Andy Fairweather Low still crowing 50 years on ... great song, esp. for those who rely on the bottle to get through the night.

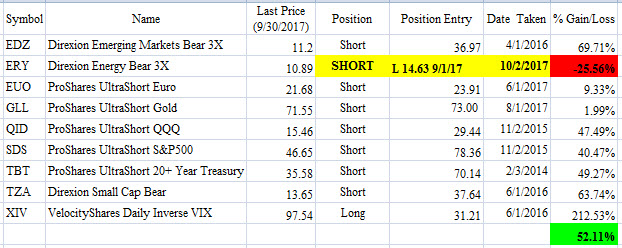

ETF Trading Portfolio Update -- End of September 2017

Getting short the Energies (long the bear fund) at the beginning of September was perfectly bad timing, and I will take a big loss first thing tomorrow morning (Oct. 2). Will my reversal long (short the bear fund) also be perfectly wrong? Time will tell....

Dirty Dozen, Long Only Portfolio, End of September 2017

One change this month, getting long Amgen (AMGN) tomorrow (Oct. 2). Why sell it at $139 last November only to buy back at $186 this October? Good question ... and the reason why buy and hold (and forget about it) is so compelling. But look at the exits on Chipotle and Gilead and Starbucks and Twitter ... I don't always get it so wrong.

Movies Watched -- Hell or High Water

102 minute running time. [SPOILERS]

Inexplicably has a 96% Fresh rating from "Top Critics" at Rotten Tomatoes, which caused me to borrow it from the local Redbox, to my chagrin. Mumble, mumble, couldn't understand half the dialogue and for some reason the subtitles were disabled on my disc.

Has a weird No Country For Old Men copycat vibe (that was a *great* movie), but it just doesn't work. Jeff Bridges plays Tommy Lee Jones, but he's mumbling worse than ever, even worse than his Texas Marshal role in True Grit. He has a half-Mexican, half-Injun partner whom he insults endlessly ... don't worry, the "half-breed" has his head blown off in the end.

Two scrawny brothers ... old Ma dies with family ranch in hock to EVIL banksters and back taxes ... one brother recently released after a ten year stretch in jail (though not for killin' his Pa) ... non-felon brother gets the bright idea to start robbin' banks across west Texas to pay off them EVIL banksters and the gubmint, and dumb criminal brother is game.

Scenes of these desolate, shitty towns and FAST CASH billboards (hint hint) ... oh, and the movie starts off with graffiti on the side of a house that says, "Three tours in I-raq but no bailout for folks like me," or something along those lines. Ya know, subtle.

Badly done poker scene where criminal brother splashes the pot with a bet -- I winced. And you can't exchange more than X dollars at the casino without having your tax ID attached to it.

They keep burying cars that are worth more than the bank drawer cash they're stealin', but I guess they're stolen cars. Old Jeff Bridges mumbling and stumbling after them across the vast expanse of west Texas. Jeff will forever be The Dude, he isn't going to shake that no matter how much he mumbles and stumbles.

Surly ex-wife of the non-felon brother, ya know, once a purty girl but run-down by her shitty life ... it isn't clear what he's done to earn such derision from his ex- and boys (one, a fatty with glasses, only get a glimpse of him at the end) ... maybe it was explained and I didn't hear it (possible), but I doubt it. Did I mention that this brother is a dead ringer for Josh Brolin's kid brother?

Dumbest part of all is there's Crude Earl or Natty under the ranch, and old Ma could've leased it to Chevron decades ago and been pumpin' out $50,000 worth every month since then ... but nah, scrawny cows were the way to go. And the boys couldn't have done the lease at any time before her death, just cuz.

Ends with Bridges and Brolin's little brother exchanging mumbled threats across a bare lawn, pfffffft. Only saving grace here is the movie stopped short of the sacred 100 minute mark.

Ah, I see now that the kid who wrote it also did Sicario, which I didn't like either.

There were some funny bits, and some clever bits of dialogue in the little I could understand, but damn, this movie is NOT recommended. Let me go find some critics who agree and paste their stuff below ... only able to find ONE! Crazy, what a bunch of hacks.

Peter Sobczynski: "it's somewhat less than the sum of its parts ... [the writer] appears to have elected to raid the Cormac McCarthy playbook in order to employ the celebrated author’s sparse and laconic tone wherever possible ... it tries so hard to emulate the likes of 'No Country for Old Men' at times that you can feel it practically straining from the effort without quite pulling it off" ... and the key paragraph in its entirety, with which I agree:

"It’s frustrating that 'Hell or High Water' contains so many good things that just don’t coalesce into a fully satisfying moviegoing experience [He means movie but needed more syllables]. The story as a whole is a little too derivative for its own good and not even the strong elements are quite able to compensate for that. Of course, seeing as how even vaguely competent films have been so few and far between as of late, some viewers may be a little more willing to overlook its flaws—to wildly paraphrase one of the key lines from 'No Country for Old Men,' 'If it ain’t a good movie, it’ll do till the good movie gets here.' [SAD] If only it had spent a little more time trying to find its own voice and a little less overtly trying to ape the styles of its influences, 'Hell or High Water' might have been as good of a movie as it wishes it was."

Notes for Chat with Traders, Episode 63

Episode 63 ... Nicola Duke (44:00)

- Has a posh? British accent [I'm no judge of accents]

- Mom gave her money when in her teens and she bought stocks

- Joined the Royal Air Force

- Later worked as air traffic controller at Heathrow

- Chemical Bank did experiment training air traffic controllers as traders, before her time

- Working in Toronto, running a company

- Boyfriend gave her a copy of Victor Sperandeo's book, she thought, "I can do this"

- Trading FX from Toronto, not getting much sleep

- Sold company and went full time trading FX

- Air traffic controllers feel they're always minutes away from disaster

- Trading is similar, you're often uncomfortable

- Must learn to be comfortable with being uncomfortable

- Joined a live trading room, learned a lot

- Doesn't believe people should trade alone, should at least have a mentor

- Blew out first account ($10,000) within a month after being "the queen of paper trading"

- Got a mentor who helped her with discipline

- Got through her first year flat, mentor said "this proves that you can make it"

- Bad days where you stick to your rules are good days -- treat yourself!

- Mentor was friend of Tom Dante's ... met in a forum

- Mentor taught her how to take emotion out when you win or lose

- She's an introvert, doesn't like shouting

- Mentor never gave her a single trade idea or set-up ... just worked on her mental game

- In Toronto she would trade London open (2 AM her time), no social life for two years

- Trading knocks keep you from getting full of yourself

- 2008 lots of money to be made, went full time

- Got lucky to sell her travel? business before the crash

- Swing trader using Fibonacci levels for entries / exits

- Uses Heiken-Ashi charts and moving averages as triggers

- Looks at 36 markets every day

- Scans weekly and daily charts

- Average trade lasts a couple of days in 2016

- In 2015 she would hold trades for two or three weeks

- Volatile markets hard to trade as a discretionary trader -- too much emotion

- Rules-based triggers, targets, stop adjustment ... all systematic now, no discretion

- Won't move a stop until price has made a new high or low

- Looks at closing prices only, close below a 50-period MA would instantly get her out

- Has lots of "time of day" rules

- Don't spend mental capital in an "offside position" for too long, use a time stop

- Don't be patient with losers -- they don't just cost money, but "mental capital"

- Only risks 3% of her capital at any one time

- Avoids news events

- Looks at monthly, weekly, daily charts

- Finds entries on intraday chart

- Planning is everything

- Looks at Fibonacci patterns, measured moves ... marks all the levels on the chart

- Levels of confluence, high probability of reversal (or support)

- People who can make a plan and stick to it can be good traders

- Trading is really hard work, not a hobby, don't treat it that way

- She is not competitive, you're only accountable to yourself, be better than you were yesterday

- Compete with yourself, cooperate with others

- When she sees squeezes, she feels that "us versus them" thing, but fleetingly

- People fail because they can't lose money well -- it's all about mindset

- Trading is the hardest simple thing to do

- Everyone she follows or re-tweets on Twitter is awesome

- She uses:

- CQG for charts (expensive, over GBP1000 a month),

- TTX Trader to execute,

- started off on MetaTrader 4

- Twitter: @NicTrades

Have Pity On Those Whose Chances Grow Thinner

A live version of the Chambers Brothers covering Curtis Mayfield's great song, "People Get Ready."

No More Yellow Clover

Completely unintelligible lyrics but I dig the sound ... I heard Kacy & Clayton interviewed, they come across like nitwit inbreds from backwoods Canada, but I love that retro-folk sound.

Notes for Chat with Traders, Episode 29

Episode 29 ... Brian Shannon (63:13)

- As a kid, watched Wall Street Week with his doctor Dad on Friday nights

- Made money as a kid from caddying and delivering newspapers

- First stock he ever bought was LoJack, made $6,000, hooked him for life, "why work?"

- Grew up in Massachusetts?

- First job after college as a stockbroker

- Passed Series 7, realized job was glorified telemarketer

- Went to Lehman Brothers next and learned how to sell

- Learned how markets worked using other people's money

- Read the Cabot Market Letter, idea was buying above levels of resistance

- Read Investors Business Daily, saw prop firm ad that offered 20:1 leverage

- Made $25,000 deposit with this prop firm

- Excited with his 48K baud modem trading from his home's basement for the firm

- Opened office for this NYC-based prop firm in Denver

- Prop firm made money from commissions

- People are their own worst enemies in the market

- Still astounded by dumb decisions he makes even today

- Chantal Pharmaceuticals, miracle skin cream, stock got halted after hit piece in Barron's

- Lost $8-$12K overnight in Chantal Pharma ... one lesson he learned along the way, position with too much size

- In 2000, 2001 market was getting crushed and he was losing pretty consistently, thought about quitting

- Slowed things down, reduced size dramatically, ground his way back

- His first six or seven months, he was profitable every month, then he got cocky

- Trading is an evolution, you always come back to the basic principles

- "Only price pays. Follow the trend" -- these are his catchphrases

- Hold yourself accountable, don't blame other things, only yourself

- Uses multiple time frames

- Swing trading his preferred time frame

- Looks at direction of 50-day moving average: uptrend or downtrend

- Looks for volatility contraction, diminished volume, pullbacks to "support" on daily chart

- Drops to 30-minute chart next, looks at 5-day moving average on 30-min chart

- Distance from entry to his initial protective stop, distance to perceived targets measured -- figures his risk : reward

- Drops to 10-minute chart, looks for an entry that makes sense given all of the above analysis

- Don't gamble on earnings plays

- Accountants lie, CEOs lie, only price pays

- Ego and the need to be right clouds your judgment

- Fan of using Volume Weighted Average Price -- VWAP -- esp. since some specific event (e.g., the IPO date)

- Been looking at VWAP for 12 or 13 years

- Stumbled across VWAP, it spoke to him ... now becoming more widely used by retail traders

- Stan Weinstein's book, Secrets For Profiting in Bull and Bear Markets, had a huge influence on him

- "If they don't scare you out, they'll wear you out"

- Traders tend to be ADD looking for action

- Time frame must suit your personality ... how much time, capital, and experience do you have?

- Never start off by day trading, that's something you evolve to, or devolve to [chuckling]

- Start off with a longer term horizon, like swing trading

- Swing traders should make more money than day traders

- Trading is extremely difficult ... anyone who says it's easy is lying ... misleading you for nefarious reasons

- You need a lot of capital to start

- People get impatient, make big mistakes before they learn who they are

- First master yourself (understand yourself and which time frame suits you)

- Brian says some nice things to Aaron in parting ... Aaron not as polished in these early episodes

- www.alphatrends.net

- His book: Technical Analysis Using Multiple Timeframes

- Twitter: @alphatrends

Notes for Chat with Traders, Episode 66

Episode 66 ... Dan Shapiro (66:25)

- Return guest (Episode 32)

- First started looking at charts in 2003

- Fast talker, native New Yorker? ... sounds remarkably like Joe Fahmy

- Looks at 60 minute charts exclusively

- Social media the best and worst thing for new traders

- Most new day traders obsess over the one minute chart

- Uneducated, underfunded, no-process bungee jumpers are down on the one minute chart

- "Barry Sanders Effect" -- getting stopped for two yards twenty times a day -->

- Instead you should wait for a hole to open up, run 60 yards

- Most stocks are not tradable

- Get rid of the social media noise

- He's "not the sharpest tool in the shed" [sounds pretty sharp to me]

- He's been trading since 1999, has a lot of screen time

- Netflix and Tesla his two favorite stocks

- Hasn't updated his eSignal in at least a decade

- His charts are covered with squiggly lines: moving averages, Bollinger Bands, linear regression lines

- You need to know where the bodies are buried (areas of supply)

- Most traders don't know what they're being patient for

- [Likes to use football analogies]

- Stocks go from supply to supply (areas of support / resistance)

- FANG (Facebook, Apple, (Amazon?), Netflix, Google) names are market sensitive -- is Netflix weak when the market is strong? Why?

- Don't win the day, win the intervals of the chart

- Is the trade worth it? Distance from one zone to the next large enough?

- FANG stocks have great range and volume ... tradable [i.e., Usual Suspects]

- Six years ago started doing live webinars

- Looks through 500 daily charts every night, finds things "coming out of a range"

- Writes down six to ten ideas every day

- He'd rather drink cyanide than trade the pre-market highs and lows lists

- Everybody wants to drive that fast car, but new drivers should drive slowly

- Newborn babies don't come out of the womb running

- How many horror stories are there of people shorting a pre-market screamer ("Flying Pig") and busting out

- Trading should be boring

- Watching six candles a day (60 minute charts) forces you to be patient

- Doesn't want to be fighting a guy with a $2,000 account who is getting stopped out every two minutes

- Traders have to be humble but also killers, willing to take food out of some other guy's kids' mouths

- Don't turn a paper cut into a severed head

- [He's a fun guy, fast talker, should be in sales, maybe he was, maybe he still is]

- During monthly review, looks hardest at his losing days

- "Don't trade like a putz" -- spot those days you were trading like a putz

- "Ish happens" [instead of "shit happens" ... a Yiddish thing?]

- Advice to new traders: don't be undercapitalized (and max risk should be 1% of account)

- Trades only have three parts: process [method], tier size [risk management], result [trade management]

- Don't risk $1000 to make $300

- "Let me give you the reality"

- Prop firms used to make so much money from commissions, they didn't care about how much risk people were taking

- Only four or five major players left in the prop business ... it's dead

- Game has completely changed -- no money left in commissions

- The money isn't in commissions anymore, it's in "education"

- Prop firms won't give you any capital now, won't let you trade any more than 100 share lots

- Offshore prop firms are bookies

- Avoiding "Pattern Day Trader" rule by going offshore to a "bookie" broker a bad idea

- What's a good amount of money to start trading: A LOT

- "You, my friend, are a commodity"

- If you're doing millions of shares a month, you can negotiate a very low commission rate

- "You are the rising star ... invest in youself."

- Peter Luger doesn't serve his steaks on paper plates

- You need screen time to learn what NOT to do, not what to do [yes, indeed]

- Borrowed money from a loan shark to get his start [I'd like to hear more about this]

- In 2003 he was at Spectrum Securities, bought out by Schonfeld Securities, met Dan Mirkin then

- In 2003 he started using Trade-Ideas [should have Dan Mirkin on the show]

- Trade-Ideas still cheap at $500 a month [it isn't that much]

- He doesn't upgrade anything he uses, 2003 version of Trade-Ideas, ancient version of eSignal

- Turned profitable after 2003, a coincidence with Trade-Ideas adoption?

- Many years of desperate trial and error before he found success

- Has no need to show off, hates the social media circus

- You need to put in the time to learn how to trade ... people will doubt you and you will doubt yourself, but don't give up

- "Some random avatar isn't a superstar, you are the superstar"

- How does he have this level of energy? Lots of cocaine [he's a funny guy]

- www.accessatrader.com

- Twitter: danshep55

ETF Trading Portfolio Update -- End of August 2017

One change to the portfolio ... covered the Energy (ERY) short from May 2016 and got long on September 1. Getting short gold at the beginning of August appears to be a well-timed move (so far).

Dirty Dozen, Long Only Portfolio, End of August 2017

No changes this month ... still the seven longs in place: two from 2015 (Amazon and NVIDIA), three from 2016 (Apple, Google, and Netflix), and two from 2017 (Facebook and Tesla).

You Were Sweet To Offer Your Hand

Lots of recordings of this great song, but I like Helen Merrill's version best (with Clifford Brown on trumpet). She comes closest to capturing the crazy ex-lover thing ... the sort of shriek at 1:30, amazing stuff. No hugs, I understand.

Notes for Chat with Traders, Episode 11

Episode 11 ... Zach Hurwitz (123:31)

- 10 AM to Noon, no calls, no appointments for Zach

- Tufts, class of 2008, transitioned from English major to Econ major

- Started trading during a volatile time

- 2008, 2009, 2010 ... algos began impacting the markets

- Retail guys need both screen time and coding time

- Lost all his initial trading stake in six weeks in 2008

- Had a visceral connection with chart patterns

- Two classes that helped him with trading: AP English and Drama

- In 2010 introduced to quant trader, "David," randomly met

- Lives in Ohio, middle of nowhere, just got lucky meeting "David"

- His analyst says "trust the process" [Zach goes to psychotherapy?]

- [Zach tends to ramble on at length, but he's likable....]

- David tip: some days you have to be the mouse (detail oriented), some days the eagle (visionary), some days the donkey (do grunt work)

- No trader wants to admit he's a beginner

- Non-traders think day trading is glamorous, but they're wrong

- Trading is "quiet, lonely struggle ... and it's hard" [I like it]

- Poisonous self-talk during dark hours of trading

- A trader is the boss, the employee and the janitor, all in one

- Have to learn to identify when you are being ridiculous

- You can't learn to trade if you can't spend 40 hours a week on it

- Risk management, position sizing ... these can be learned

- Trading psychology, controlling yourself, is the thing you can't really learn

- Step one is being honest with yourself

- A trading coach is not a cheerleader

- We are in charge of deceiving ourselves

- Spending 20 hours a day six days a week to make $40K (40% on 100K), you feel like a jerk

- VWAP is his holy grail, the thing that made sense to him, would have quit in 2011 if he hadn't found it

- Zach is 28 years old now

- Zerohedge and Brian Shannon of Alphatrends turned him on to VWAP

- VWAP was available on the ThinkOrSwim platform so he could explore it

- VWAP -- Volume Weighted Average Price ... like the ultimate "moving average"

- VWAP originally built to benchmark execution quality

- All indicators are arbitrary

- ["Let me go off on a little tangent here...."]

- Chat with Traders podcast is a killer resource

- It's easier to learn from watching a developing athlete, not a pro

- Good traders like good athletes, they make it look easy

- VWAP looks like a moving average and acts like a pivot

- VWAP responsive in a morning, dull in middle of the day, then picks up again at end of day (because it's volume weighted :) )

- VWAP gives you your bias for the day

- ["Forgive me for the meandering and tangentials..."]

- VWAP will lead you to trade the most liquid names

- People who want to trade stocks "in play" should be slapped in the face [who, moi?]

- Mentions Mitch Hedberg ... Zach sounds a bit like a non-stoned Mitch, no?

- Most people fly around as an eagle, spend a minute as a mouse, and never get around to being the donkey

- VWAP best for intraday, mega-cap traders

- Zach is now a systematic trade, no longer discretionary

- Trading is lonely and difficult, it's invaluable to have a trading comrade

- ["I'll turn this into a four hour podcast!"]

- Not much good, free VWAP information out there ... not many people using it every day

- Brian Shannon is excellent, a wonderful educator, and a nice guy

- Zach uses ThinkOrSwim, likes it, but is not paid for referrals ... just use the demo account

- Your family and friends will think you are just playing video games, but day trading is incredibly hard, needs to be respected

- "You're clicking buttons just like every other schmo out there"

- Most people don't pay attention -- they don't pay attention to others, themselves or the market

- Give up on your unrealistic dreams of the Bugatti ... focus on your realistic dreams

- Stop worrying about where you enter a trade, just get in if you think it's going higher

- He uses shorter term 14 period RSI in conjunction with VWAP, but only for confirmation

- You want a consistent approach

- You want to take what you know works, and have it put into code

- finviz dot com has a good filter ... start there

- ThinkOrSwim has great beginning coding language

- If an English major like him can learn to code, so can you

- Ten years ago you'd have to know MatLab, not so today, barriers to entry have fallen

- If you think everything is going to fall into your lap, you're going to blow up

- Failing traders have not mastered even one thing, they bounce around

- Trading is a predatory business ... you're a baby duckling and there are hawks out there

- Find earnest, honest, real people to talk to about trading [I know of one or two on Twitter]

- You don't want to be a jack of all trades, master of none

- "If you want to be here for the good days, you have to be here for all the days" -- Ben Lichtenstein

- Discretionary traders are all bald ... they drive themselves crazy

- Recommends Reminiscences of a Stock Operator, all the Market Wizards books

- "I'm not just trying to blow smoke up your skirt" [when singing Aaron's praises]

- Make your eagle vision a reality by being the mouse and donkey

- Are you life-changing rich by quadrupling your account? No, so stop trying to do that

- Lower the stakes for yourself !

- Nobody is your overseer as a trader ... you have to control yourself

- More traders collapse mentally than financially

- "You choose your tuition in the market"

- When you don't feel bad about losing trades, you've won

- Don't make it harder on yourself than it has to be

- ["Thank you for indulging my meandering ... babbling for two hours"]

- Twitter: @ZachHurwitz

Like Workin' Without No Pay

The great Melvin Taylor ...

Take a Dive Off River Street

I'm a sucker for this kind of harmonizing, but these pretty white brothers have a great sound ... a dark song for sure, but only if you listen to the lyrics:

She Knows Who and What's To Blame

One of the greatest smoker's voices of all time, Lee Hazlewood .. the second song is no good, but She Comes Running is a classic.

Notes for Chat with Traders, Episode 58

Episode 58 ... Paul Singh (54:01)

- Started trading in college

- 40 years old now

- Went to law school in 1990s

- Took $5,000 to $200,000 during dot com boom

- Worst time to learn how to trade since you could just blindly buy and make money

- $200,000 went to zero in the dot com bust

- Blew up another $5,000 account a little later

- Third attempt in 2004, 2005 with $5,000 ... things started to click, he got more serious

- Have to persevere ... helps if you love it ... never give up

- Working as a lawyer then

- Commodities boom next to play ... recognized it from dot com boom experience

- 2011 started trading full time, stopped lawyering

- Waited until he had enough money, patiently built a large stake, before he went full time

- His wife works, she has a good job, they had a lot of savings, good safety net

- Needed mid six figures as trading stake to be comfortable going full time

- Biggest mistake people make is trying to trade without a proper trading stake

- Don't give up your paycheck until you have built a significant trading stake

- Can never be worried about daily expenses when you're trading

- Take the amount you think you need to be comfortable trading full time and double it

- Trading full time is boring, esp. swing trading (holding several days to several months)

- Have to prevent yourself from "filling your day" by watching every tick

- Swing trading all about after-hours homework, market hours just about executing the trade

- Trading is more than stock picking

- Three parts to trading:

- Stock picking the least important part,

- Risk management, which is fairly easy,

- Trade management, which is the hard part

- Risk management is understanding probability and risk versus reward

- Trade management separates winning and losing traders -- the psychological game

- Trade management is where you need to work really hard, controlling emotions

- Lightbulb moment: doesn't matter what stock you pick, with proper risk and trade management, can be profitable

- Has basket of 10 to 15 set-ups he trades regularly

- Pays close attention to money flow across broad market and sectors

- Doesn't have a favorite set-up

- Whatever is working today is his favorite set-up, have to be adaptable

- Set-ups stop working

- Breakouts, breakout-pullbacks, moving averages, re-mounts -- fall in and out of usefulness

- He exclusively trades stocks -- have to master one domain

- Used to do options, futures, etc. but has dropped all that ... just stocks now

- Hated to have to trade around the clock ... likes defined hours of stocks

- Got interested in pre-market trading

- The more experience you have, the fewer indicators you use

- Experts learn to simplify, tune things out

- New painters paint lots of lines ... not true of experienced painters

- "Set it and forget it" -- don't micromanage positions

- Don't watch every tick, don't switch up timeframes and see "new" things

- Day trading gets his mind off his swing trading

- Easier to part-time swing trade than full-time swing trade since mind occupied elsewhere

- Taking a quick profit is human nature, hardwired, but the antithesis of good trading

- You can't be a successful trader with 1:1 risk reward

- First thing he does is a market analysis, looking for market leaders

- Focuses on money flows across sectors

- Builds watchlist of 50-150 stocks to stalk

- Tries to narrow it down to 5-15 stocks in the evening or morning

- Then writes a plan for each stock: entry range, stop range, target range -- in Evernote

- Sizes positons based on those levels in advance

- Doing position sizing in advance makes it so he has no anxiety, just pulls trigger given plan

- Common mistake traders make is not taking into account the natural volatility of a stock

- [They set their stops too tight]

- Bad idea to place stops at obvious support and resistance, everyone is there ... it will be run

- Take smaller position to be able to hold through stop gunning, then add once the stop gunning has passed

- Used to look at ATR and volatility measures for stop placement, but now just eyeballs it

- Pattern recognition comes after time, have to put in the hours

- "John Tudor Jones" ;-)

- His wife can't tell if he's had a winning or losing day [she must be an angel]

- People have goals without a plan

- Focus on one thing and master it

- Gets up at 4AM (lives on west coast)

- Does a detailed monthly review of his trades

- www.bullsonwallstreet.com

- themarketspeculator.blogspot.com

- www.pauljsingh.com

- Twitter: @PaulJSingh

Notes for Chat with Traders, Episode 126

Episode 126 ... "Jonathan" (69:55)

- Division 1 baseball scholarship to college in Louisiana

- Got injured (hurt back), professional baseball career not possible

- Lost scholarship, didn't know if he could stay in school

- Back still nags him today

- Uncle was a Wall Street guy, worked for Shearson Lehman

- Uncle had a nice house, nice car, nice boat ... that attracted him

- Had friends who had moved to NYC ... visited ... loved it, moved there, age 20

- Spent a lot of time in the New York Public Library trying to educate himself

- Did odd jobs, but had some savings

- Read the Jack Schwager Market Wizards books at library

- Met a guy (won't name names) in 2004 through family friends who had worked for Steve Cohen, retired at age 35, working from home

- Guy took him under his wing, acted as mentor

- Jonathan sat with him at his trading desk, for over a year he did this

- Mentor from India, born poor, but he made it big in America ... saw Jonathan's passion, competitive drive

- At first Jonathan was incredibly intimidated

- Mentor traded futures, 250 contracts at a clip

- Mentor did stat arb ... a quant

- Mentor taught Jonathan to be open minded, you can learn something new every day

- Jonathan's first account was $10,000, piggybacked off of the mentor's trades, did well

- Mentor wanted Jonathan to finish his college degree, so he moved home to Dallas and got degree in economics / quantitative finance

- Mentor discouraged him from going to a prop firm, get a degree instead, work for a hedge fund

- Many prop firms in New York City were Churn and Burn outfits

- Took out student loans and used money to trade futures and lost all of it ($35,000)

- Traded too big with his student loan money and blew up

- Most people who blow up, quit, but not him

- Sent resume out blind to many hedge funds ... 92 hedge funds ... got three interviews

- Paradigm Capital in Ft. Worth hired him as intern

- Thought he blew the interview, lots of tough math questions

- What is 24 times 86? He froze up, started sweating, took him five to seven minutes to answer

- Paradigm traded credit default swaps, he knew nothing about them

- Promoted from intern to assistant trader to trader to head trader, within six months (in 2008)

- Paradigm did well between 2008 and 2013 ... all discretionary, no modeling

- Learned MatLab, started building models, also used Bloomberg Terminal to build stuff

- European sovereign credit crisis was a great opportunity, worked 3AM to 6PM, seven days a week

- Paradigm was $5BB at its biggest, trading book had $3BB ... [not a garage band hedge fund]

- When he joined it was $2BB

- Left Paradigm in 2013 ... he had made partner, had equity in the fund, started butting heads with the boss

- "The bacon is all in the year-end bonus."

- He took equity in the fund instead of a year-end bonus

- European regulators "banned" speculation in European CDS ... liquidity vanished

- Wife encouraged him to quit, trade from home [she must be an angel]

- Started trading 2014 on his own with $250,000 ... all discretionary trading

- Made $60K in first month, thought this is easy!

- Lost $80K in second month, oops, needed to create a systematic approach

- Didn't have Bloomberg Terminal at home

- Taught himself "R" language and built a system, sort of a hybrid, still uses some discretion

- Still executes all trades manually

- Mentor recommended Market Delta platform

- Found patterns in the data ... uses Volume Profile, spots order flow stuck at extremes

- Not a fan of derivatives of price (moving averages, lagging indicators)

- Fan of re-tests ... people stuck getting out at "breakeven," easy to see on Footprint charts

- Numbers don't lie, your eyeballing stuff lies

- Brains are pattern recognition machines, sees patterns everywhere

- Have to teach your system "market context"

- Found his entries and exits better when he does it manually

- Patient, he always waits for a signal

- But there are times he gets a signal and ignores it

- He only trades E-mini (ES) futures and crude oil (CL) futures ... most liquid markets

- Doesn't like headline risk of trading FX

- Specializing in one market is a great thing, just need to master one

- Has six monitors in home office

- Don't complicate things, keep your approach simple

- He knows nothing about candlesticks and MACD and stochastics, etc.

- Trading isn't rocket science

- Given his results, has been approached by people about starting a hedge fund, but he has no interest

- Too many regulations to start a hedge fund ... just a headache

- Wife encouraged him to get Twitter account [she must be an angel]

- Twitter: @HF_Trader

Notes for Chat with Traders, Episode 129

Episode 129 ... Victor Haghani (42:49)

- Father was a goods trader (Sephardic Jew born in Iran?)

- Went to University in London (LSE)

- His dad said go for the less bureaucratic firm (why he chose Salomon over JP Morgan)

- John Merriwether asked him to become a trader, government bonds arb desk

- Youngest trader on the desk

- He had been in fixed income research at Salomon Brothers

- Merriwether left Salomon in 1992, Haghani left in late 1992 ... founded LTCM

- Started LTCM's London office

- Worked for 13 bank consortium after LTCM failed in 1998 ... helped liquidate portfolio

- JWM Partners hedge fund ... also helped start that

- Founded Elm Partners five years ago ... "active index investing"

- Lowenstein's "When Genius Failed" -- a good read, but not 100% accurate

- Dunbar's book is also OK

- Buy the Harvard Business School case studies on LTCM, by Andre Perold

- We're a product of our experiences

- Haghani wrote paper on biased coin flip

- Gave 61 subjects (financial professionals) $25, coin biased 60% heads, could keep whatever they made after 30 minutes of flipping, capped at $250

- [Sounds similar to Van Tharp's old experiment that he has given hundreds of times]

- [Van Tharp gave subjects bag of ten marbles: Seven 1R losers, one 5R loser, two 10R winners. Subjects got 40 marble pulls and a $100,000 bankroll. Expectancy is 0.8R (positive) but most people end up broke because their bet size is too large and they revenge trade]

- People bet a lot on tails :-) ... usually after a streak of heads [laughing]

- People believe random things have some sort of predictability (human experience versus math)

- People got bored of betting on heads [laughing again]

- 1/3 of people went bust betting on a 60:40 biased coin

- 1/5 reached max payout ... kids who could flip really fast with smaller bet size mainly

- 1/2 won $80

- Using simple rule of only betting 15% of bankroll would give 95% chance of hitting max payout within 30 minutes

- "Suboptimal behavior"

- Nearly everyone voluntarily bet their whole stake at some point

- Those all-in bets *always* happened after someone took a loss on an outsized bet, classic need to "get it back"

- People who busted didn't want to talk about it

- A whole range of bet sizes works (8 or 9% to 20%) to hit max payout within 30 minutes

- Kelly Criterion number (optimal bet) was 20%

- Optimal solution is very complicated, but just use heuristics (common sense)

- Without the cap, expected value would be $3,000,000, 4% return on every flip (betting 20% of bankroll)

- St. Petersburg Paradox ... expected value versus expected utility

- People won't bother to play even if they have positive expected payout

- Have to understand your own risk aversion

- Betting 50% gives negative expected utility (with 60:40 coin)

- Bet sizing is not simple, not secondary ... it's incredibly important [I say it's *everything*]

- LTCM trade sizing was all screwed up (position sizes were way too big)

- Global equities should have a positive expected return above the risk-free rate or inflation, trouble is the Sharpe Ratio

- Thorp inspired the coin-flipping experiment

- Haghani believes there are some rare people who can beat the market, trouble is finding them, identifying them in time

- Past returns are not indicative of future returns (because we don't have enough data)

- How do you identify the biased coin after only 30 flips? You can't, it takes 143 flips

- Need to find an investor or trader with 143 year track record

- "I don't have very much on the wisdom front"

- www.elmfunds.com

- Not on Twitter, "haven't figured it out"

You Hang Your Head and Pray

From 2006 ... dummy falling from the balcony a gag ... Folds is solidly Gen X and lives in California.