was a value investor -- read Ben Graham, Peter Lynch

- Bought Apple, Wells Fargo, Baidu, Dow Chemical all at the lows during the crash

- Realized he didn't have the patience to hold all this stuff

- Turned $20K into $30K, got account over the pattern day trader rule

- Third stage: day trader using technical analysis

- Mom's friend taught him how to read charts and structure trades

- Read a lot of blogs, sourced his learning from all over

- Discovered the ARCA pre-market cross in OTC junk stocks

- Stock closed at $1, offered in pre-market on ARCA at $0.85

- Would pick off all those $0.85 offers pre-open then sell for $1 at the open

- This happened from time to time over two years, a few times a month

- OTC market making is manual ... quotes not honored ... shady stuff

- Moved to NYC and started prop trading

- Doesn't want to name prop firm

- Had been trading every day for two years while in college

- Started trading club in college

- Good things and bad things about being in prop firm, but experience invaluable

- Many prop firms are about "burn and churn" ... get a guy in, get commissions, until he blows up

- Prop firms would "fine" people ... e.g., couldn't trade odd lots

- Prop firms can offer capital to scale stategy, proprietary technology to enhance strategy

- Started meeting seven-figure traders, their strategies not do-able on a retail platform, needed capital and technology of prop firm

- Compares a good prop firm to a good farm team in baseball [nice analogy]

- Read Glassdoor about every prop firm you're considering, lots of shady practices

- Big red flag is if prop firm requires a deposit

- Careful of groupthink in a prop firm, herd mentality, tunnel vision

- There's lots of ways to make money trading, not just momentum

- Wants to catch all-day runners

- Unusual volume, unusual volatility, unusual attention being paid to it

- Not intellectually deep, just using intraday chart, price and volume

- Shorting parabolic microcap stocks, thesis is overextended junk will eventually collapse

- Trick is timing the turn precisely, how to minimize damage when your timing is off

- Takes years to hone this skill

- Follow the order flow, can't just rely on your shorting-microcap-parabolics-play, they dry up

- Chapter on Jimmy Balodimas in Schwager book made big impression on him

- "Stepping in Front of Freight Trains" -- fight trend, add to losers, fades huge moves, gave self huge leeway, took quick profits, in short Jimmy did everything "wrong" based on conventional wisdom

- Peter has developed "trading nihilism" -- process doesn't matter [another smart comment]

- His firm bought the Flash Crash, risked the firm, risked everything, best day ever. Skill or luck? Was it wrong?

- No mathematical framework in trading that you have in poker

- The market never repeats itself like a poker or blackjack hand does [yes, exactly]

- Throwing the book out from time to time, not following your rules, it's all guts and intuition

- Some people just have conviction, don't care about price action

- He was consistently profitable at first, but made no money [just like "winning" with tight, passive poker play]

- He's a very emotional person, but makes emotion work for him

- Feels the fire and allows his greed to take over -- results in best or worst days

- Fannie Mae his biggest loss ever, most popular blog post

- Shorted AVXL, one of his best trades ever

- When he loses money, he wants to sleep in the next day

- When the wheels fall off, self-doubt creeps in, needs to take a break

- Has had worries that he'll never trade again

- October 2016 the worst month in an otherwise good year

- Can't get out in these microcap stocks, you get stuck, 1x loss become 3x loss

- Built muscle memory for trading certain stocks, which betrayed him when trading OTC stocks

- Lived in NYC for four years, 26 yo now

- Used to keep detailed journal, made detailed plans, did detailed trading reviews -- now he's relaxed, doesn't do any of this, just wings it [sounds familiar]

- Try less hard, take the pressure off yourself

- Trading is not easy, markets constantly changing

- Thoughts on trading BitCoin: insane volume and volatility, psychology same as crazy stocks

- Exchange security is everything, you get hacked and lose everything, you're just not safe

- Multiple exchanges with multiple rules, none of them have good infrastructure and security and no oversight, don't get involved with this, way too risky

- peterkto.blogspot.com

- Twitter: @peterkto