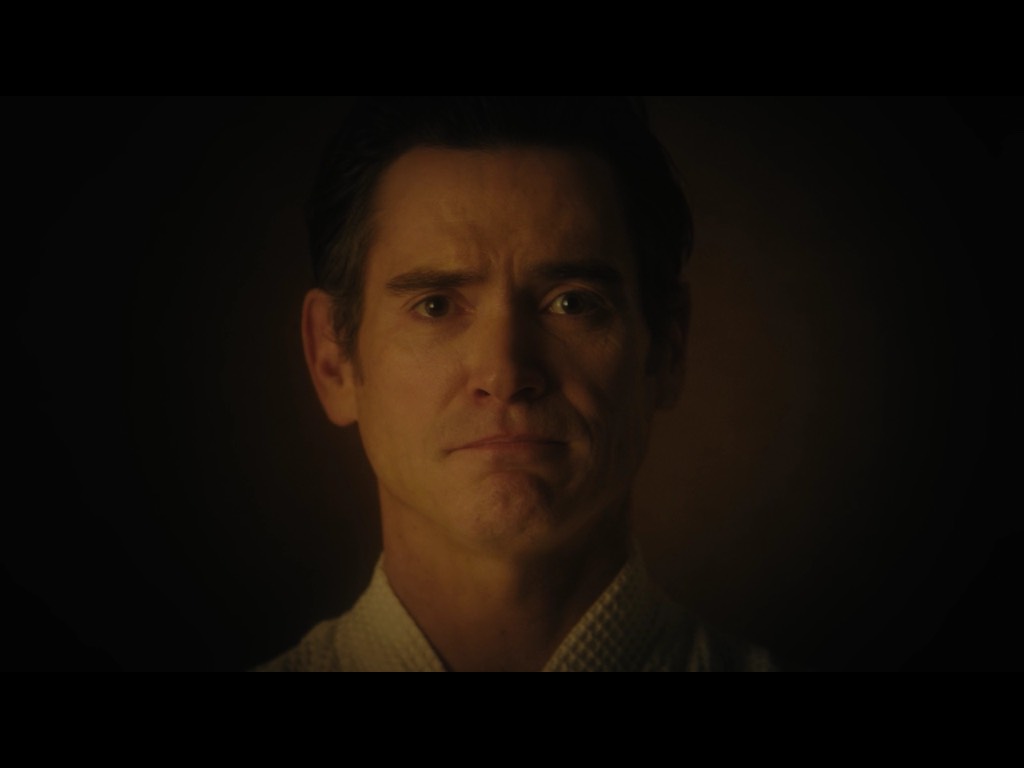

Episode 105 ... Brendan Poots (58:00)

- Family in Perth, but he's Irish

- Bet size versus volume of bets taken per match very important (bet sizing)

- English Premier League match has average pool of $10-$20MM , AFL (Australian Football League) only $300,000

- Bet size must be proportional to pool, must focus on liquid sports

- There are only a few global sports betting exchanges

- Advent of in-play sports betting, basically real-time now, not a binary outcome anymore

- Win lose draw ... must consider the draws in many sports

- Money comes in towards kickoff, odds tend to be farther off before then

- "Having a bet" is an Irish tradition, "the joys of punting"

- Studied chemical engineering in University

- Played cricket in England, his sponsor was a bookmaker. he worked nights for him

- Couldn't cut the mustard as a cricketer, switched to investment banking

- 2006 got scholarship to Columbia U., got his MBA

- Didn't want to be lackey at age 33 in investment banking [also true for me with an MBA at age 30 after dot com bust]

- Plus no jobs after Great Financial Crisis

- Understood BetFair, 2008-2009 started building his own sports betting business

- Made money on his own with sports betting, built short track record

- 2010 raised some money and started his "sports hedge fund"

- Individuals now give him several hundred thousand dollars a pop to manage

- Started out as a punter but quickly morphed into strategic betting

- "Betting" "Gambling" "Investing in Sport"

- Has offshore office in Gibraltar, AIFMD regulated

- Australia-based fund, small fund, number of investors limited, investors must have $500K+

- Everyone got hit in Global Financial Crisis, but sports betting uncorrelated, immune to crisis

- Lot of smart people in financial world, tough to compete, esp. if you lack passion

- He lacked motivation and passion for finance, but loved sports

- He's obstinate and likes proving people wrong

- He's good at compartmentalizing his loves, driven by numbers and opportunity, not emotionally invested in any one team

- First investors were friends, but still had to capital-guarantee their investments

- Sports betting is no longer a binary outcome

- Betfair, Matchbook

- Bad month -1%, good month +4%, he has taken the volatility out of it

- Cherry picks the trades he makes, only acts when he can capture big premium

- 95-97% of his trades are hedged, will act in real time to offset bet

- Typical trade lasts 15 or 20 minutes, by end of game he's long gone

- Psychological aspect of taking your profit and running, plus the risk/reward ratio changes after first goal (for example)

- Doesn't touch basketball (injuries throw off data)

- Markets overreact to injured players, presents opportunity

- European fund denominated in GBP

- Need more than a smart statistician or mathematician, need one with an innate understanding of the sport

- Need to understand momentum shifts in sports

- AFL too small a market, just can't play it, liquidity isn't there, can't hedge, can't exit

- His analysts don't trade and his traders don't analyze

- American gamblers used to binary outcomes, don't get the hedging concept

- Needs at least 25% premium (his price vs. market price) in marketplace for him to get interested, a.k.a., Ben Grossbaum's "margin of safety"

- Trials trading strategies, builds database, backtests it against old results

- Historical sports data is a commodity, easy to build a model

- Real-time data you have to subscribe to

- Ball possession used to be considered a useful statistic, not true anymore, just noise

- People want to see volatility-adjusted returns, "number of negative months"

- Match fixing, spot fixing still happens ... incentives not there at high levels of sport, just low levels

- "Tennis players at low levels scratching around for a living"

- Three things you need to know to get into sports betting:

- there's always another race

- bet what you know and understand

- if you want to make money, do it in a boring way, slow and steady

- His typical bet size is very small -- single trade max 3% funds under management (bankroll), typically 1 to 1.5%

- Hit singles, not home runs (which are hard to find)

- www.priomha.com

- Twitter: @priomha