Doesn't trade the close anymore

The close used to be his go-to time, but not anymore

Doesn't hold overnight

Biggest position on by 9:45 AM, trades around core until 11 AM, usually flat by noon

Things are mispriced in the morning, but fairly priced by noon

Forgets tickers shortly after he's done trading them

Aaron mentions Stan's CLRO trade from morning of recording

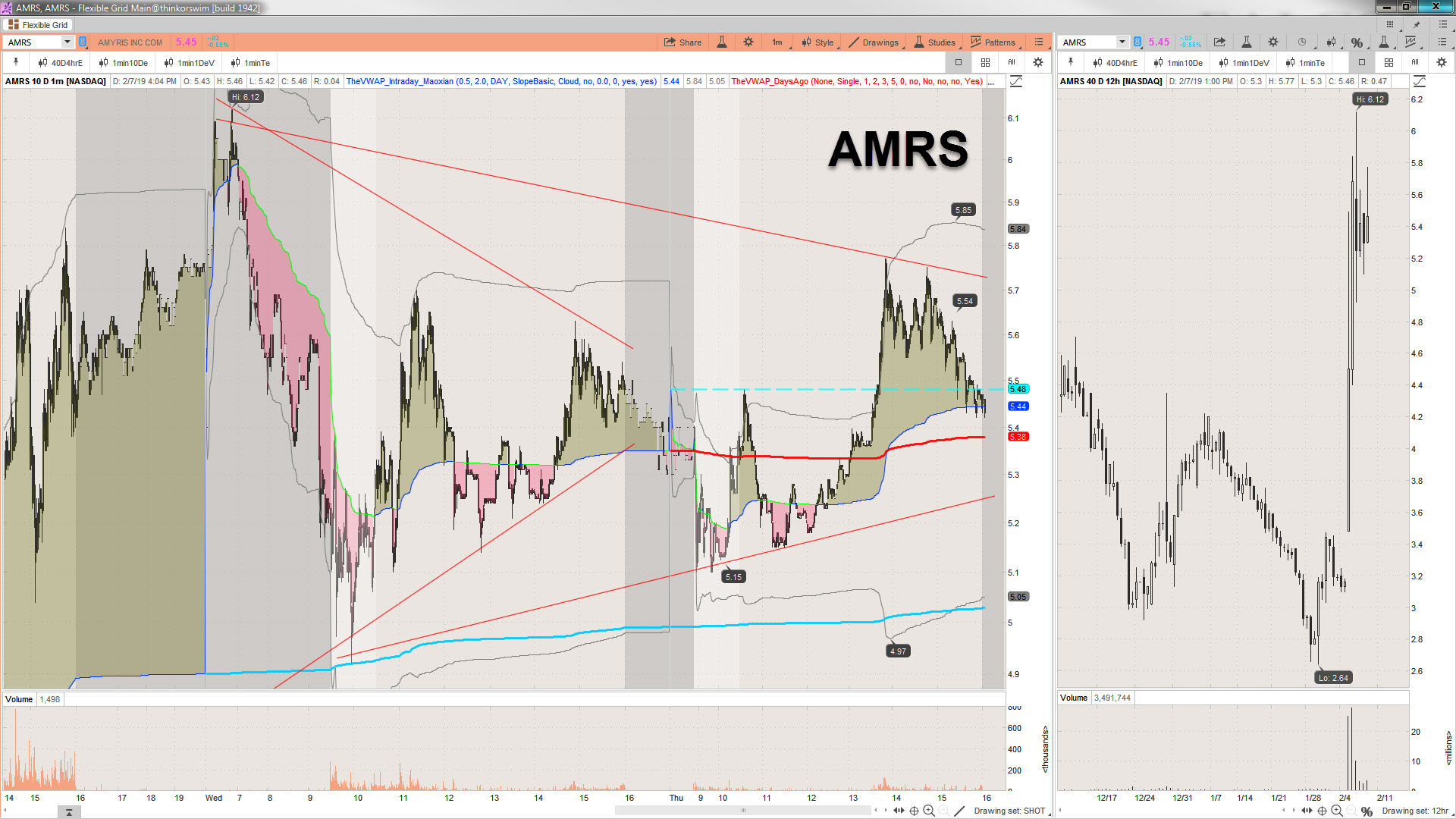

Looks at VWAP

Tries to short near top, covers half on washout, re-shorts the next pop, covers wash, etc.

All chat rooms watch the same stock, pump it multiple times throughout the day

Trading full-time 4.5 years, another 1.5 years part-time before then while in college

Started in 2013 when in college, made 30% on a $5 stock in two days, "bitten by the bug"

Started studying trading on his own while still in college, joined chat rooms, bought DVDs

Locked himself in his room and "started blowing up accounts" in 2014

Realized he needed to be surrounded by professionals, joined prop firm in 2015

Was a breakeven trader when he joined the prop firm, before accounting for commissions

Undercapitalized, so commissions made him a net loser despite breaking even on trades

At prop firm he first learned how to scalp for half a penny trading millions of shares

Read on a forum that a good prop firm doesn't take your money, no capital contribution

Seven Points Capital office right next to his college

Seven Points doesn't require capital contribution, charges no commissions

Seven Points wanted people who were teachable and passionate about trading

Advantage of being prop trader versus retail trader: "like working out in a high-end gym with a personal trainer versus working out in your backyard with buckets of water"

In prop you're trading other people's money, not your own, so no psychological pressure

Routes are important, has access to ten dark pools, six aggregators, plus all the exchanges

Have to figure out how to jump the queue by figuring out which dark pool is actually buying or selling

Has 150 (?!?) hot keys set up

Most used hot key, "F2" short the bid [I laughed]

Uses scroll wheel to select position size

Mike Katz was his first real mentor

Mike Katz always keeps his eyes open, in the right places at the right times, on his toes

Red two days in a row? Try to figure out the error

When losing money, he sizes down, divides his daily lockout dollar loss by four

Got his first paycheck five months in at Seven Points Capital, been sizing up ever since

2015 his first full profitable year

In 2016 he traded 260,000,000 shares, more than a million shares a day scalping [no commissions key?]

First time he lost $1,000 was a shock, but as he sized up, it became a regular sized hit, no longer hurt

In 2016 he would take advantage of inefficient algorithms, "short the offer, cover the mid"

In 2016, Sprint (S), Sirius (SIRI), Ford (F) were ticker symbols he'd trade: high volume, small range

Short the offer, saw offer was about to lift, would cover the offer or cover at the bid once it flipped up

96% success rate doing the kind of scalping, but that was 2016, can't do this anymore

Can gauge "Book Pressure" by watching the tape

Algos didn't care about book pressure, it would just execute at some regular interval

Could spot the algo because the same price and quantity was printing at a regular interval

Midpoint is price between bid and offer, there is "invisible" liquidity there, "peg to midpoint"

BYX is his preferred route for the midpoint

"Can't get the bid, go for the mid"

Crappy little penny stocks are volatile and retail-driven, small order sizes, not scalpable with size

Switched from scalping stocks like Sprint to scalping SSR (short sale restriction) stocks

Using his superior routing skills, he could short SSR stocks at the mid as they fell

Most people are at the offer or the bid, they don't even know about the mid

Gives example from his SSR trading that day: one gain was five cents, other gain was 35 cents -- "scalpy"

SSR strategy just a tool in his toolbox now, the edge has sort of disappeared

Small-cap stocks gap up and fail, a "fader" [no mention of locate fees, alas]

Small caps are volatile, full of dumb money: newbies plus true believers

Also trades big cap stocks on earnings days

Small cap stocks gap up for a lot of reasons, usually a press release

Uses gap scanner, filters by float and market cap, less than 100 million share float, usually under 20 million

Uses multiple entries and multiple exits ... this is the secret to his success

Takes 1/4 position at point he thinks is the top, if wrong he just loses 1/4; if he's right, he adds as it falls

Scalps half his position and holds half for the all day fade

If he thinks he's right, and a big bid appears, he'll smash the bid

You'll never pick the top or the bottom, you always have to scale in and out

Give yourself room to be right

If stock drops sharply, will take off a quarter, drops sharply again, will take off another quarter

After every sharp drop he covers, then re-shorts the bounce if it happens

Has a set risk amount on every trade that he's willing to lose

When he doesn't follow that set risk amount, "gets stubborn," he takes his biggest losses

"Do you want to make money, or do you want to be right?"

Tracks performance of his setups: size of float, size of gap, time of topping out, pre-market volume, etc.

Has created "money box" ranges where he expects stocks to top out or bottom out

Visualizes the "money box" on his charts

Learned how to code to create the "money box" visual indicator on his charts

Stocks that continue to squeeze up are outliers

Tries to line up fundamental reasons, tape reading, basic technical analysis, on every position

Learned about volume forecasting from AllDayFaders

Idea is to forecast volume to predict if price will fade or squeeze during the day

Unusual demand leads to squeezes

Stan doesn't want to get a job, so he trades for a living [chuckling]

June 2018 he had a red month, it was rough, he pulled a lot of all-nighters

Learned a ton from JTrader, who helped him get through June slump

Mike Mangieri encouraged him, had his back despite the losses

NYC is expensive and the weather isn't great, so he left for Florida (also taxes too high in NY)

Set up Ft. Lauderdale office with Krishna Joshi

Has three other traders on the desk in Ft. Lauderdale, plus one studying for his license

New traders shadow him for a couple of weeks, can figure things out more quickly that way

Records his screen every day, posts it to group intranet so colleagues can study

Eliminate mistakes, don't repeat the same mistakes

Being fearful when entering a trade is a mistake to be worked on

Sized up in 2018 and wasn't as consistent as 2017

Goal for 2019 is to find balance between taking full-size positions and not shooting for home runs (holding too long)

Added many new setups to his toolbox in 2018

"If the market changes, I will adapt."

Twitter: @ciocanatrader