Glare + Nectar ... took awhile.

Lumber Liquidators Liquidation, 1 Minute View

Interesting one, got active at 10:32, scanner should have alerted you. Reported earnings but included the paragraph about a possible Department of Justice investigation not in the 8-K but in the 10-K, which people only discovered later? Maybe there was a conference call and something was revealed on it that caused the stock to go into freefall. Anyway, regardless of the news quick witted traders could have shorted this thing for some serious money.

Click to enlarge

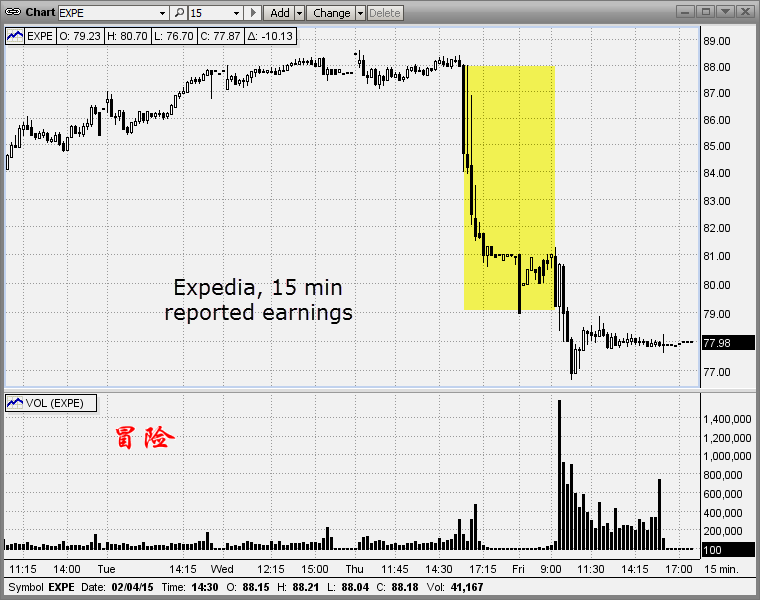

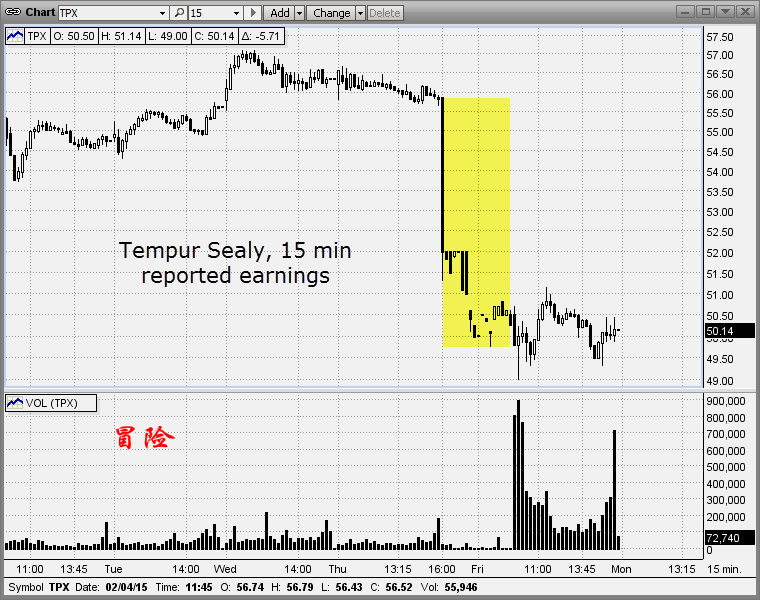

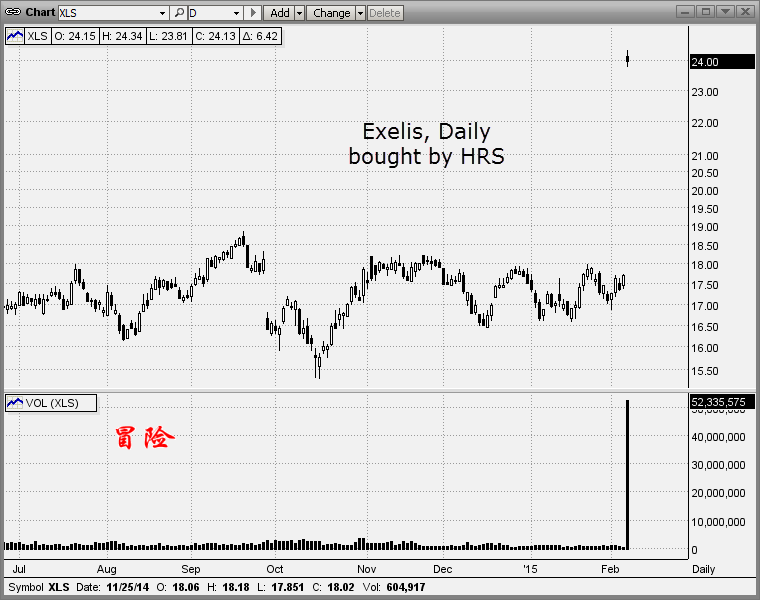

Charts of Note, Fri. Feb. 6, 2015

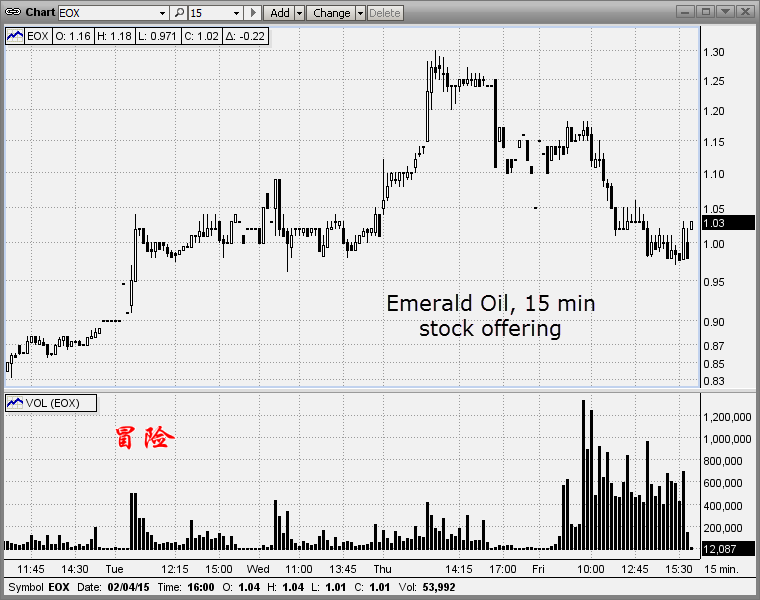

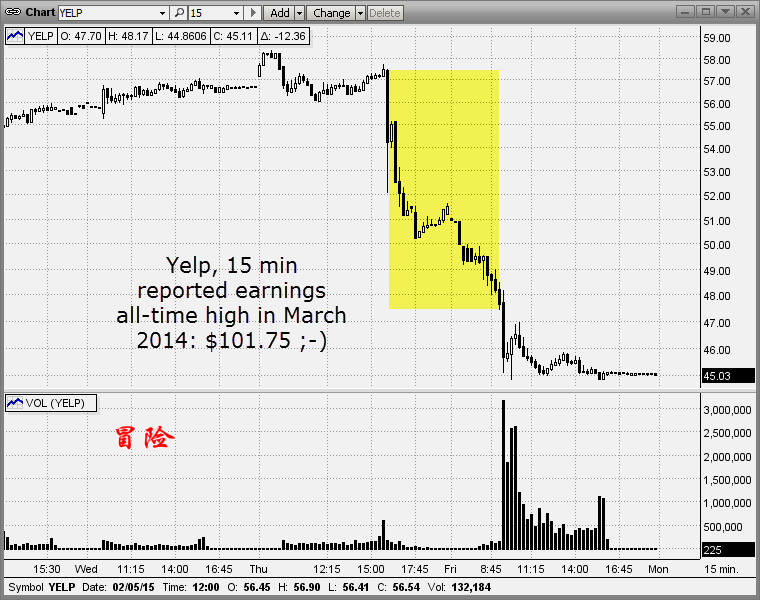

Six today: EOX, EXPE, HRS, TPX, XLS, YELP.

I'm going on vacation today for Chinese New Year and will be back at the end of the month, so this will be the last post for awhile. I don't know if I'll continue doing Charts of Note since I'm not sure how much value it adds. Might be better to do an after-hours report? We'll see.

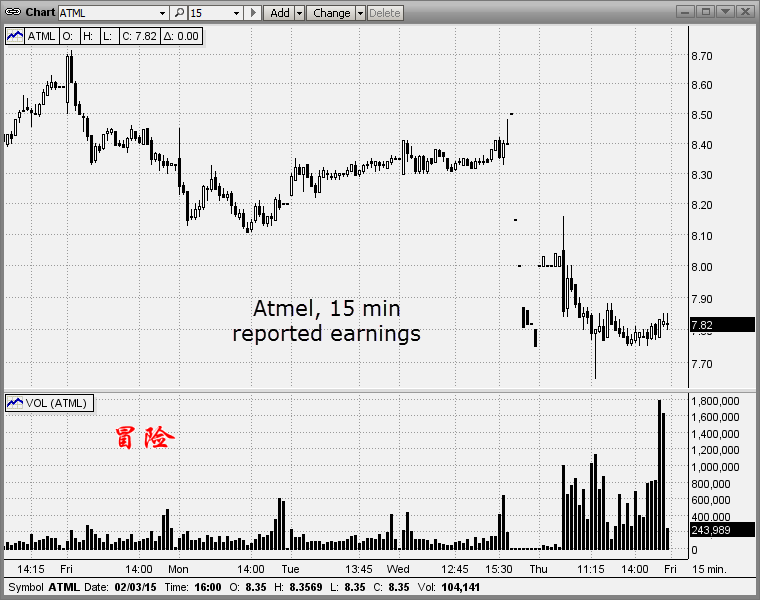

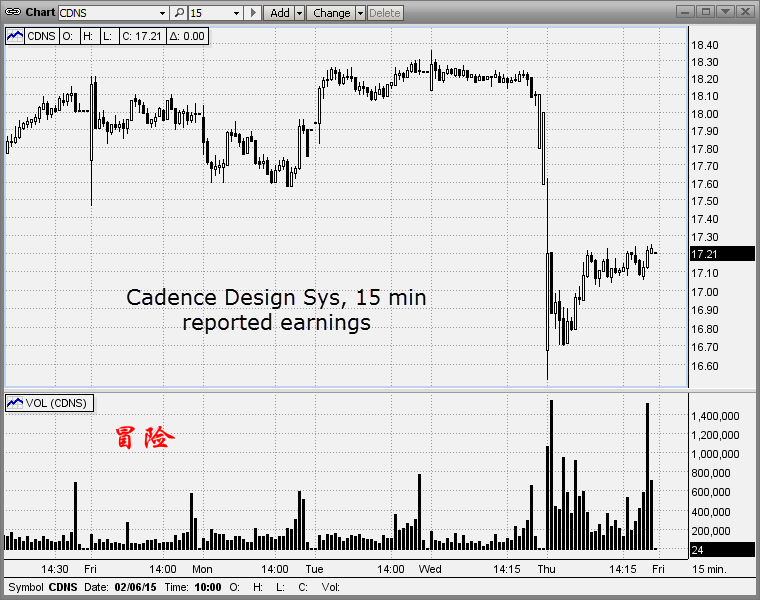

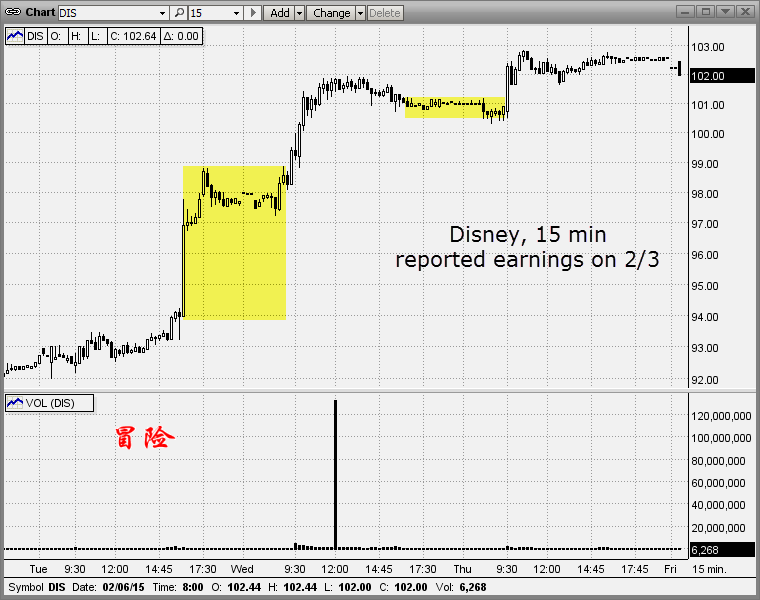

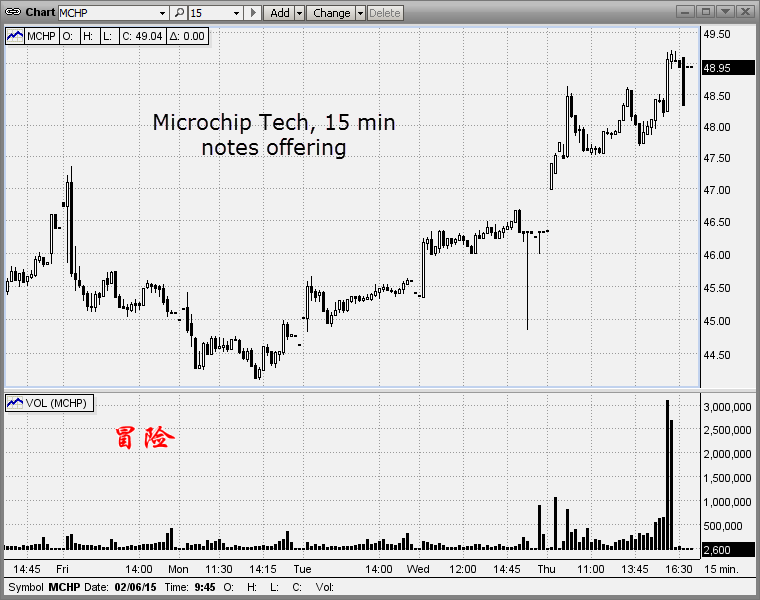

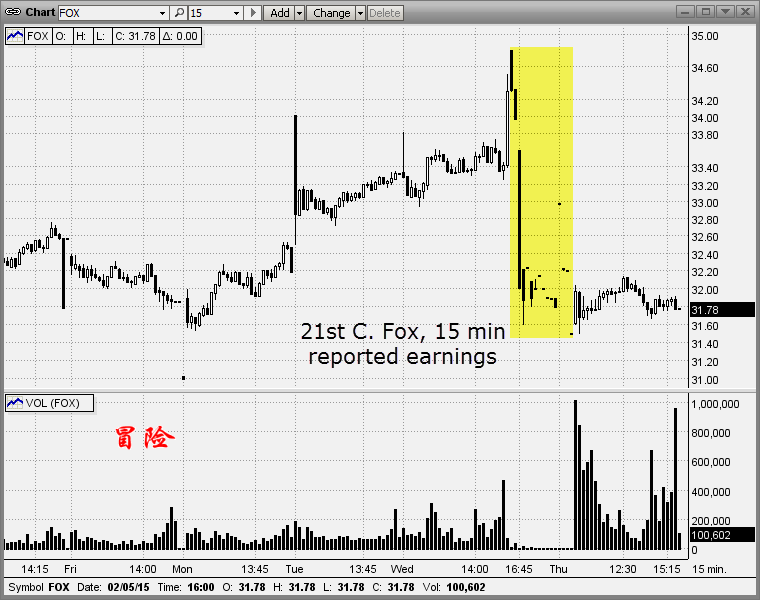

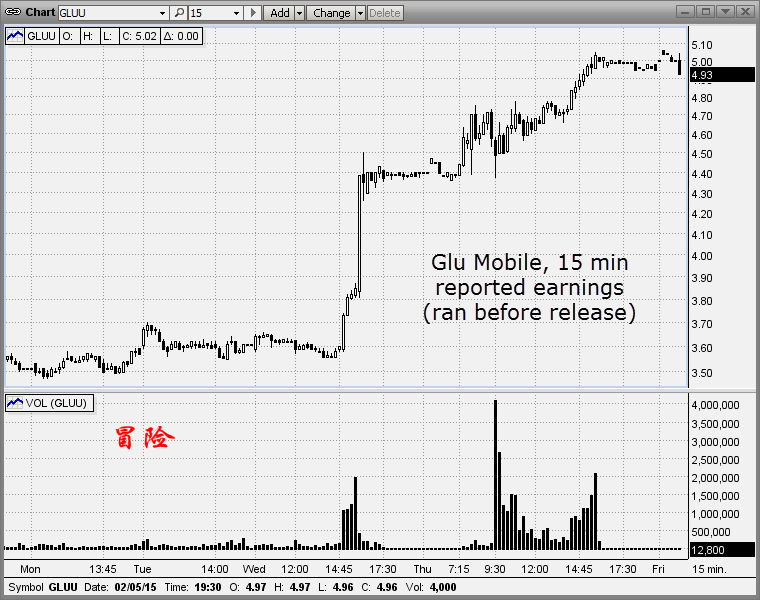

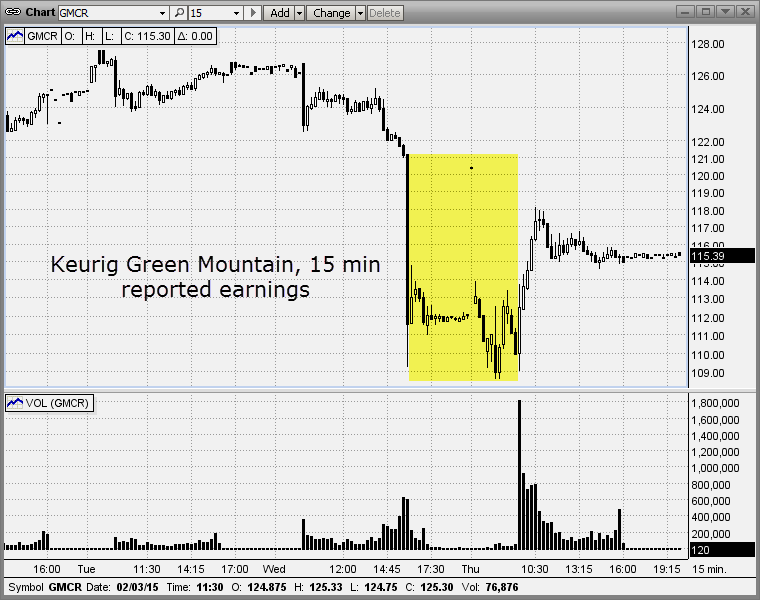

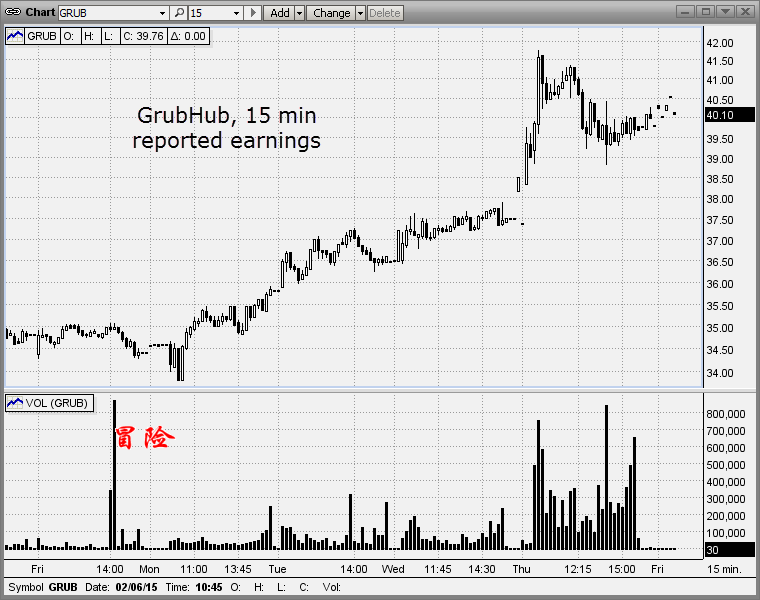

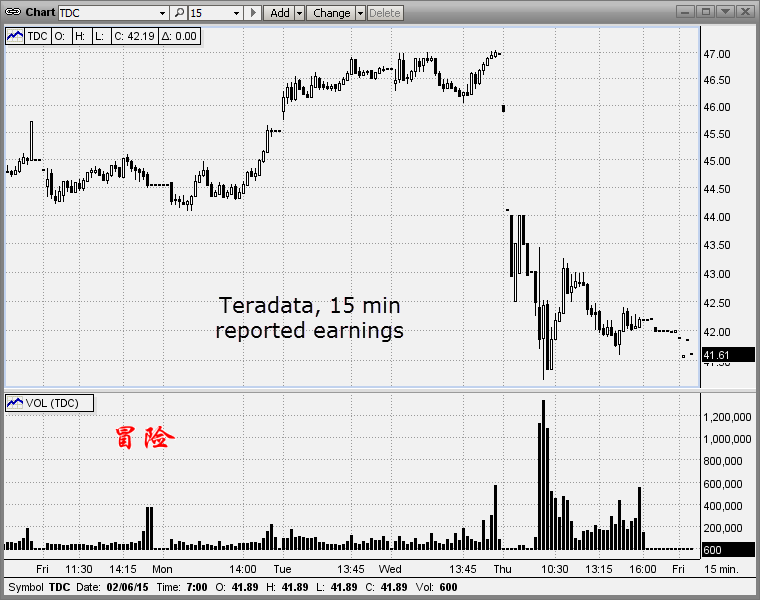

Charts of Note, Thu. Feb. 5, 2015

Eleven today: ATML, CDNS, DIS, FOX, GLUU, GMCR, GRUB, MCHP, PRU, TDC, UA.

Not sure how much value I'm adding by posting these... maybe I'll do an after-hours report instead.

Bloomberg Most Popular Newsletter Disappears

Bloomberg.com is blocked in Mainland China so I relied on their daily "Most Popular" email to scan headlines every day. It appears that the newsletter is no longer being sent. The horrific re-design of the Bloomberg website is probably to blame. What a mess. When I had a Bloomberg terminal I found the most read function <READ> incredibly valuable because my fellow terminal subscribers filtered the news for me. The most read stories on the website aren't the same thing, but still useful.

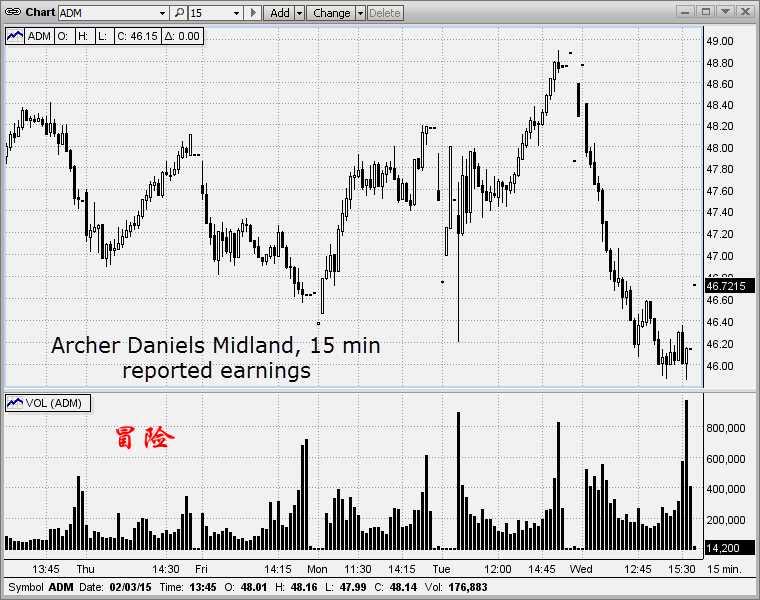

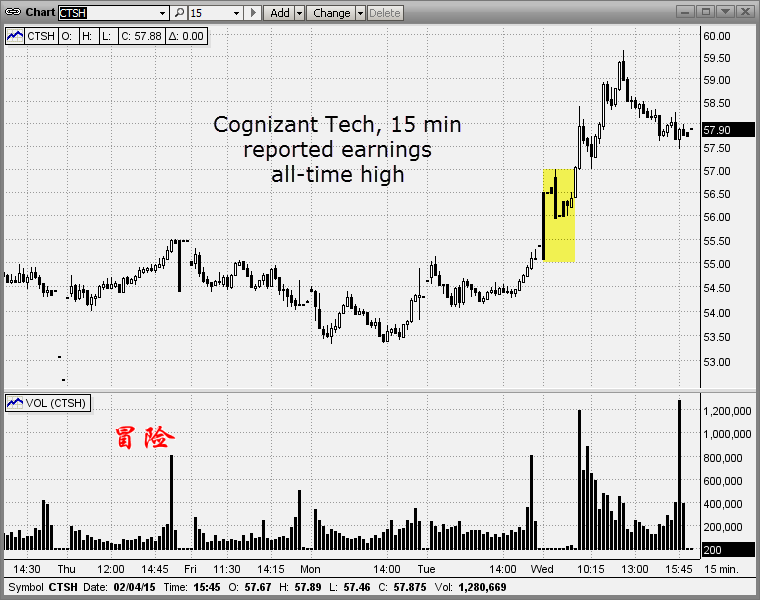

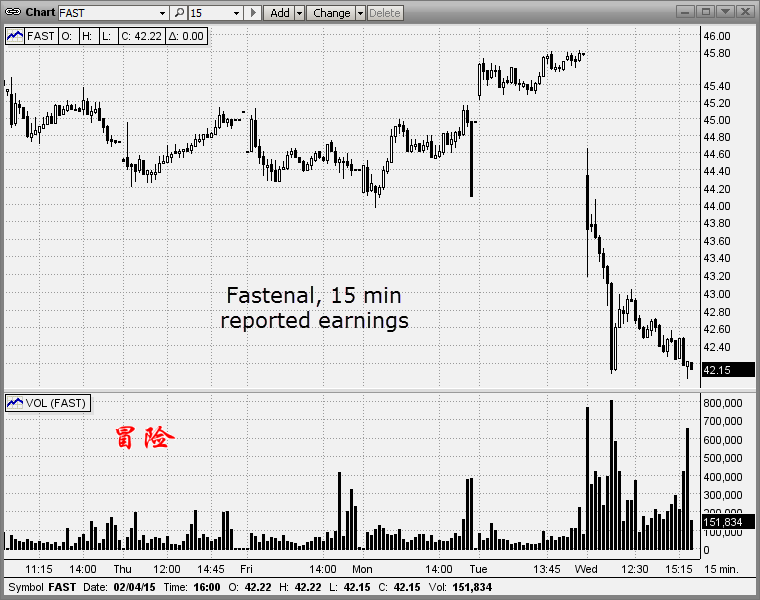

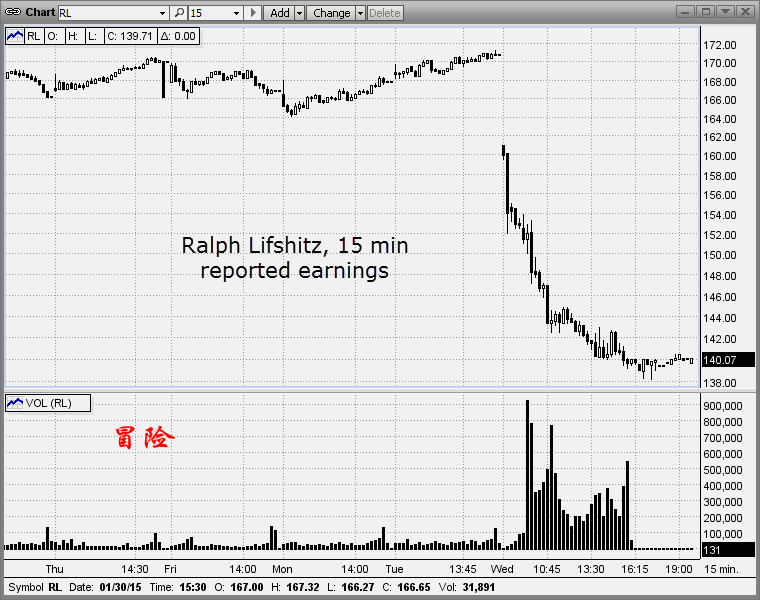

Charts of Note, Wed. Feb. 4, 2015

Four today: ADM, CTSH, FAST, RL, SNH.

Glu Mobile Pop, 1 Minute View

GLUU reported earnings after the bell but began to behave strangely just after 3 PM. It was possible to get long it at $3.71 with a $3.65 stop. Once again turned out to be better to carry it through earnings than try to be tricky and trade it and only make a dime.

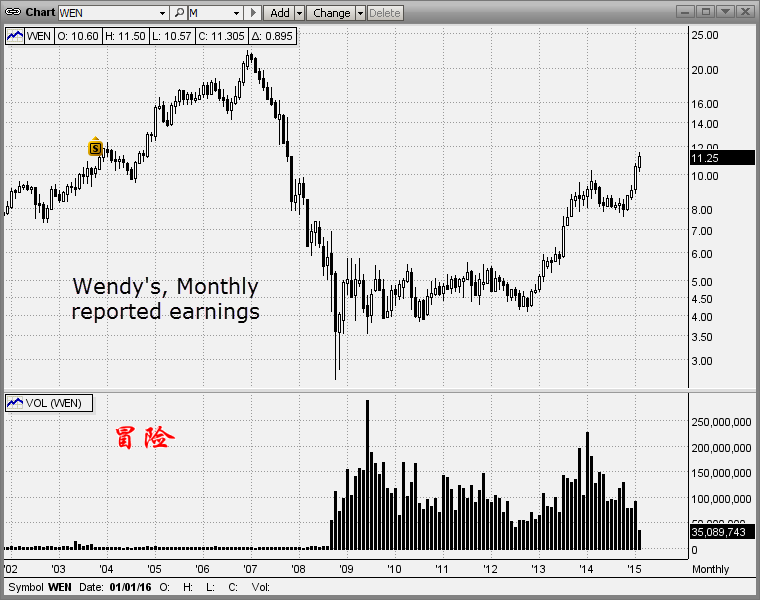

Wendy's Pop, 1 Minute View

Again, it would have been a very difficult play. Wasn't at my desk but I assume given the pre-market activity the scanner would have picked up on it ... it is Nasdaq listed though and a LOT of stuff moves at the open ... this was done by 9:38 AM, so...

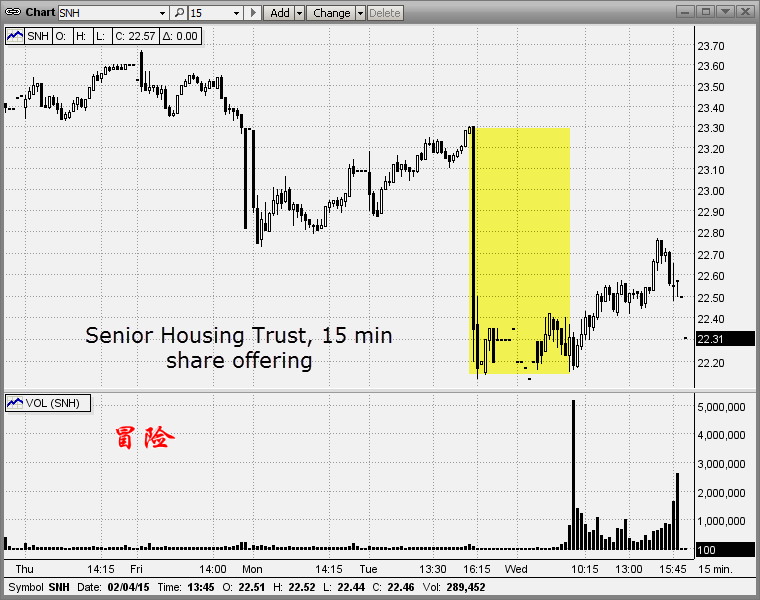

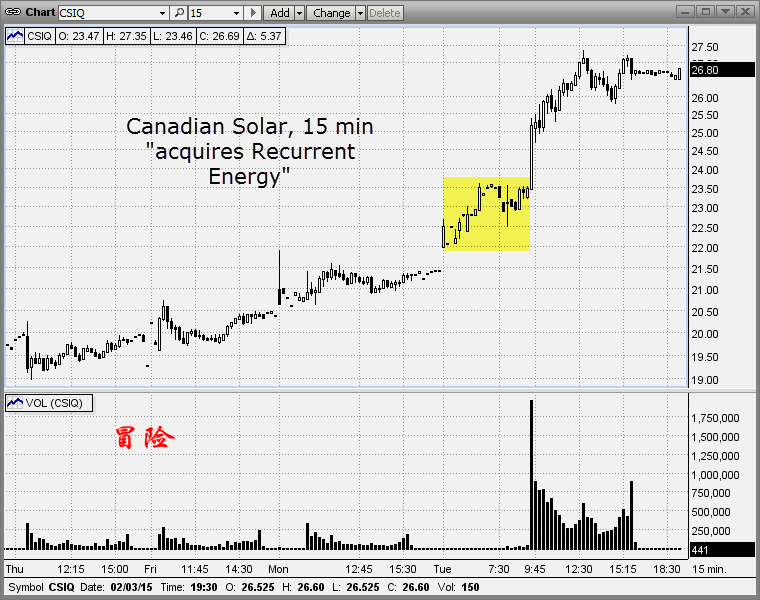

Charts of Note, Tue. Feb. 3, 2015

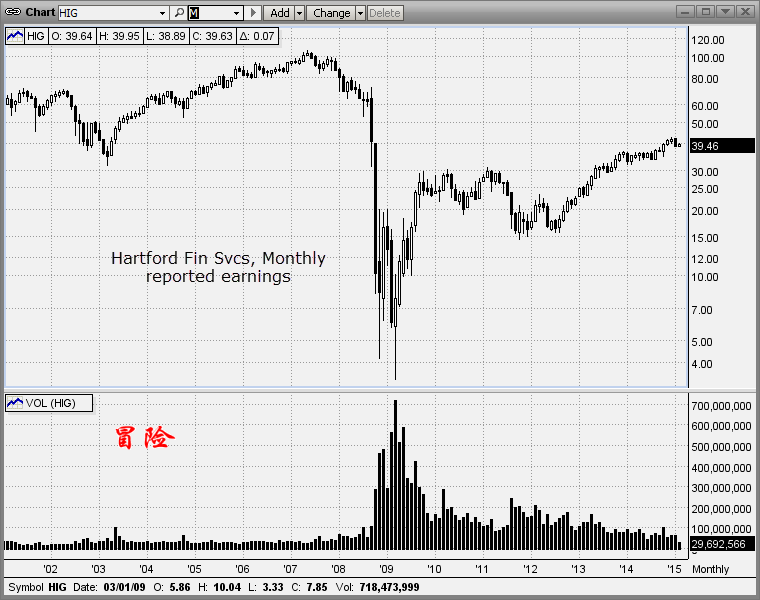

Five today: CSIQ, FTR, HIG, SSYS, WEN.

ETF Trading Portfolio Update -- February 2, 2015

Interestingly four out of five of the longs put on back on November 3, 2015 reversed together (all scratches, more or less) ... now again short the Dow, the S&P 500, Small Caps and Tech. We'll see if we get whipsawed out once again or if the timing of these shorts will stick.