Thanks to my Twitter buddy, JackInFlorida, and others for recommending Banshee ... I enjoyed the first season. The story is a little dumb (ex-con becomes small-town sheriff), and they try to make it more believable by basing it in Amish country (ya know, no cellphones, computers, etc.), but it's still silly.

And the violence, oh my god, it's just over the top. It's like X-rated violence, pornographic violence. Every episode has at least one extended fight scene or gun battle which ends with everyone covered with vast amounts of blood, dripping from heads and mouths. It's gory, not for the squeamish or sensitive.

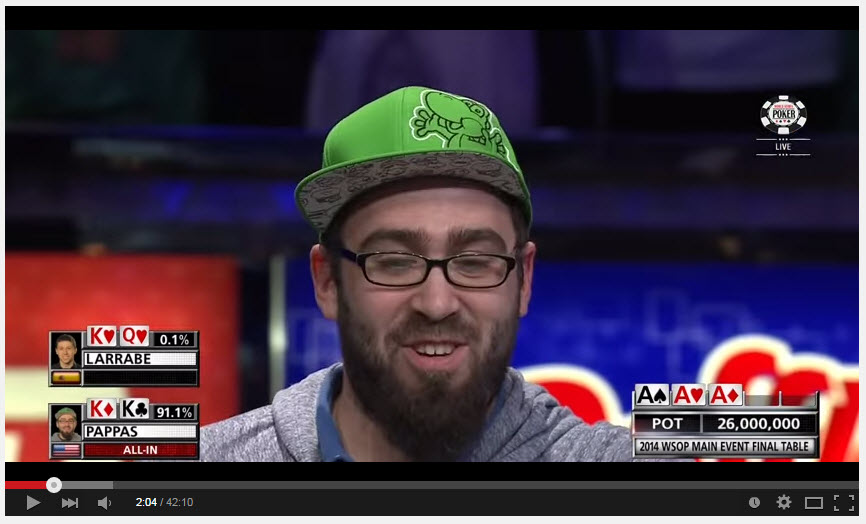

But it's also funny. Lots of clever lines and amusing situations that are well done. It's campy, which balances out the ultra-violence. The lead male isn't going to win any acting awards, but the lead actress isn't bad, a La Femme Nikita type, ya know, eastern European bones. The villains are all good, older guys who are still ripped (they're not Americans, that's why), which is nice to see. Remember my big objection to House of Cards is seeing pudgy, effeminate Kevin Spacey playing a tough guy. Anyway, give it a try if you haven't seen it ... here are my selected screenshots.